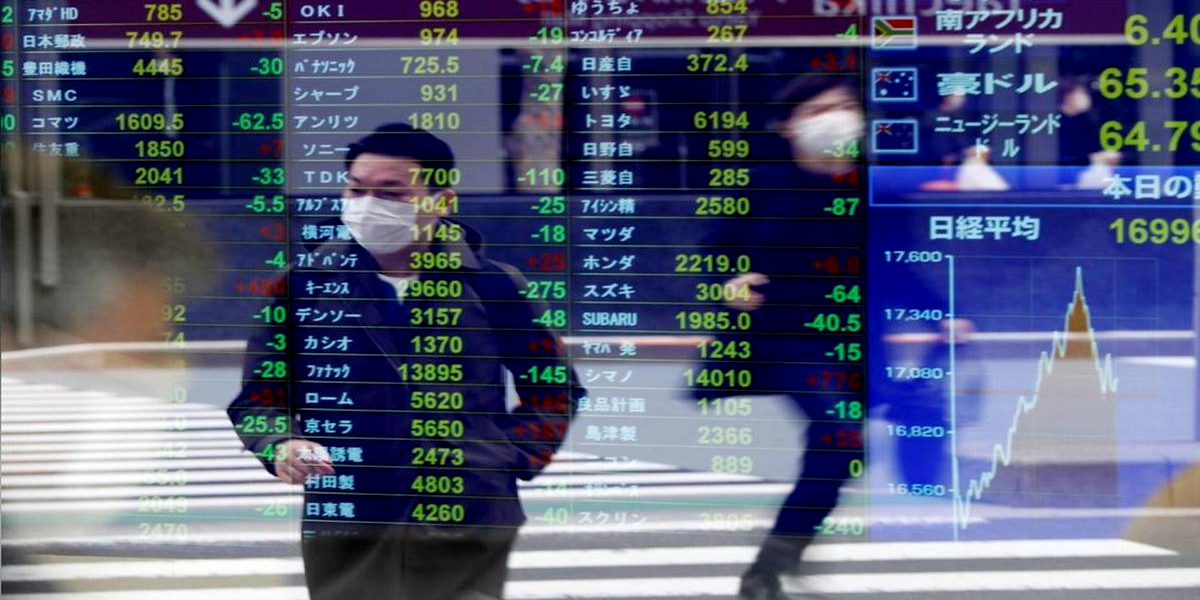

Asian Shares shake in Friday trading after US Tech stocks tumbled on Wall Street

Asian shares struggle to shake off bearish mood after United States technology stocks giant fell anew on Friday on Wall Street.

According to the details, Japan’s benchmark Nikkei 225 recouped early losses to rise 0.3% in morning trading to 23,310.94.

South Korea’s Kospi dropped 0.8% to 2,377.92, while Australia’s S&P/ASX 200 lost 0.8% to 5,860.50.

Hong Kong’s Hang Seng gained 0.3% to 24,394.06, while the Shanghai Composite slipped 0.2% to 3,228.01.

The S&P 500 fell 1.8% to 3,339.19, its fourth decline in five days.

The index is on pace for its second straight weekly loss.

Dow Jones Industrial Average dropped 1.5%, to 27,534.58.

Nasdaq gave up 2% to 10,919.59.

The Russell 2000 index of smaller-company stocks lost 1.2%, to 1,507.75.

Shares were lower in Taiwan and Southeast Asia.

Furthermore, analysts say investors are preoccupied with the coronavirus pandemic and hopes for the development of a safe, effective vaccine.

It should be noted that on Thursday, the Senate of the United States dissolved a Republican bill that would have provided around $300 billion in new coronavirus aid, as Democrats seeking far more funding prevented it from advancing.

Moreover, the U.S. dollar edged up to 106.19 Japanese yen from 106.15 yen late Thursday.

Meanwhile, the euro rose to $1.1837 from $1.1816.

Read More News On

- asian markets

- Asian Shares

- asian stock market

- china market

- coronavirus

- covid-19

- dow jones

- dow jones index

- dow jones live

- global stocks

- investing

- market watch

- markets

- nasdaq

- shares

- shares market

- stock exchange

- Stock Market

- stock markets today

- Stocks

- stocks market

- wall street

- world stock market index

- world stock markets

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.