PM Imran Khan will ‘never compromise’ on Kashmir cause

ISLAMABAD: Rejecting opposition’s undue criticism on Prime Minister Imran Khan’s Kashmir Policy,...

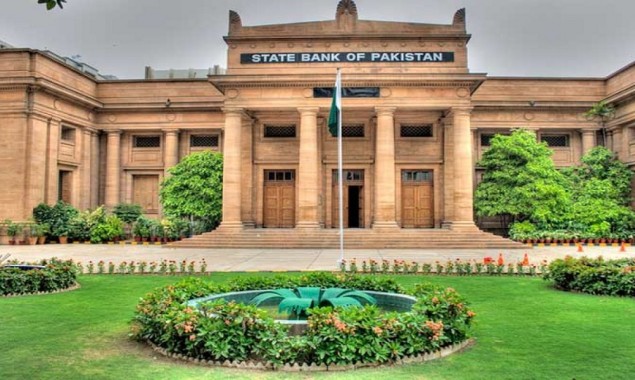

KARACHI: The deposits of Islamic banking system have recorded a sharp increase of 28.42 per cent for the quarter January-March 2021, compared with the corresponding period of the last fiscal year, the central bank reported on Friday.

The State Bank of Pakistan (SBP) issued Islamic Banking Bulletin for the period January-March 2021, which showed the deposits increased to Rs3.46 trillion during the period under review, compared with Rs2.69 trillion in the corresponding period of the last year.

The share of Islamic banks in the overall banking system of the country also increased to 18.7 per cent for the quarter under review, compared with the share of 16.9 per cent recorded in the January-March quarter of 2020.

The assets of the Islamic banking institutions also registered a growth of 30.6 per cent to Rs4.39 trillion for the January-March period of 2021, compared with Rs3.36 trillion in the same quarter of the last year.

The State Bank said the composition of Islamic banking industry remained the same with 22 Islamic banking institutions, comprising five full-fledged Islamic banks and 17 conventional banks having standalone Islamic banking branches by the end of March 2021.

During the period under review, 48 branches were added in the branch network of Islamic banking institutions; as a result, the branch network increased to 3,504 branches, spread across 124 districts of the country by the end of March 2021.

Likewise, the number of Islamic banking windows (dedicated counters at conventional branches) operated stood at 1,595 by the end of March 2021, the central bank added.

The profit-before-tax of the Islamic banks was recorded at Rs21.3 billion by the end of March 2021, compared with Rs20.60 billion during the same quarter last year.

Operating expense to gross income of Islamic banking institutions was registered at 51.5 per cent by the end of March 2021, compared with 47.5 per cent in the previous quarter.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.