SAPM briefs US diplomat on Pakistan’s energy sector

ISLAMABAD: Special Assistant to Prime Minister on Petroleum and Power Tabish Gohar...

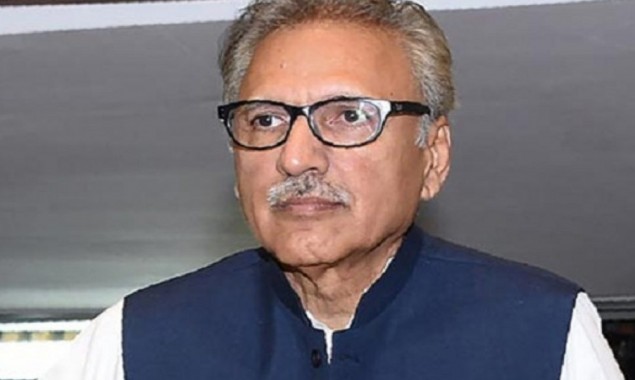

President Alvi

ISLAMABAD: President Dr Arif Alvi on Friday rejected the representation of the MCB Bank Limited, assailing the order of the Banking Mohtasib to credit the lost money to its accountholder, who had fallen victim to the Internet banking fraud.

The president said the bank’s argument on declaring the unauthorised funds transfer as the customer’s liability for divulging his personal information to an unknown caller, was “not tenable”.

“The strange and evasive stance of the MCB Bank that this being a matter of internet fraud and the bank is not responsible for the loss of its customer’s money, owing to compromised credentials by customer himself is just shrugging off the bank’s fiduciary responsibilities to an innocent accountholder,” he wrote in his order.

The president, in his decision, pointed out that the MCB Bank failed to explain how an aggregate amount of Rs497,600 was transferred in a day from the complainant’s account against the default/day limit of Rs100,000 set on his Visa Debit Card.

“This is a serious gap where the system has allowed fund transfers beyond the assigned/day internet banking limit on a transaction,” he said, adding that had the internet banking system been properly functioning, it could have prevented transfer of funds.

A sum of Rs497,600 was unauthorisedly transferred from the account of Shaukat Ali, a bank account holder with the MCB Bank Karachi, after he received multiple calls on his mobile phone on October 28, 2018, posing to be from the Census Department and the bank.

The unknown callers sought from Shaukat Ali (complainant) the details of his bank account, which he admittedly shared assuming the calls were from the bank.

For retrieval of his lost funds, he filed several complaints with the bank; however, on finding no redressal of his grievance, he approached the Banking Mohtasib.

The finding of the Banking Mohtasib revealed that the complainant had never requested for the internet/mobile banking facility and also had no knowledge about its use. However, on his request to enhance the limit of his debit card in 2016, the bank activated the said feature without his consent.

It said the bank gave no evidence on holding any consent from the accountholder for registration of the mobile banking/internet banking applications under the violation of the State Bank of Pakistan Circular No. 3 of 2015, dated October 21, 2015.

The Banking Mohtasib, in its order, said no matter if the customer had divulged his personal information to an unknown caller, but had the “unsolicited facility not become functional automatically, that too without knowledge and consent of the complainant, the account holder would have been saved from the loss”.

The president; therefore, rejected the representation of the bank for being “devoid of any merit”, in favour of the complainant, seeking refund of money fraudulently transferred from his account.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.