Higher cost jacks up tyre prices; 30% surge since July

KARACHI: There has been a significant increase in the tyre prices due...

Image: Geotv

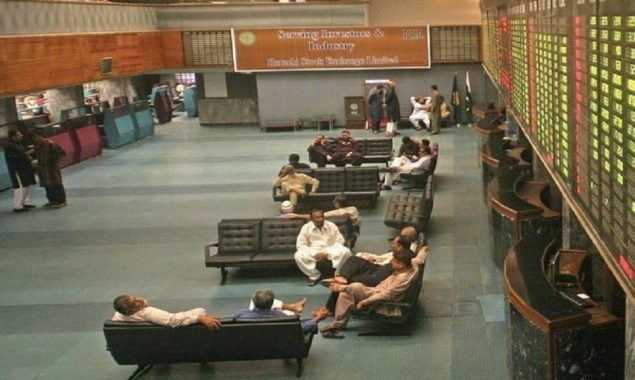

KARACHI: The Pakistan bourse tumbled on Thursday, as the less-than-expected rate hike and the central bank’s forward guidance was disregarded by the market after the T-Bills target was missed and yields didn’t ease, dealers said.

The State Bank of Pakistan (SBP) raised Rs1,285 billion against the target of Rs1,400 billion at an auction held on Wednesday evening. The cutoff yields on three-month, six-month and 12-month remained unchanged at 10.79 per cent, 11.5 per cent and 11.51 per cent, respectively.

The Pakistan Stock Exchange KSE-100 shares Index shed 1.43 per cent, or 635.66 points, to close at 43,731.20 points. The KSE-30 shares index lost 1.48 per cent, or 258.60 points, to close at 17,214.28 points.

As many as 345 scrips were active, of which only 86 advanced, 248 declined and 11 remained unchanged. The ready market volumes stood at 312.07 million shares, compared with the turnover of 398.09 million shares in the last trading session.

An analyst at Topline Securities said the market opened on a negative note and profit-taking continued; following the T-Bills auction where yields remained flat contrary to the investors’ expectations.

“[The] investors were expecting a cut; following [a] fall in [the] secondary market yields by 25bps yesterday.”

Ahsan Mehanti at Arif Habib Corporation said that the stocks closed lower in the overbought market on the concerns over the SBP’s policy tightening and foreign outflows.

“Likely announcements of a mini-budget for the resumption of the IMF [International Monetary Fund] programme and reports of the UK court, imposing over Rs19.4 billion fine on Sui Northern Gas Pipelines Limited (SNGPL) played a catalytic role in the bearish close.”

The companies, that reflected the highest gains included Blessed Textile, up Rs31.21 to close at Rs447.46/share; and Mari Petroleum, up Rs17.26 to close at Rs1,673.72/share.

The companies, which reflected the most losses included Unilever Foods, down Rs949.99 to close at Rs19,000/share; and Rafhan Maize, down Rs300 to close at Rs9.500/share.

The highest volumes were witnessed in WorldCall Telecom with a turnover of 49.18 million shares. The scrip gained one paisa to close at Rs2.21/share; followed by Telecard Limited with a turnover of 30.92 million shares. It gained 97 paisas to close at Rs15.75/share. Byco Petroleum remained the third with a turnover of 18.96 million shares. It shed 31 paisas to finish at Rs6.44/share.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.