In an attempt to revolutionise and digitalise Pakistan, the citizens will soon be using digital wallets, which will replace the existing computerised national identity cards (CNICs). This task comes under the umbrella of the Digital Pakistan vision that the government is pursuing vigorously. While the aim looks pretty decent and will take Pakistan into the future, it may have some challenges to overcome.

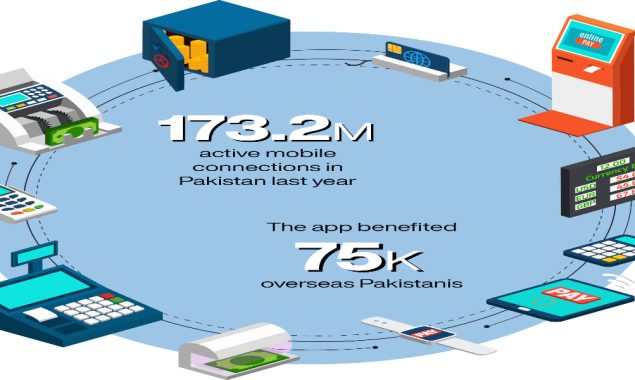

First, although 173.2 million mobile connections are active in Pakistan (January 2021), all of the mobile phone users may not switch to the digital wallet at once. Senior citizens face a hard time accepting new technologies. They tend to follow previously accepted norms even if the world shifts to modern actions.

Second, the application, ‘Pak Identity’ should also be made available in Urdu and regional languages. Steps must be taken to facilitate the citizens living in rural and far-flung, interior areas of the provinces.

Once the citizens will be asked to switch their CNIC to digital wallets, conspiracy theorists will also surface. They will promote unique theories of how these digital wallets were to gather their credentials to be used by the Western forces to dominate us by their influence.

According to Tariq Malik, chairperson of NADRA, this is an attempt to translate the vision of Digital Pakistan into a reality. Talking to the media, he said: “We have launched the ‘Pak Identity’ mobile app as a key building block of digital ID to facilitate applicants of the national identity cards through an online portal.” The app uses modern technologies. It will capture biometric fingerprints and facial recognition. It will also scan documents that are required to process ID cards. The person will not have to visit the NADRA office. The documentation process, including uploading of scanned documents will be completed by using the app.

Interestingly, the app benefited 75,000 overseas Pakistanis. They were able to process their National Identity Card for Overseas Pakistanis (NICOP). It is supported by two-factor authentication that adds layers to provide enhanced security.

While revolutionising the citizen’s database is the need of the hour, this conversion will bring to the surface the data that will help in making key decisions at the macro levels. Once completely implemented, the digital wallet’s backend system will compile data of the citizens, including their name, age, area of birth, current residence, etc. If the digital wallet has such a provision to track the citizen’s movements and activities such as selling and purchasing, the data acquired will provide insights to the corporate sector. Marketing companies will make calculated moves based on the data acquired.

The revolution that is set into motion to streamline and modernise the national ID ecosystem will certainly be a step forward. Once the conventional physical ID card era is over, the digital wallet, akin to the person’s social media profile, will be deemed as the credible profile of the citizen. The digital wallet will facilitate citizens to conduct contactless banking and would yield provisions of financial inclusion, as well.

The vision of Digital Pakistan has clear objectives to steer the country into the age of digitalisation and connectivity. However, the recently imposed new taxes on the telecom services and mobile phones may not bode well for the effective implementation of this vision. The imposition of new taxes will also hinder the expansion of Pakistan’s digital economy.

The idea of a digital wallet looks good. However, with the online media being the foundation of this setup, NADRA needs to remain cautious of any unforeseen incident. Implementing a database for the digital wallet will be a daunting task, in its regard. Although it will be the citizens who will upload credentials onto the app, the backend process of managing the data will require continuous efforts.

Two factors will be of paramount significance. First, the use of advanced technology to modernise the processes and the steps involved in converting the physical ID card into a digital wallet. Second, the human resource that is required to work around the digital technology, front-end and back-end graphics, interface, and the user’s journey must be proficient, efficient, and experienced. The online system should work on a high-end efficient server that does not halt or go down if high traffic logs into the app.

Further, NADRA would need to remain proactive in overcoming any glitches that may arise. These may include temporary shutdowns and crashes, which are a normal part of any digital media user interface, be it a website or an app. Moreover, NADRA would need to implement multiple layers of security on its app to prevent it from being hacked.

Since digital media is also used by scammers, NADRA must create avenues to train its staff, especially its IT personnel and those managing the app, to ward off such ills. The citizens would also need to be educated regarding how to use the app. They should be informed about frequently asked questions for ease of navigation across the app.

(The author is a fiction writer and columnist. He can be reached at [email protected] and Tweets @omariftikhar. Views expressed by him are his own and do not reflect the newspaper’s policy.)

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.