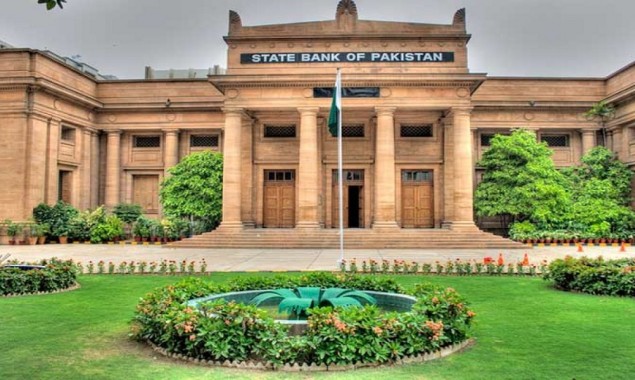

State Bank to announce monetary policy on 27th

KARACHI: The Monetary Policy Committee of the State Bank of Pakistan (SBP)...

KARACHI: The State Bank of Pakistan (SBP) has announced two new initiatives to facilitate the introduction of digital financial products and services by financial institutions to benefit all segments of the society.

A statement issued by the central bank on Wednesday said that State Bank of Pakistan (SBP) Governor Dr Reza Baqir announced the initiatives at the 5th stakeholders meeting on digital financial services held on Monday, August 2, 2021.

These initiatives are the introduction of digital cheques clearing and a unified QR code for payments.

The SBP governor also shared that the central bank is actively exploring the development of open banking, which allows sharing and leveraging of customer-permissioned information among the financial institutions to facilitate consumer choice, promote competition and efficiency in the financial sector, and encourage the introduction of innovative products and services for the benefit of the consumers.

The goal of these stakeholders meetings that were started by the SBP governor in October 2019 is to bring key players from the public and private sectors together to share information and coordinate the resolution of cross-cutting issues in a collaborative manner and to accelerate the digitalisation of financial services and promote the vision for Digital Pakistan.

The meeting was attended by a wide range of stakeholders, including Pakistan Telecommunication Authority (PTA) chairman Major General Amir Azeem Bajwa (Retd); FBR chairman Asim Ahmed; Nadra chairman Muhammad Tariq Malik; World Bank Country Director Najy Benhassine; and representative from the Bill and Melinda Gates Foundation.

The representatives from Accountant General of Pakistan Revenue (AGPR), Controller General of Accounts (CGA), Ministry of IT and Telecommunication, Ministry of Commerce were also present on the occasion.

The financial sector was represented by CEOs of banks, microfinance banks and electronic money institutions (EMIs), PSOs and PSPs, as well as several other digital financial services stakeholders.

The initiatives announced by Governor Baqir are targeted towards the overarching objective of accelerating digitalisation and financial inclusion.

The digital cheque clearing initiative will replace the physical presentation and clearing of cheques; thereby, substantially reducing the time involved. The second initiative, the introduction of a unified QR code, will allow payments by users from any digital application eliminating the need to use separate apps.

Dr Baqir said that the SBP will continue to promote innovative digital financial services and is ready to facilitate these endeavours by resolving the issues as far as possible.

He appreciated the stakeholders’ support in facilitating the digital initiatives of the SBP, particularly by the FBR and Nadra in moving forward the drive for digital financial services.

The forum was briefed about the significant progress made on the issues identified earlier by the industry, including removal/reduction of taxes and duties by the FBR on the import of Point of Sale (PoS) machines used for accepting payment cards; facilitation of remote account opening by Nadra; and a review of pricing mechanism for the verification of mobile SIMs by the telecom industry with the help of the PTA.

During the meeting, the SBP and PTA announced the formation of a SBP-PTA joint task force to work towards the prevention of digital financial services frauds.

In addition, the SBP and the FBR have also agreed to form a joint committee to collaborate on a regular basis to increase digitalisation in the economy.

These and other initiatives have led to 30 per cent and 20 per cent growth in the internet and mobile banking, respectively, in the third quarter of FY21, compared with the corresponding period of the last year.

Briefing the participants on the progress made on the SBP’s Raast payment platform, Governor Baqir said that the second phase of person-to-person payments would be launched by October 2021 for which the banks are being integrated with Raast.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.