The government plans to sell 20% of its stake in PAKRI through the PSX

The Pakistani government wants to sell 60,000,000 (20 percent) shares of Pakistan...

The data showed the import of goods for the quarter July-September 2021/22 at $17.47 billion, while the Pakistan Bureau of Statistics (PBS) revealed that the import bill of the country was $18.74 billion for the quarter under review. Photo: File

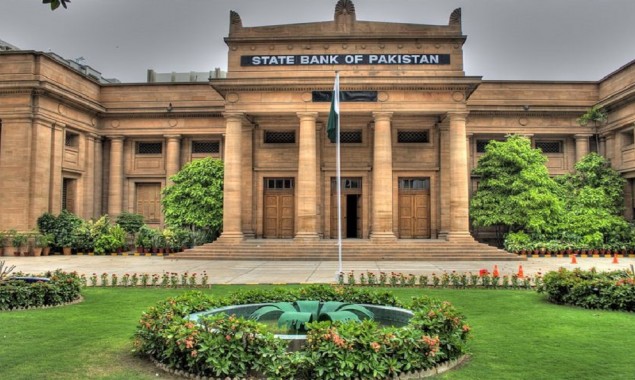

The State Bank of Pakistan (SBP) has repeatedly instructed banks to verify that banking regulations, such as AML, CFT, and foreign exchange restrictions, are followed. It has adopted a stringent approach to enforce such regulations in financial transactions, both in letter and spirit, in order to avoid being placed on the Financial Action Task Force’s (FATF) grey list.

During the quarter ending June 30, 2021, the central bank penalized eight banks with monetary penalties totaling over half a billion rupees for violating anti-money laundering (AML), combating the financing of terrorism (CFT), and foreign exchange rules.

“In addition to penal action, the bank has been advised to conduct an internal inquiry on breaches of regulatory instructions and take disciplinary action against the delinquent officials,” SBP supervised one of the country’s top five banks.

A major bank has been fined Rs289.09 million for “violation of regulatory instructions pertaining to AML/CFT and general banking operations,” it said.

At least four banks were found to have violated money laundering and terror financing regulations, and the regulator ordered that all of them conduct internal investigations into the violations and take disciplinary action against the officials responsible.

The regulator (SBP) has fined eight banks between Rs10 and Rs290 million, totaling Rs525.24 million under the subject “details of significant enforcement actions by SBP during the quarter ended June 30, 2021,” according to a statement issued by the central bank.

Other banks, particularly tier-II institutions, were fined for breaking rules governing foreign exchange, customer due diligence (CDD), and know-your-client (KYC) (KYC). Criminal elements may be able to gain access to banks and perform unlawful financial activities by gathering incomplete information on clients.

“These actions (monetary and disciplinary) are based on deficiencies in compliance of regulatory instructions and do not constitute a comment on the financial soundness of the entities,” the central bank said.

SBP urged banking institutions to invest in technology and human resources to establish an enabling environment for detecting unlawful financial transactions in October, and personnel was required to keep the likely suspected transaction secret. It also requested them to notify the Financial Monitoring Unit about the situation (FMU).

“Accordingly, all SBP REs (regulated entities) shall implement automated transaction monitoring systems (TMS) capable of producing meaningful alerts based on pre-defined parameters/ thresholds and customer profile, for analysis and possible reporting of suspicious transactions.

“Furthermore, SBP REs shall establish criteria in their AML/CFT/CPF policies and/or procedures for management of such alerts. The adequacy of staff posted for effective monitoring and reporting of STRs is a critical factor of customer due diligence,” it said.

It told the REs that training for staff who are directly or indirectly liable for AML/CFT/CPF will enable them to comprehend new innovations, money laundering, and terrorism financing techniques, methodologies, and trends.

The REs included banks, development finance institutions, microfinance banks, exchange companies, payment system operators, payment service providers, electronic money institutions, and third-party payment service providers.

Catch all the Pakistan News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.