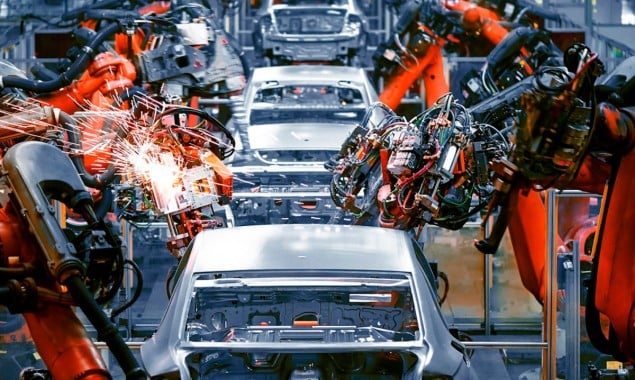

File Photo

KARACHI: The auto companies’ earnings growth is expected to remain slow on account of currency devaluation and higher cost of raw materials, especially steel, as well as increasing freight cost, an analyst at the KASB said on Monday.

“The earnings of auto universe will slow down, despite anticipating record sales this quarter accredited to strong volumetric growth of 81 per cent on a year-on-year basis in September 2021.”

Pak Suzuki Motor Company (PSMC) witnessed a growth in volumes by 1.2x on a year-on-year basis that would improve the earnings to Rs5.8/share in the third quarter of 2020, compared with a loss of Rs1.7/share in the same period of the last year, a PMSC official said in a statement.

“The gross margins of the company are likely to contract because of the weakened currency; however, the availability of low-cost inventory is going to partially offset this impact,” it added.

Indus Motor Company anticipated to post an EPS of Rs57.8/share in the first quarter of FY22. This is accredited to an increase in sales of Yaris and Corolla, both combining to make up 74 per cent of the total sales.

“We expect the gross margins to decline 2.8 per cent [ona] quarter-on-quarter [basis] on account of the currency devaluation, higher input costs and inability to pass on the prices,” an official of Indus Motor said.

The order book of the company is expected to improve, which would elevate cash balances and boost other income by around 12 per cent on a sequential basis.

“We expect the company to announce an interim dividend of Rs35/share, it added.

Similarly, Honda Atlas Cars Pakistan (HCAR) expects the earnings to improve on a sequential basis by 26 per cent as it rolled out a new model of Honda City.

With the sales of 9,172 units in the second quarter of FY22, the company expects the topline to grow 105 per cent on a quarter-on-quarter basis to Rs25.08 billion.

“We foresee slight gross margin attrition to 6.9 per cent from 7.3 per cent in [the] previous quarter because of [the] currency depreciation. However, notable improvement in other income is likely to help the company post profit of Rs1.1 billion for the quarter,” a statement by HCAR said.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.