Govt working for private sector development: official

KARACHI: The government is working to provide a better business environment to...

Mini-budget will keep the inflation in double-digit

KARACHI: Since the start of FY21, Pakistan’s economy has started recovering, but the boom in the international commodity prices after the opening up of global economies, amid ample liquidity, brought the country’s external account under pressure.

“The economy is now on the path of stabilisation due to painful yet necessary policy measures undertaken by the incumbent government required for the continuation of the IMF programme,” NBP Funds chief executive officer Dr Amjad Waheed said in the Economic and Investment Outlook 2022.

“The economic recovery is reflected in most high-frequency indicators of domestic demand, including automobile sales, POL [petroleum, oil and lubricants] sales, and electricity generation, as well as the strength of imports and tax revenues,” he added.

“Pakistan’s economy staged a V-shaped recovery and posted a 3.9 per cent growth in FY2021 and we anticipate an accelerated 4.3 per cent growth in FY2022 driven by falling Covid-19 cases, uninterrupted service sector activity, and pent-up demand in some sectors of the economy.”

Inflation and interest rate

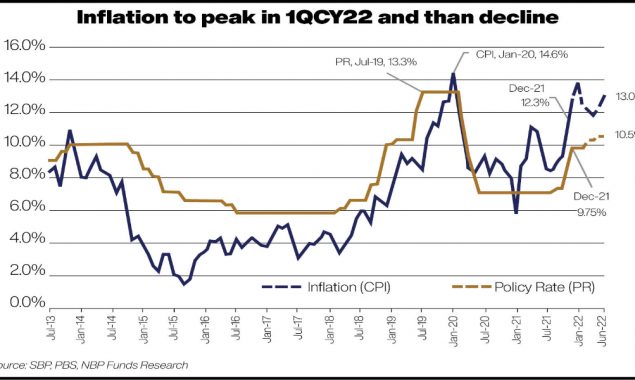

The inflation numbers have overshot the market consensus where the Consumer Price Index (CPI) has jumped to double-digits, clocking-in at 12.3 per cent for December 2021.

“We project the inflation to remain elevated in the first half of CY22, driven by the removal of subsidies in mini-budget, upward adjustments in utility prices, and increase in the international commodity prices; however, we estimate inflation to fall sharply in the second half of the year,” Dr Waheed said.

“For FY22, we expect inflation to average around 11.2 per cent. As a consequence, we expect interest rates to increase by around 50 to 100bps in [the] first half of CY22, with stable to falling interest rates, especially if commodities ease, in [the] second half of the year.”

External account

The consequence of the robust recovery in the domestic demand, amid sharp surge in the global commodity prices has remained hefty in the import bill. Though the exports have also rebounded, there are rising concerns on the balance of payments position since Pakistan’s imports considerably outweigh the exports.

The current account deficit remains an Achilles’ heel for the economy that has risen sharply to $7.1 billion during the five months of FY22, compared with the current account surplus of $1.9 billion during the same period of the last year.

This time around; however, the policymakers seem inclined to better navigate the pressure on the balance of payments position.

The recently enacted policy actions such as large currency depreciation, broadening the scope of 100 per cent cash margin requirement on imports, temporarily banning/levying of regulatory duties on non-essential imported items, and tapering of the monetary stimulus by the State Bank of Pakistan (SBP) are expected to contain the import bill, going forward.

The central bank is also geared up to contain the domestic demand, as the Cash Reserve Requirement (CRR) of the banking industry has been raised from 5 per cent to 6 per cent to curtail the money supply.

“We expect the CAD [current account deficit] to increase to $13.5 billion for FY2022 due to [the] pick-up in economy and increased commodity prices in [the] international markets,” the NBP Funds chief executive officer said.

The foreign exchange reserves of the SBP improved from $13.4 billion at the end of CY20 to around $17.9 billion at the end of CY21 on the back of flows from multilateral agencies such as the Asian Development Bank (ADB), the World Bank and the Kingdom of Saudi Arabia.

“We expect [the] FX [forex] reserves to remain stable due to expected resumption of [the] IMF programme, which will make available 750 million in Special Drawing Rights (equivalent to $1,059 million), and the planned issuance of the international bonds in the first half of CY22.

Foreign exchange market

In the foreign exchange market, the Pakistani rupee suffered a further 10.6 per cent depreciation against the dollar in CY21. Resultantly, it is now slightly below its equilibrium value as measured by the Real Effective Exchange Rate (REER) with the latest reading of 95.6, indicating a low risk of substantial depreciation.

“Going forward, with the rupee now near its equilibrium value as measured by REER and widening external account position, we expect a measured 7 per cent to 8 per cent depreciation against the dollar during CY22,” Dr Waheed said.

Bond market

The yields on fixed income avenues remained stable till the last quarter of CY21. Last quarter was volatile, as yields responded to the rise in inflation and import bill. The rupee came under pressure and the State Bank of Pakistan responded by 250bps rate hike in the last quarter.

Before the announcement of the last monetary policy statement of CY21, the yields across all tenors had risen significantly in anticipation of major hike in the policy rate.

After the announcement of the monetary policy statement on December 14, 2021 and subsequent open market operations (OMOs) by the State Bank, the yields on different tenors dropped around 50bps. Overall, the yield on six-month and one-year T-bills increased 277bps and 251bps to 10.76 per cent and 11.24 per cent, respectively, and the yield on the 5-year and 10-year PIB hiked 136bps and 109bps, respectively, to 11.31 per cent and 11.54 per cent, respectively, during the last quarter of CY21.

“The average inflation for FY22 is expected to be around 11.2 per cent and we expect around 50 to 100bps further buildup in the SBP policy rate in the first half of CY22,” the NBP Funds CEO said, adding: “Owing to the shrinking fiscal space and adamant inflation, we expect the market yields to increase and peak out somewhere in the middle of CY22. At that point, investing in [the] long-term fixed return bonds and increasing the duration of the portfolio will be recommended.

Stock market

The Pakistan stock market remained range-bound and posted a 1.9 per cent return, bottoming at 42,780 points in March 2021 and peaking at 48,726 in the middle of June.

The market remained range-bound, as it oscillated between the bottom-up bulls and top-down bears. Given the mounting challenges on the economic front in the form of elevated current account deficit and inflationary pressure due to the commodity up-cycle and higher aggregate demand, “we highlight that the government and central bank have been very proactive this time around to bring stability and preserve growth”.

The passing of the mini-budget, which aims at collecting additional revenues/remove subsidies of around Rs350 billion, will also address the fiscal concerns but will keep the inflation in double-digits.

The revival of EFF facility with the International Monetary Fund (IMF) will not only allow the resumption of multilateral flows of international finance institutions (IFIs), easing pressure on the balance of payments, it will also bring discipline on part of the government towards macro-prudential measures.

From the fundamental perspective, the market is trading at an attractive forward price-to-earnings (P/E) multiple of 5.7x versus 10-year average of 8.4x.

On a relative basis, 17.5 per cent earnings yield offered by the market coupled with a healthy 6 per cent dividend yield looks appealing, compared with the 10-year PIB yield of 11.62 per cent.

Over the years, the PE of PSX has been on a decline, especially after touching the high of 11.4x in May 2017. At that time, the regional markets traded at 29 per cent premium (14.7x) to Pakistan.

This premium over the years has expanded and currently stands at 270 per cent (PE of Pakistan at financial crisis level of 5.3x against regional PE of 19.7x)!

“We strongly believe that this premium is expected to narrow in the coming years, as the local participation is slated to increase with the increasing documentation of the economy and foreign selling is expected to ease or even reverse from the next calendar year.

The channeling of liquidity towards the market should materialise next year, resulting in improvement in PE of the Pakistan market.

“To conclude, we expect the stock market to post around 20 per cent return during CY22 driven by attractive valuations and double-digit corporate profitability growth. We advise investors with medium- to long-term investment horizon to build position in the stock market through our NBP stock funds,” Dr Waheed, chief executive officer of NBP Funds, said.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.