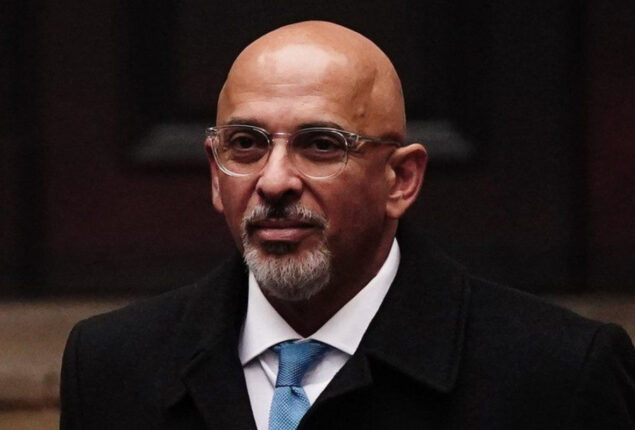

Nadhim Zahawi claims tax error was careless and not deliberate

Nadhim Zahawi says he paid a tax bill to HM Revenue and...

No penalties for ‘innocent’ tax errors, says HMRC chief

The head of HM Revenue & Customs (HMRC) informed MPs that there are no consequences for “innocent” tax mistakes.

Jim Harra was questioned by a Commons committee during his appearance on Nadhim Zahawi’s tax matters.

After it was revealed that the Conservative Party chairman paid a penalty to HMRC, requests for his resignation have been made.

Mr. Harra emphasized that he was unable to comment on specific incidents but claimed that when someone used “reasonable caution,” sanctions were not imposed.

Mr. Zahawi has said HMRC accepted the error over previously unpaid tax was “careless and not deliberate”. He has also insisted he has “acted properly throughout”.

The Public Accounts Committee was scheduled to hear testimony from the HMRC chief executive regarding how to manage tax compliance in the wake of the pandemic.

But he also had to answer enquiries about Mr. Zahawi’s tax arrangements, who has been under increasing criticism lately.

There are no repercussions for innocent mistakes in your tax dealings, Mr. Harra added, while declining to comment on specific people. Therefore, even though you used reasonable care but still made a mistake, you would not be subject to a penalty even though you would still be liable for the tax and any interest if it was paid after the deadline.

“But if your error was as a result of carelessness, then legislation says that a penalty could apply in those circumstances.”

When he was chancellor last year, Mr. Zahawi reportedly settled a multi-million dollar dispute with HMRC.

He settled for £4.8 million, according to the Media, which included the tax he owed as well as a 30% penalty.

The tax was connected to a stake in YouGov, the polling firm he co-founded in 2000 before being elected to the House of Commons.

Prime Minister Rishi Sunak instructed Sir Laurie Magnus, an impartial ethics adviser, to investigate if Mr. Zahawi violated ministerial guidelines about the matter earlier this week.

Downing Street said it wanted the investigation to be completed “as quickly as possible” but that the timeline was a matter for the independent adviser.

Mr. Harra said that if HMRC was asked by Sir Laurie to help with the inquiry “we will do so in any way we possibly can”.

When he was chancellor last year, Mr. Zahawi reportedly settled a multi-million dollar dispute with HMRC.

He settled for £4.8 million, according to the Media, which included the tax he owed as well as a 30% penalty.

The tax was connected to a stake in YouGov, the polling firm he co-founded in 2000 before being elected to the House of Commons.

Prime Minister Rishi Sunak instructed Sir Laurie Magnus, an impartial ethics adviser, to investigate if Mr. Zahawi violated ministerial guidelines about the matter earlier this week.

Catch all the UK News, World News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.