Amazon.com’s Ring provided information to the police without user consent

Amazon.com's Ring doorbell gave the footage to law enforcement. Without the user's...

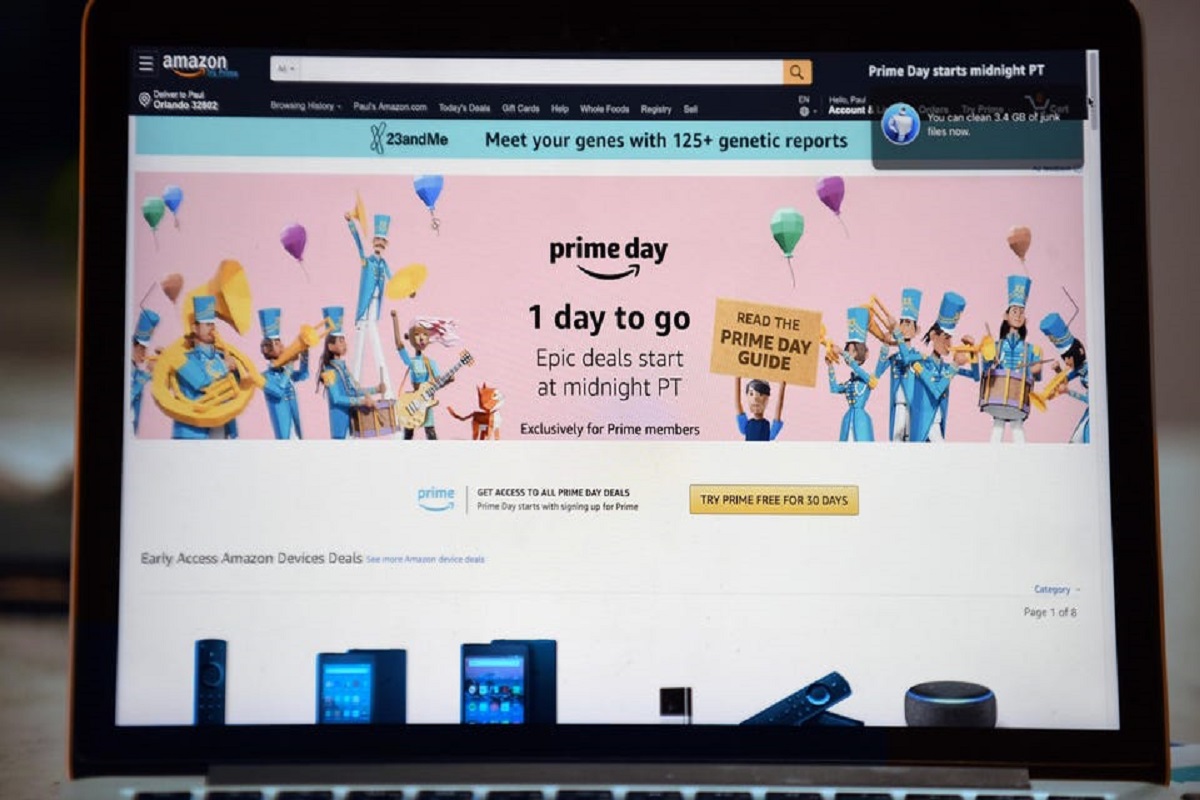

Amazon’s ‘Prime Day’ is America’s biggest online shopping day. (credits: Google)

This week, when Amazon’s 48-hour “Prime Day” sales promotion began, the United States experienced the busiest day of online spending of the year.

According to the Adobe Digital Economy Index, which monitors online purchases, total online sales exceeded $6 billion, an increase of 7.8% from a year ago.

According to data from Adobe, the amount spent this week exceeded that of Thanksgiving Day last year. Adobe claimed that the discounts being offered had a significant impact on the large amount spent this week. However, this does not imply that customers are acting irresponsibly. In the current economic climate, they continue to be price sensitive.

Consumers are looking for deals wherever they can find them because inflation rates hit a four-decade high in June, according to Vivek Pandya, manager of digital insights at Adobe.

Prices for so-called durable goods like clothing, appliances, and gadgets are beginning to decline even while prices for basics like food and gasoline continue to rise. And customers are taking notice.

Pandya added, referring to the classes of consumer items whose prices have levelled off, “Shoppers saw an opportunity to stretch their buying power a little more and conduct some shopping here.” “The degree of discounting that began to take effect around this Prime Day event is the main emphasis of this. Because there is a chance to save, consumers are reacting.”

According to Adobe, online costs fell 1% from one month to the next in June. Pandya claimed that shops have higher inventories of those things after the early-pandemic buying frenzy for commodities like gym equipment and home office supplies because consumers have now switched some of their spending toward services, including tourism.

Retailers want to maintain growth, but if demand begins to wane a bit, they will need to resume discounting to entice customers to make purchases, he added.

Following Wednesday’s inflation report, economists at Bank of America predicted that if consumers cut down on spending, the United States would likely experience a small recession. The spending on services like travel has not been as strong as the economists had projected, they note.

Bank of America stated that while weaker spending on services came as a surprise because it had been anticipated that a shift in household expenditure from commodities to services during the re-opening would result in higher spending on services.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.