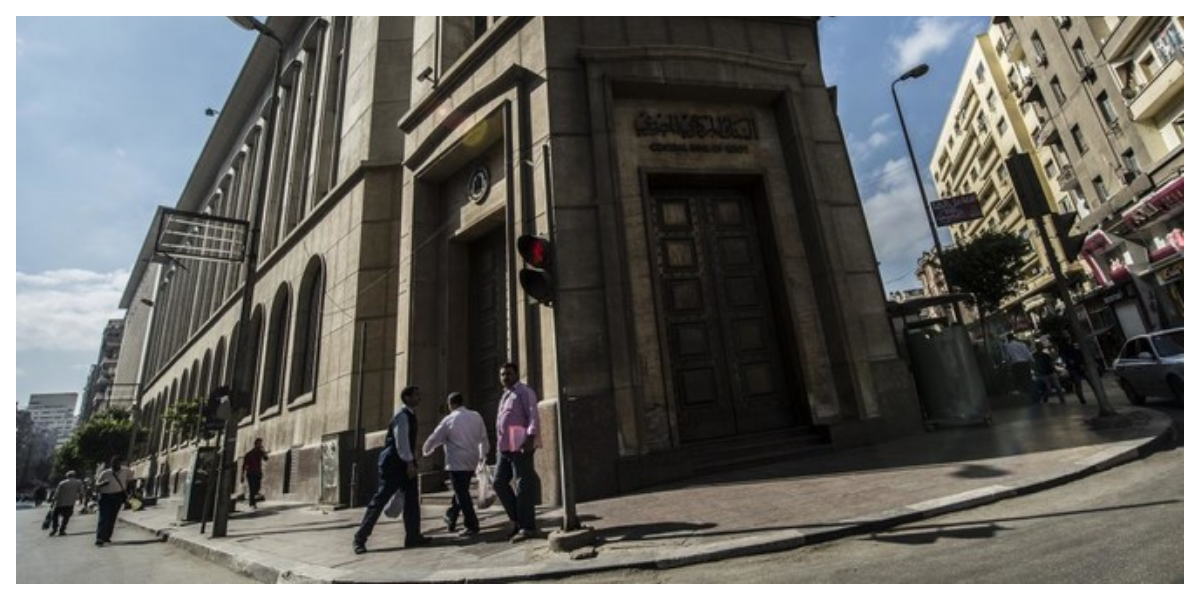

Egypt to privatise key state companies as inflation surges

Egypt to privatise key state companies as inflation surges

Egyptian Prime Minister Mostafa Madbouli announced a slew of planned privatisations of state-owned enterprises on Sunday, as Cairo grapples with an economic crisis and inflation of nearly 15%.

Following years of accusations that state-owned enterprises were crowding out private investments, the government announced a plan on Sunday to more than double the private sector’s share of the economy.

Madbouli laid out plans for 10 state-owned companies and two army-owned companies to be listed on the stock market later this year.

Two new holding companies, to incorporate “the seven largest ports” and “Egypt’s top hotels” will also be formed, percentages of which “will be listed on the stock exchange”, he told reporters.

By 2025, the government hopes to see “private sector contribution in investment grow to 65 percent,” up from 30 percent today.

President Abdel Fattah al-Sisi last month announced plans to “double its support to the private sector” in a programme aimed to attract $10 billion annually over the next four years.

Earlier this month, American firm S&P Global released their latest Egypt Purchasing Manager’s Index, which showed the state’s non-oil private sector economy contracting for the 17th straight month.

Inflation hit a three-year high of 14.9 percent in April, a month after the Egyptian pound lost 17 percent of its value overnight.

The state’s grip on Egypt’s economy has been criticized as creating unfair competition.

Business magnate Naguib Sawiris last year warned of the effects of an unfair playing field, arguing that “the state has to be a regulator, not an owner” of economic activity.

Madbouli on Sunday said there was “no alternative” to the state’s involvement in the economy, considering the “instability” of recent years, alluding to security concerns surrounding Sisi’s rise to power, and more recently the Covid-19 pandemic.

Since Sisi became president in 2014, the former army general has embarked on massive national infrastructure projects, where the key but opaque role the army has played in Egypt’s economy for decades took centre stage.

Although no official figures on the army’s financial interests have been released, the new push for privatization of military-owned companies may seek to correct a skewed investment environment.

Egypt, the world’s largest importer of wheat, has been reeling from mounting economic pressures since Russia’s invasion of Ukraine in late February, prompting the country to apply for a new loan from the International Monetary Fund.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.