Qaumi Bachat Bank latest profit rate for Regular Income Certificates- July 2024

Qaumi Bachat Bank latest profit rate for Regular Income Certificates- July 2024

In May this year, National Savings, also known as Qaumi Bachat Bank, revised the profit rates for various products, including Regular Income Certificates.

On May 14, 2024, the bank set the new profit rate for Regular Income Certificates at 14.64 percent, equating to Rs1,220 per Rs100,000 investment.

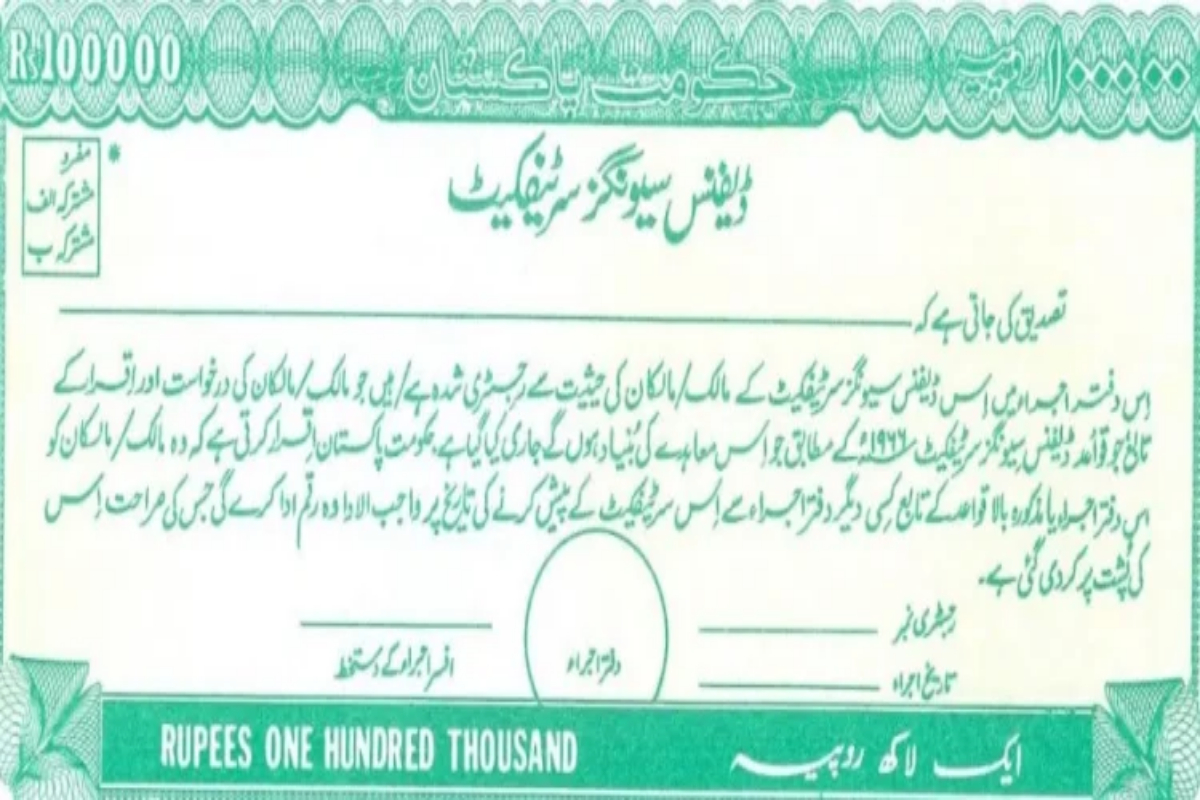

To meet the monthly financial needs of the public, the government introduced Regular Income Certificates (RICs) in February 1993, with a maturity period of five years.

These certificates are available in denominations of Rs. 50,000, Rs. 100,000, Rs. 500,000, Rs. 1,000,000, Rs. 5,000,000, and Rs. 10,000,000.

Investors receive profit payments on a monthly basis, starting from the issue date of the certificates.

Latest Profit Rate for Regular Income Certificates in July 2024

As per the revised policy, the profit rate on Regular Income Certificates has been increased to 14.64% per annum.

The Qaumi Bachat Banks offer Rs1,220 per month to the investors, with effect from May 14, 2024.

Zakat Deduction

The investment made in Regular Income Certificates is exempted from Zakat Deduction.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.