Adani: Billionaire’s empire lost $100 billion in days

Adani Enterprises announced on Wednesday that it would return to investors the...

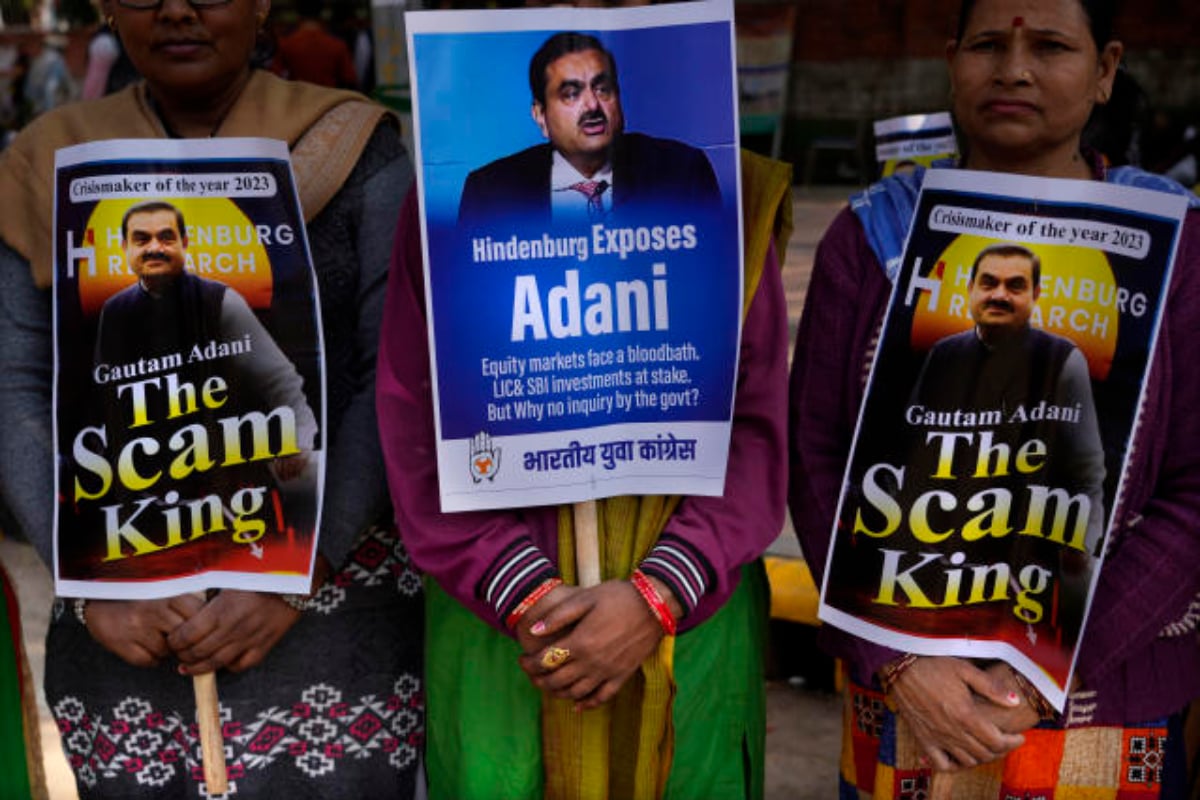

Adani shares fall once more as the Indian opposition organizes

MUMBAI: Investors sold more Adani stock on Monday as India’s opposition demanded a complete investigation into claims of serious accounting fraud at the country’s largest company.

Since the charges were leveled by short-seller US investment organization Hindenburg Research on January 24, the group owned by entrepreneur Gautam Adani has lost about $120 billion in value.

Trading in Adani Total Gas, in which TotalEnergies holds 37.4%, and Adani Power has been suspended again after the stocks plunged 5%.

Shares of Adani Enterprises, which had soared more than 1,000% in five years prior to the panic, were down 2.0% after falling over 10% in tumultuous early trade.

Concerns have been raised about the group’s capacity to acquire new funds to pay down its obligations after it halted a share sale last week and apparently also a bond issue.

On Monday, rallies were held in New Delhi and Mumbai by the main opposition Congress party, which has asked for a “serious probe” by the central bank and regulator.

According to the party, Gautam Adani’s close relations with Prime Minister Narendra Modi, who is also from Gujarat, have resulted in him winning contracts unfairly and avoiding necessary monitoring.

Indian regulators, according to Commerce Minister Piyush Goyal, “are very competent and our financial markets are amongst the most respected and well-regulated markets in the world.”

Finance Minister Nirmala Sitharaman stated on Sunday that Adani had also won contracts in Indian states not governed by Modi’s Bharatiya Janata Party (BJP).

“Any project under Prime Minister Modi goes through the open tender process (of) global tendering,” Sitharaman told

The company has rejected the claims made by Hindenburg and last week Adani, 60, insisted that the “fundamentals of our company are very strong, our balance sheet is healthy and assets robust”.

His personal fortune has more than halved, dropping from third to 22nd on the Forbes real-time wealthy list on Monday, with a fortune of $58.5 billion, down from $127.0 billion.

India´s securities regulator SEBI said Saturday that it was “committed to market integrity” and without naming, Adani said it always properly examines all “specific entity-related matters”.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.