LONDON: European stocks climbed on Thursday following U.S. President Donald Trump’s announcement that a “framework” agreement had been reached over Greenland, coupled with his decision to halt plans for escalating tariffs on certain European countries.

The Stoxx Europe 600 index rose 1% to 608.95 points by 1:46 p.m. London time, with all major sectors and regional bourses trading higher.

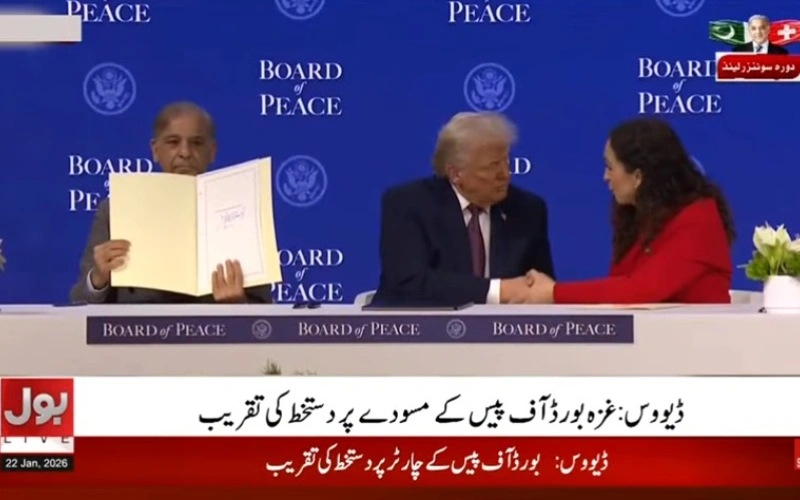

Markets rebounded after Trump, speaking at the World Economic Forum in Davos, described the Greenland deal as a conceptual framework for US-European collaboration on a proposed “Golden Dome” missile defense system and access to mineral resources in Greenland. When asked for details, Trump called it “a little bit complex” but promised further clarification in the future.

Danish Prime Minister Mette Frederiksen welcomed the U.S. pivot, stressing that negotiations could proceed on security, investments, and the economy, without compromising Denmark’s sovereignty.

She reaffirmed Denmark’s commitment to constructive dialogue with allies on Arctic security initiatives.

European market watchers welcomed the news, seeing it as a relief for NATO stability. The European Aerospace and Defense index remained flat, while auto and pharmaceutical sectors — particularly sensitive to U.S. tariffs — gained 1.4% and 0.7% respectively.

Meanwhile, German Chancellor Friedrich Merz encouraged European leaders not to “write off the transatlantic partnership” following Trump’s Greenland and tariff remarks.

Gold, often viewed as a safe-haven asset, cooled slightly after consecutive record highs last week, with U.S. gold futures for February delivery falling 0.3% to $4,824 per ounce. The U.S. dollar index edged down 0.1% amid investor uncertainty over the American economy.

Investors are also closely monitoring Trump’s comments on the Federal Reserve, with the president signaling he has decided on the next Fed chair and expressing indifference over whether Jerome Powell remains in his post.

In corporate news, Volkswagen reported a 20% increase in net cash flow, boosting its shares by 4.5%. Conversely, Ubisoft shares plunged 35% after the gaming company announced a major restructuring, including studio closures and cancellation of six games.