The Federal Board of Revenue (FBR) has dropped customs valuation rates on imported USB flash drives, data travellers, and memory cards, easing the tax burden at the import stage.

According to an official notification, the revised customs values will now be used to calculate customs duty and taxes during imports. The move aims to align valuations with international market prices and provide relief to consumers.

Under the new rates, the customs value of a 16GB USB flash drive imported from China has been fixed at $0.78, while imports from other countries will be assessed at $1. For 32GB USBs, the value has been set at $0.87 for Chinese imports and $1.13 for other origins. Similarly, 64GB USB drives will be assessed at $1.17 for Chinese products and $1.52 for imports from other countries.

For higher-capacity devices, the customs value of 128GB USB drives has been fixed at $2.60 for Chinese imports and $3.38 for imports from other countries. Meanwhile, 256GB USBs will be assessed at $2.99 for Chinese imports and $3.88 for other countries. The customs value for 512GB USB drives has been set at $3.99 for Chinese imports and $5.18 for imports from other origins.

According to the notification, 1TB USB drives will attract customs duty based on a value of $7.64 if imported from China and $9.93 from other countries. For 2TB USB drives, the customs values have been fixed at $14.76 for Chinese imports and $19.18 for imports from other origins. The FBR has issued a formal notification to implement the revised valuation for USBs, flash drives, and memory cards.

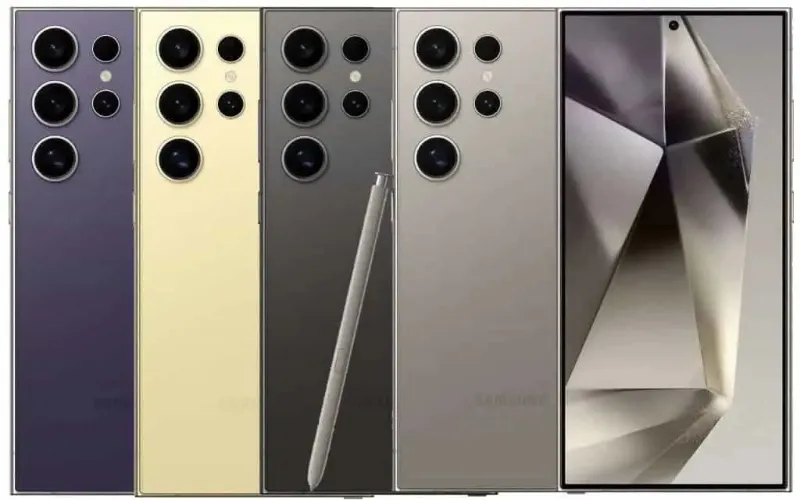

Earlier, the government also announced reduced customs values for imported used and refurbished iPhones. The Directorate General of Customs Valuation revised the rates to reflect global market trends and bring an estimated 100 million non-PTA mobile phones into the tax net. Under the new structure, taxes on 62 percent of used mobile phone models have been reduced.

Notably, the tax on a used iPhone 15 has been cut by Rs18,000 to Rs42,000, while the tax on an iPhone 14 has been reduced by Rs10,000 to Rs40,000.