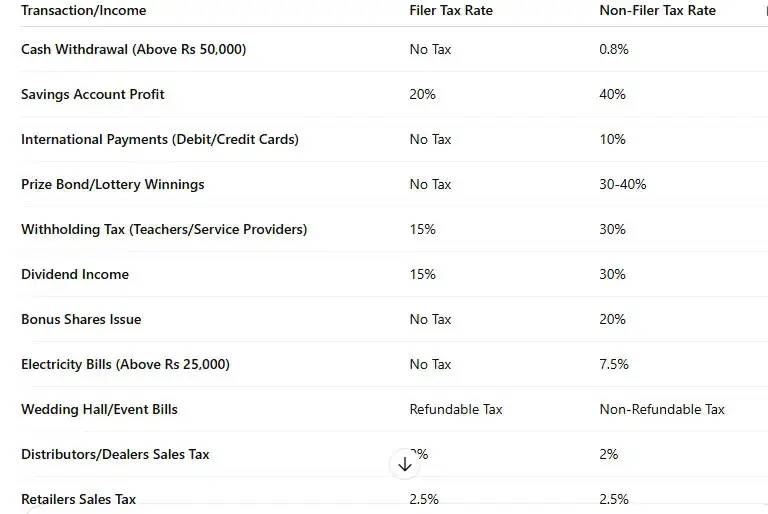

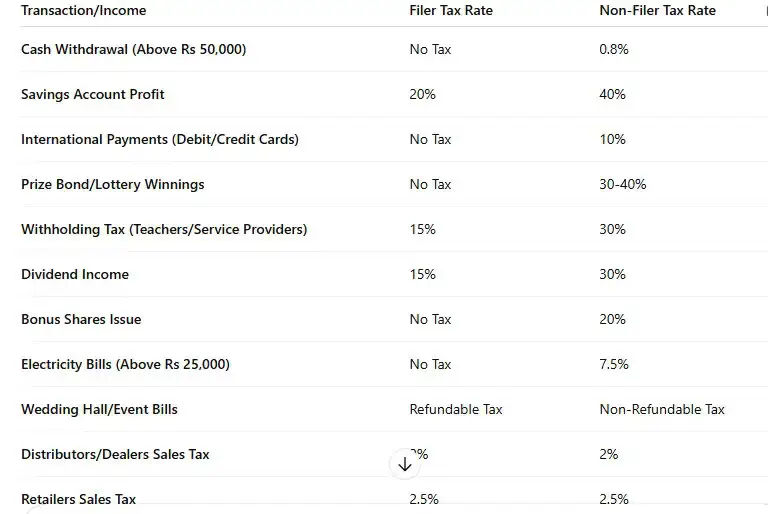

For the current fiscal year, the Federal Board of Revenue (FBR) has implemented a notable difference in tax rates between filers and non-filers.

In order to promote tax compliance and broaden the tax net, FBR levies greater taxes on non-filers in a variety of financial activities. Until June 2026, these taxes will be in effect.

Under the new regulations, non-filers faces up to double the tax rates compared to filers in several areas.

Tax on Cash Withdrawal

For example, a 0.8% tax will be levied on non-filers for cash withdrawals exceeding Rs 50,000 from banks, while filers will not face such a burden.

Tax on Savings Account Profits

Additionally, tax rates for non-filers are as high as 40% on savings account profits, compared to 20% for filers.

Read more: Tesla shares raises as Musk declares driverless robotaxi testing

Tax on Debit or Credit Cards

Other notable changes include a 10% tax on international payments made through debit and credit cards for non-filers. Additionally, non-filers will face a 30–40% tax on winnings from prize bonds.

Other Taxes

Non-filers in Pakistan will face higher withholding taxes across various sectors. Teachers and service providers who are non-filers will be taxed at 30%. For dividend income, non-filers will pay 30%, while filers will only pay 15%. Non-filers will also face a 20% tax on bonus shares and a 7.5% tax on electricity bills exceeding Rs 25,000 for residential users.

The Federal Board of Revenue (FBR) clarified that taxes on wedding hall and event bills will be non-refundable for non-filers, whereas filers will enjoy refundable taxes. For distributors and dealers, non-filers will be taxed at 2%, and retailers at 2.5%. The tax rate on service exports will remain 1% for both filers and non-filers.