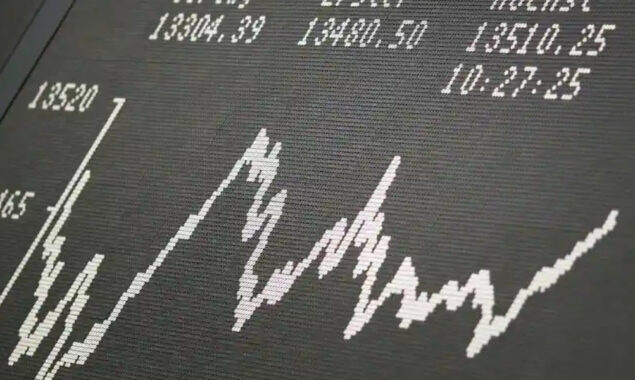

Most markets climb as calm returns

- Asian and European shares mostly rise as investors regain composure after last week’s fall.

- Analysts warn of more pain after central bank officials hint at future interest rate hikes.

- Wall Street reopens today and is anticipated to surge higher as traders catch up after a three-day holiday.

Most markets rise as investors regained their composure after last week’s drop, but analysts warned of further pain as central bank officials hinted at future interest rate hikes to tackle growing inflation.

Wall Street reopens today and is anticipated to surge higher as traders catch up after a three-day holiday weekend, but inflation fears remain.

Read More: World stocks are a mix, but Bitcoin stays steady near $20,000

Oil prices rose in anticipation of strengthening demand in China and the U.S., while the euro rose on rising euro zone borrowing costs.

“Risk appetite has managed to recover for now, perhaps because we get a much needed-break from central bank decisions this week,” IG analyst Chris Beauchamp told AFP.

“But while a bounce is overdue, it is probably only temporary.”

The steep rise in global borrowing costs has speculators worried about a global recession.

This week, Jerome Powell’s congressional testimony will be closely watched for clues about the Fed’s plans to fight rising prices.

Inflation statistics days before had crushed estimates and touched a four-decade high.

While last week’s volatility has subsided, banks’ plans to keep raising rates might roil markets.

“A sprinkle of positivity is sugaring financial markets, masking the bitter taste induced as investors have been forced to assess the repercussions of surging inflation for the global economy,” said Hargreaves Lansdown analyst Susannah Streeter.

Federal Reserve, Bank of England, Reserve Bank of Australia, and ECB officials have warned of further tightening of borrowing costs.

Due to a worldwide supply deficit and the Ukraine conflict, global inflation has surged to multi-decade highs.

Read More: Wall Street stocks begin week on positive note

Key figures at around 1100 GMT

London – FTSE 100: UP 0.8 percent at 7,181.75 points

Frankfurt – DAX: UP 1.0 percent at 13,391.94

Paris – CAC 40: UP 1.5 percent at 6,008.40

EURO STOXX 50: UP 1.2 percent at 3,510.09

Tokyo – Nikkei 225: UP 1.8 percent at 26,246.31 (close)

Hong Kong – Hang Seng Index: UP 1.9 percent at 21,559.59 (close)

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.