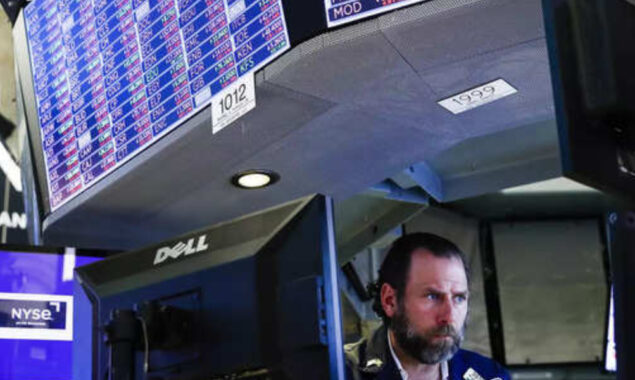

S&P 500 confirms bear market as fears of a recession mount

- As fears rise that the Federal Reserve’s projected aggressive interest rate hikes would force the economy into a recession, U.S. shares fell on Monday, with the S&P 500 confirming it is in a bear market.

- According to a widely used definition, a bear market began on Jan. 3 when the benchmark S&P index fell for four consecutive days, dropping more than 20% from its most recent record closing high.

- Markets have been under pressure this year as rising prices, notably a spike in oil prices owing to the war in Ukraine, have put the Fed on pace to pursue aggressive monetary policy steps, such as raising interest rates.

As fears rise that the Federal Reserve’s projected aggressive interest rate hikes would force the economy into a recession, U.S. shares fell on Monday, with the S&P 500 confirming it is in a bear market.

According to a widely used definition, a bear market began on Jan. 3 when the benchmark S&P index fell for four consecutive days, dropping more than 20% from its most recent record closing high.

Only around 10 components of the S&P 500 were in positive territory on the day, with all of the main S&P sectors considerably below. Markets have been under pressure this year as rising prices, notably a spike in oil prices owing to the war in Ukraine, have put the Fed on pace to pursue aggressive monetary policy steps, such as raising interest rates.

On Wednesday, the Fed will deliver its next policy decision, and investors will be looking for any indications of how aggressively the central bank intends to raise rates.

The S&P 500 was dragged down by high-growth market heavyweights like Apple Inc (AAPL.O), Microsoft Corp (MSFT.O), and Amazon.com Inc (AMZN.O), as the yield on the benchmark 10-year US Treasury note hit 3.44 percent, its highest level since April 2011. In a rising rate environment, growth equities are more likely to see their earnings decline.

Traders priced in a total of 175 basis point (bps) in interest rate hikes by September after a higher-than-expected consumer price index (CPI) reading on Friday.

For the latest International News Follow BOL News on Google News. Read more on Latest International news on oldsite.bolnews.com

Read More News On

Catch all the Business News, International News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.