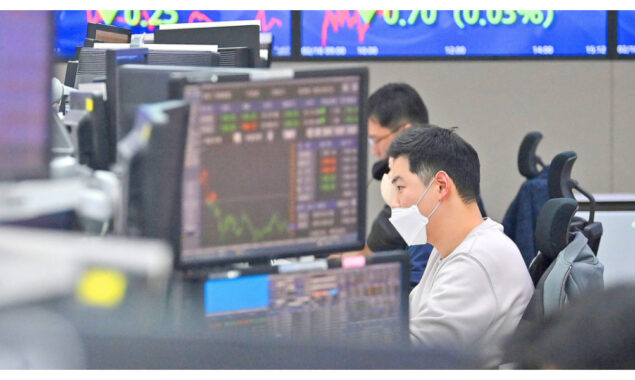

Stocks tumble worldwide as US inflation soars (Credit: Google)

- All of Europe’s major stock indices finished the week sharply lower.

- US government data showed inflation reaching 8.6 percent.

- This is the steepest rise in consumer prices since December 1981.

Stock markets fell further on Friday after data showed that US inflation rose to the highest level in more than 40 years in May, far exceeding analysts’ expectations.

All of Europe’s major stock indices finished the week sharply lower.

The blue-chip CAC 40 in Paris fell 2.7 percent on Friday, the DAX in Frankfurt fell 3.1 percent, the FTSE MIB in Milan fell 5.1 percent, the IBEX in Madrid fell 3.7 percent, and the FTSE in London fell 2.1 percent.

On Wall Street, stocks also were deep in negative territory after US government data showed inflation reached 8.6 percent in the 12 months ended in May, the steepest rise in consumer prices since December 1981, on the back of surging energy and food prices.

The data had been eagerly anticipated as investors hungrily look for clues as to the direction of US interest rates at next week’s meeting of the Federal Reserve.

“The market had expected that we’d see at least a plateauing or flattening out of inflation but it seems that inflation pressures continue to build and we’ve seen a further broadening of price pressures,” said Shaun Osborne, a foreign exchange specialist at Scotiabank.

“So it seems more entrenched, stickier kind of price or inflation situation.”

Osborne said the report will encourage investor debate on whether the US central bank will shift to a 75 basis point interest rate hike next week instead of the planned half-point increase.

Read more: Wall Street Stocks will suffer more when inflation are dashed

But Osborne believes the Fed will go with its original plan, considering a bigger increase would look “panicky.”

Adding to the unease was news that officials in China had once again locked down millions of people for Covid testing owing to another flare-up in cases, dealing a blow to hopes for an economic reopening.

“Warning signs about the economy are emerging as weekly (US) jobless claims are starting to rise, China’s Covid situation will prove troublesome for supply chains over the next couple of quarters, and as inflationary pressures broaden and show no sign of easing,” said Edward Moya, an analyst at OANDA trading group.

“It seems reductions in global growth forecasts will become a steady theme over the next few months and that should complicate how much more tightening we see from central banks,” he said.

The World Bank and the Organization for Economic Cooperation and Development both cut their global economic growth forecasts for 2022 this week.

Read more: Asian stocks are mostly higher after a shaky rally on Wall Street

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.