PSX endures another day of selling pressure

KARACHI: The Pakistan stocks endured another day of selling pressure after political...

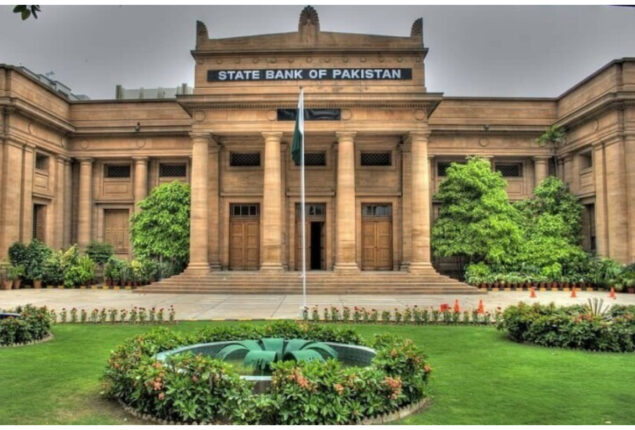

SBP jacks up policy rate by 100bps

KARACHI: The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has hiked the policy rate by 100 basis points to 17 per cent, a statement said on Monday.

The MPC, in its meeting, noted that inflationary pressures are persisting and continue to be broad-based. If these remain unchecked, they could feed into higher inflation expectations over a longer-than-anticipated period.

“It is critical to anchor inflation expectations and achieve the objective of price stability to support sustainable growth in the future. Despite some moderation in November and December, inflation continues to remain elevated,” it noted.

The core inflation has been on a rising trend for the last 10 months. Further, the recent pulse surveys show inching-up of the consumers and business inflation expectations.

The near-term challenges for the external sector have increased, despite the policy-induced contraction in the current account deficit.

“The lack of fresh financial inflows and the ongoing debt repayments have led to a continuous drawdown in the official reserves.”

The global economic and financial conditions broadly remain uncertain in the near- to short-term, leading to mixed implications for the domestic economy.

The expected slowdown in global demand could negatively impact the outlook of exports and workers’ remittances for emerging economies, including Pakistan. This would partly offset the gains from the import contraction.

On the flip side, some moderation in the international commodity prices may help reduce inflation and the improvement in the global financial conditions may also provide some relief to the external sector.

The committee reiterated its November 2022 assessment that the short-term costs of bringing down inflation are lower than the long-term costs of allowing it to become entrenched.

The MPC also emphasised on the engagements with the multilateral and bilateral partners to overcome the domestic uncertainty and to address the near-term external sector challenges.

The incoming high frequency data continues to suggest broad-based and sustained moderation in the economic activity in response to the policy tightening and exogenous shocks such as the 2022 floods.

The sale volumes of automobiles, petroleum products and cement declined significantly in December on a monthly and yearly basis. On the production side, the large-scale manufacturing (LSM) output declined 5.5 per cent in November 2022.

Going forward, the production cuts by the firms and supply constraints could pull the LSM growth further down. Further, the latest data on cotton arrivals point to lower crop production than anticipated earlier.

This could potentially weaken the agriculture sector outlook, despite satisfactory reports about the sugarcane production and progress on the sowing of wheat crop for the current season.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.