ISLAMABAD – Pakistan’s new government is implementing new measures recommended by the International Monetary Fund (IMF) to receive the final part of its bailout funds. Non-filers, those who don’t declare their income to tax authorities, will now face higher taxes when buying and selling land.

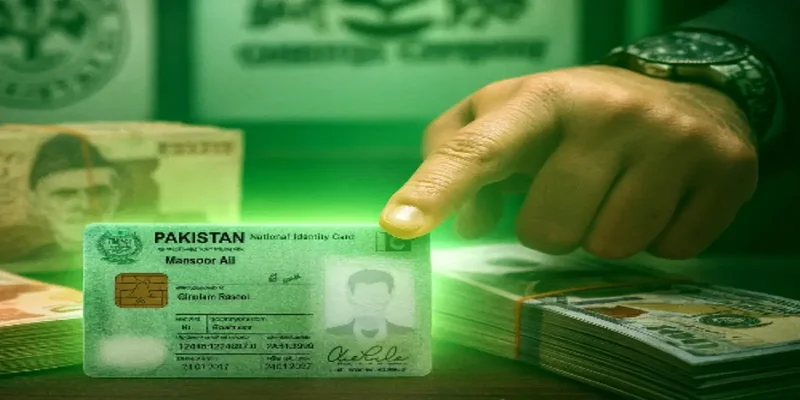

The Federal Board of Revenue (FBR) is introducing these new taxes on land transactions at the IMF’s request to bring the real estate sector into the tax system. This move aims to address the problem of tax evasion, especially by wealthy individuals who use the real estate market to hide their money.

To crack down on tax evasion in the real estate sector, the government plans to impose taxes on non-filers involved in land transactions and require housing societies to register all property dealings. The goal is to shift towards using bank transactions instead of cash to track land sales and purchases accurately.

In the upcoming budget, the government intends to introduce a seven percent withholding tax for non-filers and a four percent capital gains tax on land transactions. These measures are part of Pakistan’s efforts to increase tax revenue, as discussed with the IMF delegation during their review of the country’s economic progress under the loan program.

Overall, the government aims to reform the tax system and improve revenue collection to meet its financial goals and obligations under the IMF program.

[embedpost slug=”punjab-government-changes-office-timings-for-ramadan-2024″]