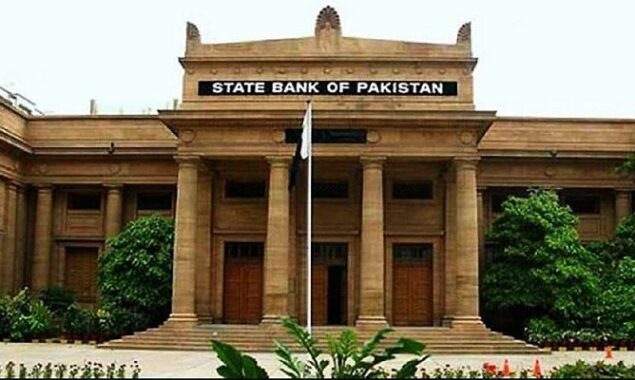

SBP increases policy rate by 1.5pc to 13.75pc. Image: File

The State Bank of Pakistan (SBP) has increased the interest rate by 150 basis points to 13.75% for the next six weeks to maintain the balance between inflation and economic growth.

Read more: Strategic dialogues between Pakistan and IMF to begin today

According to the SBP statement issued on Monday, the Monetary Policy Committee (MPC) has increased policy rate by 150bps to 13.75% as the MPC noted that after contracting by 0.9 percent in FY20 in the wake of Covid, the economy has rebounded much more strongly than anticipated, growing by 5.7 percent last year and accelerating to 5.97 per cent this year, as per provisional estimates.

1/3 At today’s meeting, MPC decided to raise policy rate by 150bps to 13.75%. This action, together with much needed fiscal consolidation, should help moderate demand to more sustainable pace while keeping inflation expectations anchored & containing risks to external stability.

Advertisement— SBP (@StateBank_Pak) May 23, 2022

2/3 Since last meeting, estimates suggest growth in FY22 has been much stronger than expected. Meanwhile external pressures remain elevated & inflation outlook deteriorated due to home-grown & international factors. With output gap now +ve economy would benefit from some cooling.

— SBP (@StateBank_Pak) May 23, 2022

3/3 MPC emphasized the urgency of strong and equitable fiscal consolidation to complement today’s monetary tightening actions. This would help alleviate pressures on inflation, market rates and the external account. See:https://t.co/5Pu6VZDXAQ

— SBP (@StateBank_Pak) May 23, 2022

“The MPC’s baseline outlook assumes continued engagement with the IMF, as well as reversal of fuel and electricity subsidies together with normalization of the petroleum development levy (PDL) and GST taxes on fuel during FY23. Under these assumptions, headline inflation is likely to increase temporarily and may remain elevated throughout the next fiscal year. Thereafter, it is expected to fall to the 5-7 percent target range by the end of FY24, driven by fiscal consolidation, moderating growth, normalization of global commodity prices, and beneficial base effects,” the statement read.

Read more: Bilawal Bhutto to attend annual meet of World Economic Forum in Switzerland

At the same time, the MPC emphasized the urgency of strong and equitable fiscal consolidation to complement today’s monetary tightening actions. This would help alleviate pressures on inflation, market rates and the external account.

For the latest BOL Live News, Follow on Google News. Read more on Latest Pakistan News on oldsite.bolnews.com

Read More News On

Catch all the Pakistan News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.