Intense Monsoon Rains Expected in Karachi From Early July

Weather experts predict above-average monsoon rains in southern Sindh. PMD forecasts very...

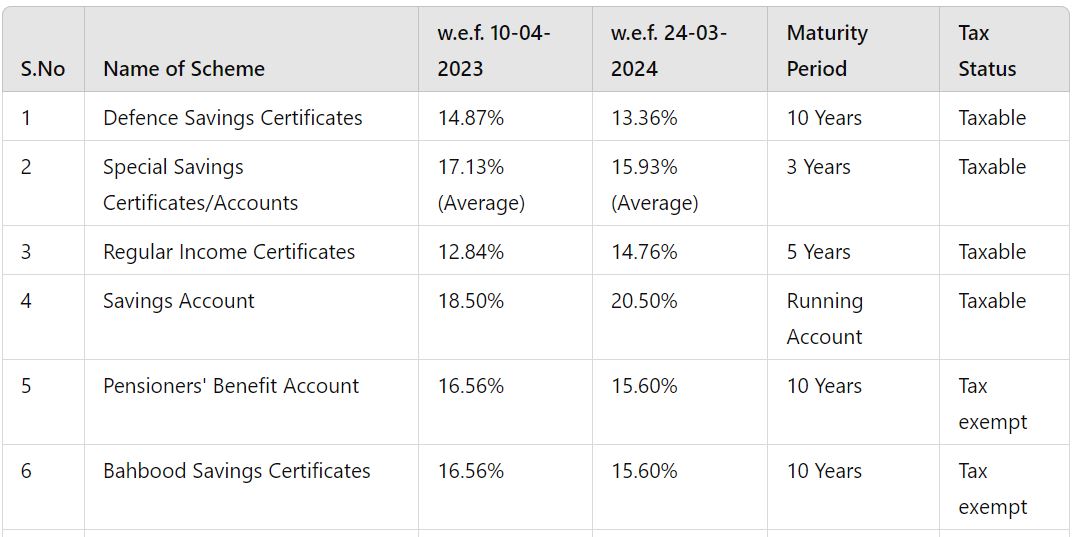

National Savings Latest Profit Rates for June 2024

In Islamabad, numerous Pakistanis opt for Central Directorate of National Savings (CDNS) investments because of the schemes’ safety, consistent returns, and range of products designed for various needs, including special offers for seniors and disadvantaged individuals.

National Savings is a key avenue for savings in the country, primarily through government securities, boasting a substantial portfolio of Rs 3.2 trillion. This constitutes approximately 14 percent of the nation’s total banking deposits and caters to around 3 million customers.

CDNS strives to offer a financial safety net to the public, with a focus on senior citizens, pensioners, widows, differently-abled individuals, and families of martyrs in the fight against terrorism. This is achieved through a diverse range of National Savings Schemes (NSS) tailored to meet the diverse needs of customers.

The Directorate recently introduced two new products: the Sarawa Islamic Savings Schemes, which offer Shariah-compliant options, and the Digital Savings Schemes. These new additions have attracted a combined net investment of Rs 78.0 billion.

The NSS product lineup ranges from 3-month short-term savings certificates (STSC) to 10-year long-term defense savings certificates.

National Savings Latest Profit Rates for June 2024

National Savings Latest Profit Rates for June 2024

| S.No | Name of Scheme | w.e.f. 10-04-2023 | w.e.f. 24-03-2024 | Maturity Period | Tax Status |

| 1 | Defence Savings Certificates | 14.87% | 13.36% | 10 Years | Taxable |

| 2 | Special Savings Certificates/Accounts | 17.13% (Average) | 15.93% (Average) | 3 Years | Taxable |

| 3 | Regular Income Certificates | 12.84% | 14.76% | 5 Years | Taxable |

| 4 | Savings Account | 18.50% | 20.50% | Running Account | Taxable |

| 5 | Pensioners’ Benefit Account | 16.56% | 15.60% | 10 Years | Tax exempt |

| 6 | Bahbood Savings Certificates | 16.56% | 15.60% | 10 Years | Tax exempt |

| 7 | Shuhada Family Welfare Account | 16.56% | 15.60% | 10 Years | Tax exempt |

| 8 | National Prize Bonds (Bearer) | 10.00% | 10.00% | Perpetual | Taxable |

| 9 | Premium Prize Bonds (Registered) | 12.92%** | 16.40%* | Perpetual | Taxable |

| 10 | Short Term Savings Certificates (STSC) | ||||

| STSC 3 Months | 19.92% | 19.40% | 3 Months | Taxable | |

| STSC 6 Months | 19.64% | 19.38% | 6 Months | Taxable | |

| STSC 12 Months | 19.82% | 19.00% | 12 Months | Taxable | |

| 11 | SARWA Islamic Savings Schemes | ||||

| SISA | – | 20.50% | Running Account | Taxable | |

| SITA 1 Year | – | 18.54% | 1 Year | Taxable | |

| SITA 3 Year | – | 15.25% | 3 Year | Taxable | |

| SITA 5 Year | – | 14.76% | 5 Year | Taxable |

Catch all the Pakistan News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.