Major stock markets frequently steadied Tuesday, with investors braced for a pointy US hobby rate hike to cut back hovering inflation.

All eyes are on the belief Wednesday of America Federal Reserve’s -day policy assembly, where it is expected to raise borrowing fees by way of half a percent factor for the first time on the grounds that 2000.

With the increase widely forecast, investors will be closely looking for clues on the outlook for future rate rises.

Central banks worldwide are tightening borrowing costs despite concerns such action could hamper financial recovery from the pandemic and even push major economies into recession.

“The markets remain edgy, as the Fed is expected to be aggressive in this monetary policy tightening cycle,” said analysts at Charles Schwab investment firm.

“Moreover, sentiment continues to be hampered by the ongoing war in Ukraine, the recent jump in interest rates, the continued rally in the US dollar, and the economic impact of the covid lockdowns in China,” they wrote.

On Tuesday, the Reserve Bank of Australia lifted interest rates 25 basis points, the first hike since 2010 and by more than expected. Officials also indicated further increases were in the pipeline.

The move sent the Australian dollar briefly rallying more than one percent against the greenback before settling back slightly.

Victoria Scholar, head of investment at Interactive Investor, said the Bank of England is expected to announce another rate hike on Thursday to its highest level since 2009.

Wall Street opened mixed, with the Dow Jones Industrial Average and S&P 500 flat while the tech-heavy Nasdaq was down 0.4 percent.

In Europe, Paris was up 0.1 percent in afternoon trading while Frankfurt was flat following sharp losses Monday.

London fell after a long holiday weekend, with investors catching up with losses elsewhere on Monday.

Traders continued to pore over earnings results from some of the world’s biggest companies.

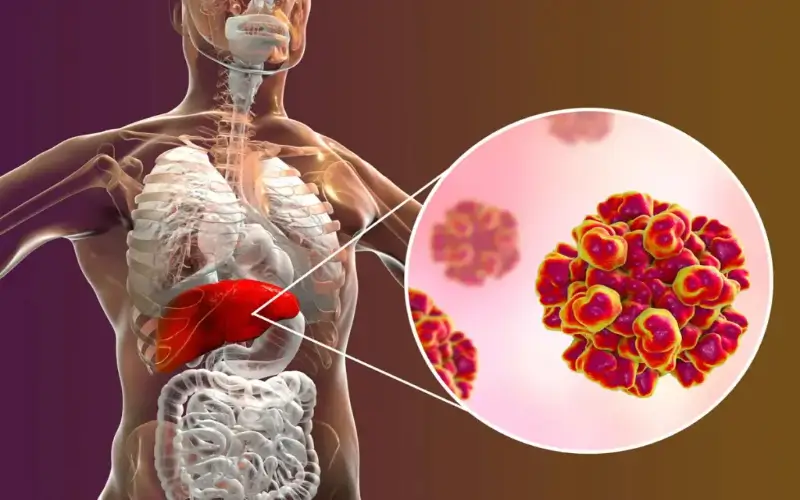

US drugmaker Pfizer reported a 77-percent jump in first-quarter revenue thanks to its Covid vaccine, though it lowered its full-year profit forecast due in part to shifts in foreign exchange.

British energy giant BP said its decision to pull out of Russia as a result of the war in Ukraine pushed it deep into the red in the first three months of this year.

But its underlying performance was strong thanks to a recent surge in oil and gas prices.

On Tuesday, crude futures declined ahead of a regular meeting this week of OPEC+.

The body comprising the Organization of Petroleum Exporting Countries plus Russia and other oil-producing nations must decide on output policy amid tight supply fears triggered by the Ukraine war.

The European Union is making ready a Russian oil embargo but some nations pretty dependent on Moscow’s crude are seeking decide-outs from the possible ban.

China’s strict Covid lockdown has weighed on crude prices because of concerns approximately call for within the global’s pinnacle importer of oil.

New York – Dow: FLAT at 33,040.06 points

London – FTSE 100: DOWN 0.3 percent at 7,524.08

Frankfurt – DAX: FLAT at 13,947.26

Paris – CAC 40: FLAT at 6,431.18

EURO STOXX 50: FLAT at 3,734.17

Hong Kong – Hang Seng Index: UP 0.1 percent at 21,101.89 (close)

Tokyo – Nikkei 225: Closed for a holiday

Shanghai – Composite: Closed for a holiday

Euro/dollar: UP at $1.0565 from $1.0506 on Monday

Pound/dollar: UP at $1.2550 from $1.2489

Euro/pound: UP at 84.18 pence from 84.09 pence

Dollar/yen: DOWN at 129.82 yen from 130.16 yen

Brent North Sea crude: DOWN 1.4 percent at $106.12 per barrel

West Texas Intermediate: DOWN 1.4 percent at $103.74 per barrel