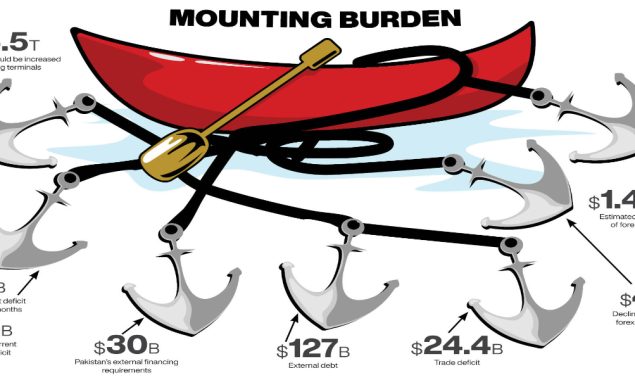

ISLAMABAD: With the overall debt liabilities of $5.5 trillion, including the external debt of over $127 billion, Pakistan’s economy remains stuck in a vicious cycle. The government is being forced to borrow from every possible quarter just to meet the debt repayment liabilities and finance the budgetary gap.

Experts believe that the government should revisit and revise its debt management strategy on modern and best global practices to boost its foreign exchange and keep the current account deficit at a manageable size.

Pakistan’s debt-to-GDP ratio after rebasing the economy stands at 86 per cent. Earlier, it was almost 100 per cent.

Sustainable Development Policy Institute (SDPI) Joint Executive Director Dr Vaqar Ahmed said that the volatility in the international market is making it difficult to predict the government’s borrowing requirements.

“At present, the ministry of finance is operating with multiple accounts and that is why it is difficult to ascertain the exact debt numbers,” he said, advising the government to manage its finances through a single treasury account, which is also one of the conditions of the International Monetary Fund (IMF).

But one of Pakistan’s leading economists, Dr Ashfaque Hasan Khan, said that single treasury account suggestion remains a non-issue as all the government money is already accounted for.

“I wonder why this was made part of the SBP bill as it was already in the Public Finance Management Act of 2019,” he said.

Only the defence and strategic planning division budget goes in separate accounts, which too is accounted for, he said.

Former Finance Minister Dr Hafiz A Pasha said that the situation has become difficult to manage as Pakistan’s external financing requirements have climbed to at least $30 billion on a short-term basis.

“The debt repayment would further escalate in the next fiscal year 2022/23 at a time when the country would be entering into a fever of electioneering after completion of the five-year term by the PTI government,” he said.

The current account deficit might touch $15 to $16 billion for the current fiscal year. In such a scenario, Dr Pasha warned that the foreign exchange reserves might start declining, so there are fears that the country may face another balance of payment crisis, he said.

Over the last two decades, Pakistan’s economy developed structural problems from an indigenous resource-based economy to becoming an import-based economy.

“In a situation, where crude oil is likely to touch $100/barrel, it is difficult to forecast borrowing requirements so is the debt accumulation,” Dr Vaqar said.

Owing to this economic imbalance, the country’s debt liabilities increased manifold and the external sector vulnerabilities multiplied and touched alarming levels.

The government has to pay back $8.64 billion on account of foreign loans in the second half (January-June) period of the current fiscal year.

The government has somehow managed to get approval for the lending of the 6th tranche of $1 billion from the IMF. Besides, it recently raised $1 billion from the Sukuk Bond offering in the international market at a cutoff yield of 7.95 per cent, which is the highest rate of return offered on any Sukuk in history.

Pakistan’s debt liabilities surged after it received the inflows of $3 billion from Saudi Arabia, over $2 billion from the IMF, $1 billion through the Eurobond issuance in the first half (July-December) period, resulting in the depletion of the foreign exchange reserves. Because of the soaring current account deficit of over $9 billion in the first six months and trade deficit of $24.4 billion, the foreign exchange reserves of the State Bank of Pakistan declined by almost $4 billion.

Due to heavy borrowing and devaluation, the repayment of foreign loans went up 399 per cent in the last four years in rupee terms. It stood at Rs286.6 billion in 2017/18 and now it is estimated at Rs1.427 trillion.

In dollar terms, Pakistan had to repay foreign loans, both the principal and markup, worth over $12.3 billion in the ongoing financial year.

The government had already paid in the shape of principle and markup on account of foreign loans worth $3.78 billion during the first five months (July-November) of FY22. Of this, $974 million were paid back to multilateral donors, $34 million to bilateral creditors and $2.74 billion to commercial banks, international bonds, and the IMF.

Dr Vaqar said that the major reason for rapid accumulation was the twin deficits of the country, which largely rose because of the stimulus of low interest rate and industrial relief package to boost GDP.

“The government didn’t foresee or conceive the fact that the prices of international commodities can increase so rapidly and this miscalculation overheated the economy and forced it to go for excessive borrowing,” he added.

For Dr Vaqar the government is in a catch-22 situation where it not only has to meet its debt obligations but, at the same time, accumulate more debt to bridge the widening deficit.

“At present, we are the major buyers of expensive loans in the international debt market,” he said, adding that the government is desperately looking at friendly countries such as China, Saudi Arabia and the UAE to rollover the debt but apparently it looks unlikely.

“Better diplomacy could have brought cheaper loans and some relaxations in the IMF programme,” he said.

“On the recent developments in Afghanistan we overreacted because the way the Taliban took over Kabul was not welcomed by the international community, especially the developed countries,” he said. The sanctions on Afghanistan put a lot of pressure on Pakistan’s exchange rate.

Finance Minister Shaukat Tarin also acknowledged the fact that at one time the dollar outflows to Afghanistan amounted to $20 million/day.

Dr Vaqar said that this time the IMF programme is harsh, compared with the last one completed by the Pakistan Muslim League (PML-N) government.

“During the PML-N government, the IMF knew that Pakistan is not desperate to get its programme because of dollar inflows from the China-Pakistan Economic Corridor (CPEC) but this time the situation is different and strained relations between the US and China also impacted the ongoing IMF programme,” he added.

Spokesman for the Ministry of Finance Muzammil Aslam, however, dispelled the impression that an increase in the debt became a cause of concern for the PTI government.

“The debt accumulation during the previous PML-N government was $4.5 billion/annum, whereas the present government has reduced it to $3 billion/annum,” he said.

Regarding borrowing of expensive loans, he said because of inflationary pressure and spike in the international commodities prices the interest rates across the world rose sharply.

“The US bonds, which used to trade on the yield of less than one per cent have now been offered above two per cent, one has to understand high interest rate is a global phenomenon,” he said.

Muzammil expressed the hope that the trade numbers of January might reflect the declining trend in the import bill.

Sources in the Pakistan Tehreek-e-Insaf (PTI) said Prime Minister Imran Khan might also request his Chinese counterpart for a loan of $2 billion and further extension in the repayment of the existing loans.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.