SBP receives $700mn loan from Chinese bank

SBP has received $700 million financing from China Development Bank The foreign...

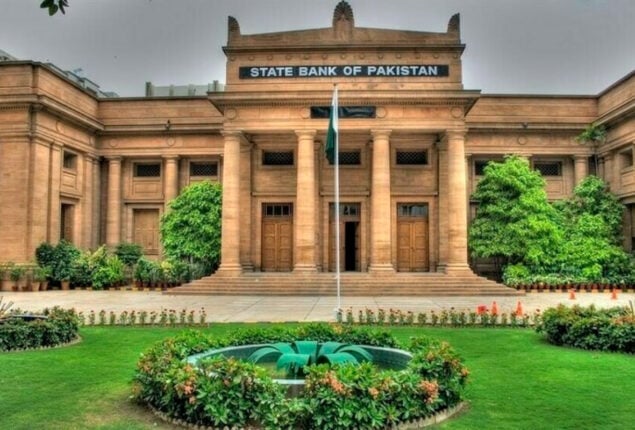

SBP to decide benchmark interest rate on March 2

KARACHI: The State Bank of Pakistan (SBP) on Monday announced that the Monetary Policy Committee (MPC) will meet on March 2, 2023 to decide the benchmark interest rate.

“The forthcoming meeting of the Monetary Policy Committee has been preponed and now it will be held on Thursday, March 2, 2023,” the SBP said in a Tweet.

The MPC was scheduled to meet on March 16, 2023.

Reportedly, the SBP is reviewing the policy rate ahead of schedule to meet the conditions of the International Monetary Fund (IMF).

The reports suggested that the IMF had demanded the authorities’ to raise the policy rate according to the mounting inflation.

As per the news flows, an increase in the policy rate by 200 to 300 basis points is IMF’s key demand for long pending staff-level agreement (SLA) for the ninth review of the Extended Fund Facility (EFF) programme, analysts at Insight Securities said.

The headline inflation based on the Consumer Price Index (CPI) is likely to make new highs and is expected to clock-in at 30.5 per cent on a year-on-year (YoY) basis in February 2023 as against 12.2 per cent in February 2022 and 27.5 per cent in the preceding month.

The hike in inflation is led by 45 per cent and 54 per cent increase in food and transport indices.

This will take eight months (July-February) 2022/23 inflation to 26 per cent, compared with 10.5 per cent in the same period of the last year.

On a month-on-month (MoM) basis, inflation is expected to increase by 3.5 per cent, compared with 2.9 per cent in the preceding month.

Within the Sensitive Price Indicator (SPI) basket, the items that recorded an increase in the prices during the period under review are liquefied petroleum gas (LPG), 29.3 per cent; motor fuel, 25.7 per cent; fresh fruits, 24.8 per cent; fresh vegetables, 21.2 per cent; and chicken 18 per cent.

On the flip side, the prices of following items eased off during the month, onions, 17.6 per cent; tomatoes, 15.4 per cent; eggs, 3.4 per cent; and wheat flour, 1 per cent.

Rampant inflation continues to squeeze the pockets of the common man led by unprecedented rise in food index, up 43 per cent in the last 12 months, mainly driven by supply side and administrative issues coupled with abrupt movement of domestic currency.

The analysts expect the average inflation for the current fiscal year 2022/23 to clock-in at 26.9 per cent, compared with 12.1 per cent in the preceding fiscal year.

The real yields were already at deep negative territory and forecasted inflation of 30.5 per cent for February 2023 will take it to negative 13.5 per cent.

Further, in the recent treasury bills auction yield on three months, six months and 12 months witnessed an increase of 195, 206, 184 basis points, respectively.

Similarly, the secondary market yields have also recorded an upward movement since the last Monetary Policy Committee meeting.

The recent increase in the motor fuel and gas tariff along with the imposition of one per cent additional sale tax is likely to keep the core inflation upbeat in the near-term.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.