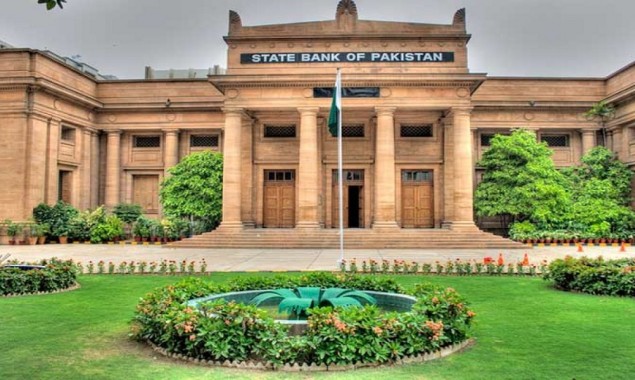

KARACHI: The State Bank of Pakistan (SBP) on Monday announced a 25 basis points increase in the key policy rate to 7.25 per cent.

The central bank said the Monetary Policy Committee (MPC) in its meeting decided to raise the policy rate by 25 basis points to 7.25 per cent. Since its last meeting in July, the MPC noted that the pace of the economic recovery has exceeded expectations.

This robust recovery in the domestic demand, coupled with the higher international commodity prices, is leading to a strong pick-up in imports and a rise in the current account deficit.

While year-on-year inflation has declined since June, rising demand pressures together with the higher imported inflation could begin to manifest in inflation readings later in the fiscal year.

With the growing signs that the latest Covid wave in Pakistan remains contained, continued progress in vaccination, and overall deft management of the pandemic by the government, the economic recovery now appears less vulnerable to the pandemic-related uncertainty.

As a result, at this more mature stage of the recovery, a greater emphasis is needed on ensuring the appropriate policy mix to protect the longevity of growth, keep inflation expectations anchored, and slow the growth in the current account deficit.

The State Bank said in line with this shift in the economic outlook, the MPC was of the view that the priority of monetary policy also needed to gradually pivot from catalysing the recovery after the Covid shock towards sustaining it.

As foreshadowed in the previous monetary policy statements, the MPC noted that this rebalancing would be best achieved by gradually tapering the significant monetary stimulus provided over the last 18 months.

The committee also said over the last few months, the burden of adjusting to the rising current account deficit had fallen primarily on the exchange rate and it was appropriate for other adjustment tools, including interest rates, to also play their due role.

It noted that the monetary policy stance is still appropriately supportive of growth, with the real interest rates remaining negative on a forward-looking basis. Looking ahead, in the absence of unforeseen circumstances, the MPC expects the monetary policy to remain accommodative in the near-term, with possible further gradual tapering of stimulus to achieve mildly positive real interest rates over time.

The pace of this possible further gradual tapering would be informed by updated information on the continued strength of demand growth and the stance of the fiscal policy, among other factors.

In reaching its decision, the MPC considered key trends and prospects in the real, external and fiscal sectors, and the resulting outlook for the monetary conditions and inflation.

The MPC observed while the flexible exchange rate has appropriately played its role as a shock absorber, it is important that its role be complemented by strong exports, targeted measures to curb non-essential imports, and appropriate macroeconomic policy settings to contain import growth.

The MPC noted that the accommodative financial conditions have provided significant support to the growth recovery since the start of FY21. Following historic cuts in the policy rate and the introduction of the SBP Covid-related support packages, the private sector credit grew more than 11 per cent during FY21, on the back of consumer loans (mainly auto finance and personal loans); followed by a broad-based expansion in credit for fixed investment and finally working capital loans.

The MPC felt that some macro-prudential tightening of consumer finance may also be appropriate to moderate demand growth as part of the move towards gradually normalising the monetary conditions.

Inflation fell from 9.7 per cent (y-o-y) in June to 8.4 per cent in both July and August. In addition to favourable base effects, this decline reflects continued deceleration in administered prices of energy due to the reduction in petroleum development levy (PDL) and sales tax on petroleum products. The core inflation also fell in both urban and rural areas in August.

Nevertheless, the momentum of prices remains relatively elevated, with the month-on-month increases of 1.3 per cent in July and 0.6 per cent in August.

In addition, the inflation expectations of both households and businesses have drifted up and wage growth picked up, as the recovery strengthened.

Looking ahead, the inflation outlook largely depends on the path of domestic demand and administered prices, notably fuel and electricity, as well as the global commodity prices.

The Monetary Policy Committee will continue to carefully monitor developments affecting medium-term prospects for inflation, financial stability and growth and stands ready to respond appropriately.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.