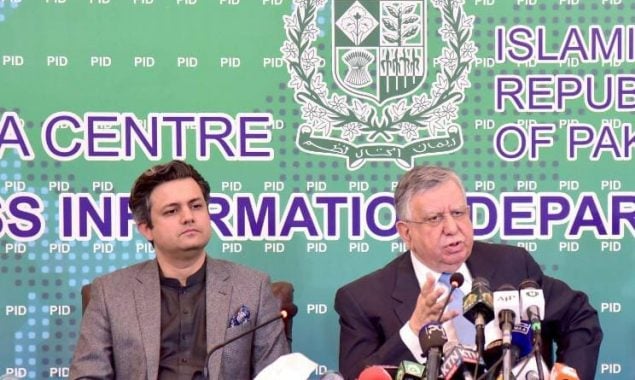

Photo Courtesy: Staff Reporter

ISLAMABAD: Adviser to the Prime Minister on Finance and Revenue Shaukat Tarin has said that the International Monetary Fund (IMF) has asked the government of Pakistan to take five prior actions, including amendments in the State Bank Act, before the approval of its Executive Board meeting.

In a media briefing, the adviser said after a staff-level agreement much of the speculations and unnecessarily uncertainty has now been fizzled out.

“I knew it was a matter of few days and now it finally reached,” he said. Elaborating the five IMF demands apart from amendments in the State Bank Act, Tarin said that the IMF wants to abolish general sales tax (GST) exemptions to various sectors, increase in electricity tariff, independent audit of the Covid-related expenditure and the recovery of petroleum development levy from the consumers.

The IMF has been told that the draft agreed in March this year was not implementable because of the reservations of the Ministry of Law and the government might face difficulty in getting the approval from both houses of the Parliament where it did not has absolute majority.

On a query that why the Finance Ministry agreed with the IMF on the amendments without consulting and bypassing the Cabinet Committee on Legislative Business, Tarin said the draft was agreed with the IMF in March before he took the charge.

Without naming former adviser on finance Dr Abdul Hafeez Shaikh and State Bank of Pakistan Governor Dr Reza Baqir, who signed the draft, he admitted the fact that unrealistic demands of the IMF were agreed without consultation with all the stakeholders.

The Fiscal and Monetary Board will be abolished and for coordination with the central bank and the Finance Ministry a liaison office will be established; however, he clarified that all the appointments in the State Bank will be made by the government.

“From governor to the board of directors, all the appointments will be made by the government so it means that it will remain in control,” he said.

Tarin said that the IMF wanted to exempt State Bank governor from the national Accountability Bureau (NAB) laws but the fund was told that when the prime minister or other ministers are not exempted from it how can he be exempted and they agreed, he added.

He said there was Rs600 billion target for PDL in the budget but because of the rising petroleum prices, the Finance Ministry couldn’t pass it to the consumers. The government has committed to the IMF that it will charge minimum PDL of Rs4/litre, adding that the PDL target now has been revised from Rs600 billion to Rs356 billion.

The revenue target of the Federal Board of Revenue (FBR) has also been revised to Rs6.1 trillion from Rs 5.9 trillion, keeping in mind the robust growth in the FBR revenue and it will be achieved easily.

The IMF wants independent audit from the third party of Covid-related expenses, Tarin said, adding that the IMF also wants to withdraw GST exemptions, which according to them is tax distortion.

“[The] IMF wants one flat rate of GST on all sectors whether its is 17 per cent or 15 per cent,” he said, adding: “The IMF won’t mind if we give subsidy to any sector.”

The IMF has been convinced that the fertiliser and pesticides will remain exempted from flat rate of 17 per cent.

On the power tariff, Federal Minister for Energy Hammad Azhar said that major condition of the IMF to raise electricity tariff by Rs1.39 has already been met and the government may increase the tariff by 40 paisas/unit after a few months.

The capacity charges of independent power producers (IPPs) are still a concern for the government and due to this domestic and industrial consumers incentivise to use electricity on cheaper rates.

Tarin said that the government is taking all possible measures to control twin deficits. The government imposed cash margins on the import of unnecessary lavish items and curbing the import of luxurious cars, as well, to reduce import bill.

The State Bank by increasing the policy rate made the right decision to control money supply and inflation, he added.

Completion of the review would make available SDR 750 million (around $1 billion), bringing the total disbursements under the Extended Fund facility (EFF) to around $3 billion and helping unlock significant funding from bilateral and multilateral partners.

An additional SDR 1.015 billion (around $1.386 billion) was disbursed in April 2020 to help Pakistan address the economic impact of the Covid-19 shock.

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.