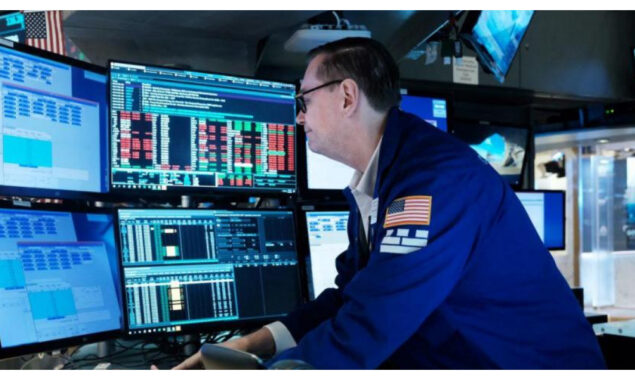

Markets rebound after Fed boss calms nerves over rates

Global stock markets rebounded Friday on easing fears approximately the pace of hobby fee rises inside the United States which might be aimed toward bringing down one of the country’s highest inflation in many years.

European equities have been up around 1.5 percent nearing the halfway degree following solid gains in Asia.

Stocks have suffered sharp losses this week, particularly on Wall Street, as investors seek safety also amid the Ukraine war and Chinese lockdowns.

“Investors are continuing to wrestle with worries over inflation as the oil price climbs back up again and supply concerns resurface amid ongoing geopolitical tensions,” noted Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

Stocks have tumbled for much of this week on fears the Federal Reserve was planning to lift US interest rates by 75 basis points at a single meeting.

However equities on Friday staged “a relief rally” after Fed boss Jerome Powell calmed nerves over the potential hefty increase, said Jeffrey Halley, an analyst at OANDA trading group.

“The rally today looks more like a technical rebound after a torrid week than a structural turn in sentiment,” he added.

Oil prices climbed Friday after much volatility, while the euro recovered from five-year lows against the dollar.

Bitcoin held above $30,000, a day after the cryptocurrency slumped under $27,000, or the lowest level since late 2020.

Its crash this week was fuelled by the collapse of two so-called “stablecoin” cryptocurrencies — TerraUSD and Tether — which proved to be anything but stable, leaving investors panicked.

On the corporate front Friday, Twitter’s share price plunged after Elon Musk said he was putting a temporary halt on his much-anticipated deal to buy the social media giant.

“Twitter deals temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users,” he wrote on the platform.

Musk, the sector’s richest man and founding father of automaker Tesla, had made the eradication of spam debts and bots one of the centerpieces of his proposed $44 billion takeovers of Twitter.

Friday’s statement noticed stocks drop by 20 percent in early electronic buying and selling earlier than Wall Street opened.

London – FTSE 100: UP 1.7 percent at 7,352.49 points

Frankfurt – DAX: UP 1.4 percent at 13,931.74

Paris – CAC 40: UP 1.7 percent at 6,312.64

EURO STOXX 50: UP 1.6 percent at 3,670.69

Hong Kong – Hang Seng Index: UP 2.7 percent at 19,898.77 (close)

Shanghai – Composite: UP 0.9 percent at 3,084.28 (close)

New York – Dow: DOWN 0.3 percent at 31,730.30 (close)

Tokyo – Nikkei 225: UP 2.6 percent at 26,427.65 (close)

Brent North Sea crude: UP 1.9 percent at $109.44 per barrel

West Texas Intermediate: UP 2.0 percent at $108.21 per barrel

Euro/dollar: UP at $1.0386 from $1.0382 at 2100 GMT Thursday

Pound/dollar: DOWN at $1.2191 from $1.2199

Euro/pound: UP at 85.18 pence from 85.08 pence

Dollar/yen: DOWN at 128.90 yen from 129.97 yen

Read More News On

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.