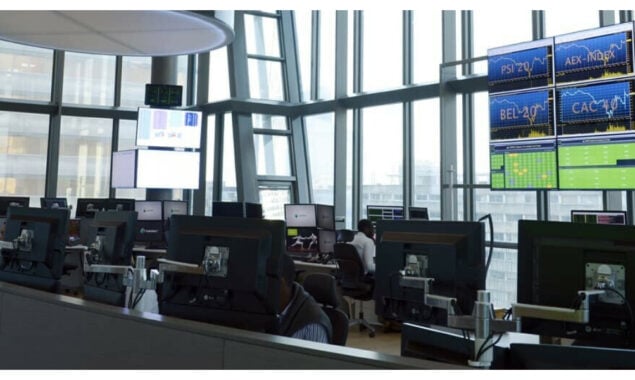

Stocks rally on Shanghai reopening hopes

On hopes that China’s economic engine Shanghai will ease its weeks-long lockdown and gradually reopen businesses, Hong Kong led a rally across stock markets on Tuesday.

The pound rose against the dollar in foreign exchange as UK job data confirmed the Bank of England’s intention to raise interest rates further, despite growing fears of a recession.

“Hopes that the Shanghai lockdowns will ease, along with the ensuing supply chain disruptions, have been enough to lift” equities, said OANDA analyst Jeffrey Halley.

Much of the city of 25 million has been under lockdown since April as Beijing attempts to stamp out an Omicron-fuelled virus surge under its strict zero-Covid policy.

Tuesday’s rally coincides with the third day in a row that Shanghai has recorded no Covid-19 cases outside of its quarantine facilities.

The impact of Beijing’s zero-Covid strategy on the world’s second-largest economy was revealed Monday when official data showed that retail sales and industrial production in April on-year had slumped to their lowest levels in more than two years.

World markets have also been roiled by surging inflation and Russia’s war in Ukraine — leaving investors jittery.

The British pound on Tuesday rallied more than one percent versus the dollar as traders bet that soaring UK inflation, lifted in part by wage rises, will see more monetary policy tightening by the Bank of England.

There are rising concerns that ongoing rapid interest rate rises by the BoE and other central banks including the Federal Reserve to curb decades-high inflation will push the economy into a downturn.

“Markets remain in fight or flight mode while rolling the dice on recession odds,” said Stephen Innes of SPI Asset Management.

On the corporate front Tuesday, India’s insurance giant LIC slumped on its market debut following the country’s biggest-ever initial public offering, closing nearly eight percent below the IPO price.

Prime Minister Narendra Modi’s government raised $2.7 billion by selling 3.5 percent of Life Insurance Corporation of India as his administration seeks to sell off state assets to bolster tattered public finances.

But it was forced to cut back the offer from a planned five percent after markets turned volatile following Russia’s invasion of Ukraine and China’s Covid lockdowns.

Elon Musk also stated that his planned purchase of Twitter would be halted unless he was assured that less than 5% of accounts on the platform were fake.

Tesla’s owner has made a $44 billion bid for the social media platform.

Read More News On

Catch all the International News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.