Friday, March 29, 2024, Islamabad — Pakistan Tobacco Company (PTC) is concerned about the recent misinformation spread across the media regarding loss to the national exchequer due to non-payment of taxes by legitimate tobacco companies.

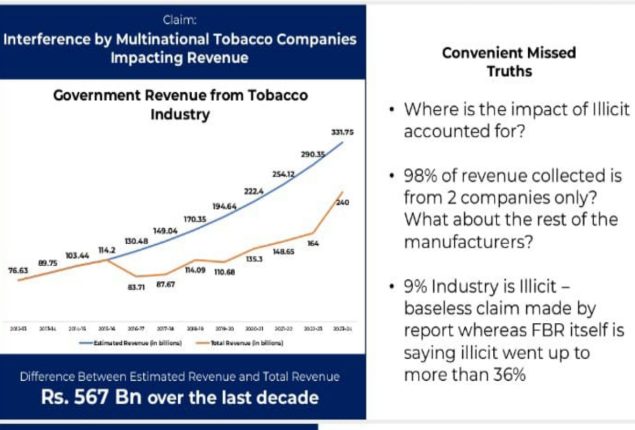

They have expressed their concerns about the figures presented by an Islamabad-based think tank, showcasing a substantial revenue loss inflicted upon the national exchequer by legitimate tobacco companies, purportedly amounting to Rs 567 billion. It is important to note that this figure is incorrect, misleading, and detached from ground realities.

The only loss incurred to the Government by the tobacco industry is because of tax evasion of illicit manufacturers as the legitimate industry pays all applicable duties and taxes. The misrepresented number is for accumulated loss over a decade, which has unfortunately been overlooked in much of the discourse following the report’s release. This oversight has led to misconceptions and potentially skewed perceptions of the legitimate tobacco industry’s economic impact.

The nuanced context of these findings is crucial for informed public dialogue, as the portrayal of the data, without explicitly clarifying its decade-long spread, might contribute to a narrative that seems to align with the interests of certain entities advocating for the illicit tobacco sector.

Representatives from PTC questioned the legitimacy of such a report, which downplayed the impact of the illicit tobacco trade in the country. They shared that the introduction of a 3-tier system in 2017 was the need of the hour for the government due to the fall in revenue collection, and this regime not only allowed revenues to increase and illicit market share to decrease but also paved the way for a level playing field and sustainability for the industry.

However, the illicit tobacco sector operates outside the stringent regulatory framework and yet, paradoxically, seems to evade the scrutiny and regulatory actions that are promptly applied to their legitimate law-abiding counterparts.

There is a growing concern within the relevant segment that this portrayal and the ensuing public narrative might be steering the government towards policy decisions that inadvertently favour these non-compliant entities.

The report also cited the Senate Special Committee on the causes of the Decline in Tax Collection of the Tobacco Sector, to highlight the issue of lower tax collection. Ironically, in the same minutes, the FBR claimed the illicit market share to be more than 36 percent, which caused tax revenues to fall.

The representatives urged the law enforcement agencies to initiate a nationwide crackdown against illicit cigarette trade, causing the Government of Pakistan losses of Rs 300 billion annually rather than what the impact the report has claimed spread out over a decade and raised questions regarding the intentions behind publishing such a report.

Contrary to the report’s impression and subsequent coverage, the legitimate tobacco industry has significantly contributed to the national exchequer, with substantial payments in the fiscal year, Rs 148 billion in 2021-22 and Rs 173 billion in 2022-23.

This financial input underscores the legitimate industry’s commitment to fulfilling its budgetary responsibilities and adhering to the agreed-upon tax structures, which were meticulously designed to ensure fair and substantial revenue generation for the country’s development.

They said that it is paramount to acknowledge that the legitimate tobacco sector has consistently complied with every regulation imposed by the government, including implementing the Track and Trace System (TTS).

This compliance starkly contrasts with the illicit sector, which continues to defy these laws with apparent impunity. This discrepancy in regulatory enforcement undermines the rule of law and places the legitimate industry at a competitive disadvantage, challenging the principles of fair trade and market competition.

The representatives highlighted that the Government of Pakistan recently recognized PTC as one of the country’s top tax-paying entities. This award showcases the company’s strict adherence to laws of the land and good corporate citizenship.

It was emphasized that provision of a level playing field is crucial for the legitimate sector to ensure sustainability which is currently undermined by the unchecked operations of the illicit sector.

Read More News On

Catch all the Pakistan News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.