Abad rejects exorbitant hike in steel prices

KARACHI: The Association of Builders and Developers (Abad) on Wednesday criticised the...

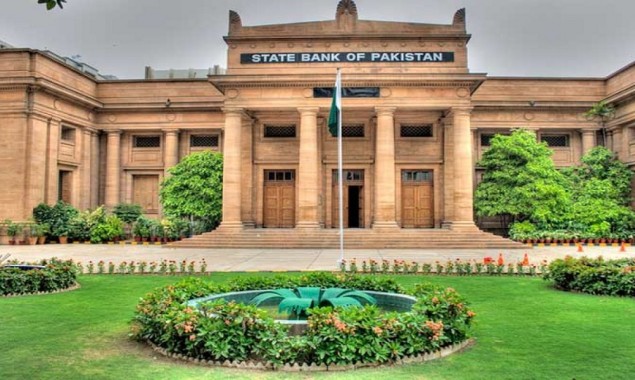

KARACHI: The central bank on Wednesday said that the financial system of the country has shown resilience to the adverse conditions during the pandemic.

The State Bank of Pakistan (SBP) has issued its flagship annual publication, the Financial Stability Review (FSR) for CY20.

The review presents performance and risk assessment of various stakeholders in the financial sector, including banks, non-banking financial institutions, financial markets, non-financial corporates and financial market infrastructures.

The Financial Stability Review highlights that CY20 was a challenging year for the financial sector, as Covid-19 pandemic triggered the deepest global recession since the Great Depression. Besides enormous loss of lives worldwide due to this health crisis of epic proportions, economic activities were severely disrupted.

To mitigate the adverse implications, national authorities and central banks’ around the globe swiftly enacted supportive policy measures, at an unprecedented scale, to preserve financial and economic resilience, it said.

The review also said the economic stress subsided in the second half of 2020 and onwards due to the revival of the economic activity in response to swift and comprehensive policy measures taken, receding intensity of infections, and easing of mobility restrictions.

The SBP’s policy measures included a speedy and significant cut in the policy rate, new concessionary refinancing schemes to support employment, healthcare services and production, deferment and rescheduling/restructuring of loans, reduction in the capital conservation buffer of banks and a host of other initiatives to ensure continuity of banking services to firms and households, while maintaining the safety of the customers, it added.

The SBP’s relief measures coupled with the fiscal stimulus provided by the government, extended necessary support to the households and businesses, which led to the revival of the economy as reflected in the estimated GDP growth of 3.94 per cent for FY21.

The review notes the financial system of Pakistan exhibited resilience and continued to perform its operations in a challenging environment. The sector’s asset base expanded 14.08 per cent in CY20, compared with 11.61 per cent in the previous year. The major contribution came from the banking sector, the largest segment of the financial sector.

Financial markets, after experiencing a short-lived bout of volatility, regained confidence in the second half of the year, owing to the timely interventions by the central bank, it said.

The banking sector showed marked performance and resilience. The sector posted a strong growth of 14.24 per cent in its asset base supported by a decent growth in deposits, a major source of funding. Within the asset mix, investments in the government securities outgrew the private sector advances.

The review also said the growth momentum for the latter remained subdued due to the pandemic-induced slowdown and weak demand for credit. The sector experienced a moderate rise in credit risk in the first half of 2020, which subsided in the second half, among others, as a result of the SBP’s regulatory relief measures.

Importantly, with a revival in the economic activities, the corporate sector’s performance and repayment capacity improved, which further subsided the credit risk concerns.

The earnings of the banks increased substantially, owing to lower interest and administrative expenses, as well as gains on the sale of securities, it said, adding that strong earnings, in turn, enhanced the solvency of the banking sector, as capital adequacy ratio (CAR) increased 156 basis points to 18.56 per cent at the end of CY20, well above the minimum regulatory requirement of 11.5 per cent.

The stress test results of the banking sector also show that, even against adverse economic conditions, it is likely to maintain resilience over a three-year projection horizon.

The Financial Stability Review mentions that the performance of Islamic banking institutions (IBIs) was significant, as their asset base expanded 30 per cent during CY20 due to a decent growth in financing and a surge in investments.

Encouragingly, availability of additional Shariah-compliant investment avenues facilitated the Islamic banking institutions to improve their liquidity profile. Asset quality indicators also improved, while healthy profitability boosted the overall earnings of the banking sector, it added.

The review also highlighted that, on an overall basis, the non-bank financial institutions performed well, owing to healthy growth in its asset management segment, though entities involved in financing businesses experienced contraction and deterioration in asset quality due to challenging economic conditions.

Despite operational constraints triggered by the pandemic, the financial market infrastructures remain resilient and continue to perform efficiently without any disruption. Particularly, increased preference of customers for the use of digital financial services and policy measures of the central bank gave a strong impetus to e-banking transactions.

Further, the industry capitalised on the unique opportunity offered by the pandemic, as it accelerated the pace of digitalisation for the provision of services in a safe and convenient manner.

Importantly, the State Bank launched ‘Raast’, an instant payment system for retail transactions, as a major step towards the implementation of the National Payment Systems Strategy, it added.

Catch all the Business News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Follow us on Google News.