Anemic Rupee Needs Lifeline

Dollar deficiency leading to dissent and discontent

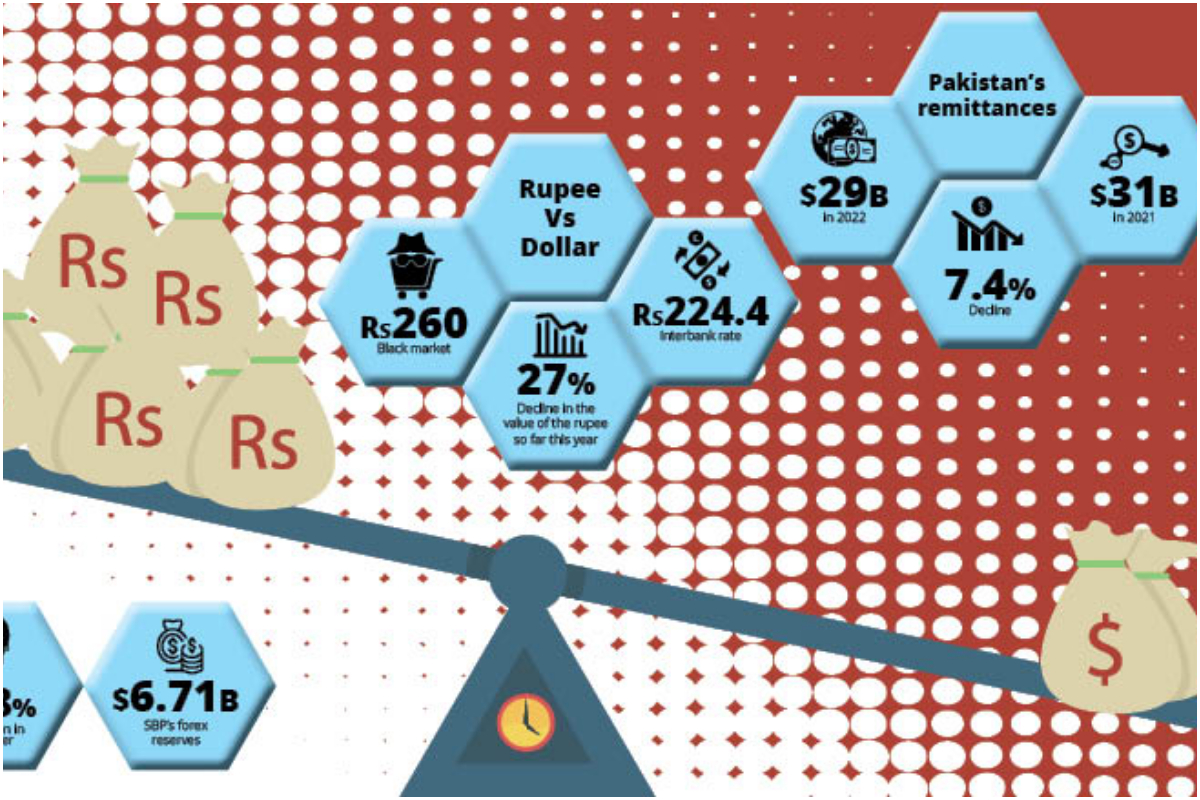

KARACHI: Currency torpedo is on the cards. Pakistan is facing a severe dollar liquidity crunch, as the foreign denominator is rare to find in the open market. In the black market, it is being pumped out at Rs260, compared with Rs224.40 in the interbank foreign exchange market.

The situation is frustrating for the importers and alarming for the consumers that more than 400 containers of perishables — onion, ginger and garlic — are stuck at the ports since the commercial banks are reluctant to issue clearance documents due to a shortage of the dollars.

According to the media reports, raw materials for export-oriented industries, pharmaceutical companies, pulse and other edible items are also facing stringent import restrictions due to the dollar shortage. The present scenario is painting a bleak picture of a future, where life-saving medicine and daily food items will be out of reach of the common man.

Experts and analysts criticised the State Bank of Pakistan (SBP) for imposing restrictions on the imports, including essential items and crucial raw materials for export-oriented industries. They urged the government to take some practical measures to reduce the energy and import bills.

Pakistan’s trade deficit widened by 23.59 per cent in November to clock-in at $2.87 billion, compared with $2.32 billion in October, as exports declined, data released by the Pakistan Bureau of Statistics (PBS) showed.

The country’s exports stood at $2.3 billion, compared with the imports of $5.24 billion. On a month-on-month basis, the exports during November 2022 decreased 0.63 per cent, while imports jumped 11.34 per cent.

The currency market experts believe the country needs foreign inflows on an immediate basis to avoid a balance of payments crisis, in a last minute endeavour to stem the rot. They say until and unless Pakistan has sufficient foreign exchange reserves to support its foreign bills, the fiat will continue to weaken. The country is stuck in a vicious cycle of the dollar deficiency.

Finance Minister Ishaq Dar, who has a reputation to keep the dollar under control, apparently failed to live up to expectations.

Soon after taking charge of the country’s finances, Dar said that he would work to rein in inflation, while cutting interest rates. He also claimed that the rupee was undervalued and promised a strong response to the country’s worst economic crisis.

“The rupee’s real value is below 200 against a dollar, and, God willing, it will come below 200 (rupees),” Dar claimed in October.

He added that the rupee would be strengthened through the government ‘policies’ as the current rate was inflated due to speculation. Neither he was able to control the dollar, which is still above Rs224, nor the inflation.

Contrary to Dar’s claims on the interest rates the Monetary Policy Committee (MPC) of the SBP in November raised the key interest rate by 100 basis points, taking it to 16 per cent, the highest since 1998/99.

Economists and analysts believe that apart from the inability and indecisiveness of the financial managers of the country, the external factors are also pushing inflation higher and weakening the local currency. The global waves of inflation after the Russian incursion into Ukraine and the aggressive interest rate hikes by the US Federal Reserve have left the emerging economies in devastation.

The Consumer Price Index (CPI) inflation increased to 23.8 per cent on a year-on-year basis in November 2022, data released by the Pakistan Bureau of Statistics (PBS) showed.

Arun Leslie John, chief market analyst at Century Financial, said that since 2019, Pakistan is following a market-based exchange rate regime. Although the official exchange rate has stayed in the range of Rs221 to Rs225 in the recent past, the black market rate is trading at a premium of more than 10 per cent at Rs240 to Rs250.

“The widening differential between the rupee in the interbank market, the open market and the rate on offer by the black market system accounts for the gradual decline in the remittance inflows, which adds an ever-rising pressure on the country’s foreign exchange reserves and consequently on the rupee/dollar exchange rate,” he said.

The foreign exchange reserves held by the State Bank of Pakistan (SBP) fell by $784 million to reach $6.71 billion during the week ended December 2, leaving import cover of only one-and-a-half months.

“Given, the widening gap between the rising demand for the dollars, compared with its low supply, the suppliers are able to charge a higher price than the official rate in the black market,” John added.

For him, the restriction on the open markets and 100 basis points rise in the key policy rate to 16 per cent on November 25 are attempts to support the currency facing serious credit risk.

“This is considering the recent losses against the greenback, a warning signal for the government, which had already failed to ensure excess loan debt financing coverage after paying off a substantial $1 billion for the outstanding obligations on December 2,” he noted.

Since the dollars are unavailable in the open market, the unregulated black market has taken a strong presence, attracting remittances from overseas Pakistanis.

The World Bank in its latest report, “Remittances Brave Global Headwinds Special Focus: Climate Migration”, said Pakistan’s remittances may fall 7.4 per cent to $29 billion in 2022 from $31 billion in 2021, as a loss of confidence contributed to the migrants’ preference for the parallel exchange market and informal channels of money transfer, which further decreased the official remittance flows to the country.

Explaining the reasons for the huge differential in the interbank, open and black markets, A A H Soomro, an independent analyst, said that the SBP is putting aggressive control over the dollar availability in the open market by administrative measures and travel restrictions.

“Also, the investors’ confidence is ebbing so they are rushing to buy dollars to preserve their real value. Moreover, a significant amount of the greenback is being smuggled to Afghanistan to sustain its economy,” Soomro said.

Rupee Debacle

Pakistan’s rupee has fallen 27 per cent this year, with around half of that drop coming since mid-June alone. The local unit is weakening mainly due to the dollar strengthening against the world currencies as the US Federal Reserve opted for a 16-fold hike this year to 4 per cent to tame the surging inflation.

Arun Leslie John, chief market analyst at Century Financial, said that higher oil prices also weighed on the currency since Pakistan is one of the major importers of oil.

“Besides, losses incurred by the devastating floods increased the greeback’s demand to import agricultural products, including cotton. Textile exporters are fearing losing orders, amid high inflation in the West,” he said.

For John, the fear that the country may not secure aid from the IMF quickly enough to avoid a default is another critical reason for the rupee’s fall. “The donors that previously have been generous have refused to lend now until a deal with the IMF is agreed,” he noted.

The Future of Fiat

The holdup in the IMF’s ninth review and the subsequent approval of a $1.2 billion loan tranche, coupled with unstable economic conditions and poor foreign exchange reserves is likely to continue to weigh on the rupee, market analysts said.

A A H Soomro, an independent analyst, said that only the market can determine the fair value of the rupee.

“However, by June 2023, I expect the IMF’s programme to remain intact and if global oil prices remain at the current levels and if the government is able to control inflation, then the rupee may stabilise below Rs250 against the dollar. That may be the fair value if the government follows a sustainable path to debt reduction, structural reforms and export growth,” he added.

“The value of the rupee under 200 is an unrealistic dream now,” Soomro said.

Arun Leslie John, chief market analyst at Century Financial, said that the widening gap between the rising demand for the dollar, compared with its low supply will cause the rupee to slide further against the greenback in the future.

“However, the pullback in the oil prices is likely to put a floor on any major losses like those witnessed in the year 2022. The rupee is expected to trade near 230 to 240 by June 2023,” he estimated.

The currency continued to remain stable between Rs220 and Rs225 for the last six to seven weeks.

“Signs that the Federal Reserve will slow down the pace of rate hikes and the likely pivot near 5 per cent is likely to limit major losses for the rupee. Nonetheless, unsteady economic conditions and deteriorating foreign exchange reserves will continue to be a drag on the currency. The currency is likely to trade in the range of Rs220 to Rs230 by the end of this year,” he noted.

Projecting the fair value of the currency, John said, according to the latest Real Effective Exchange Rate (REER), the rupee is undervalued by 9 per cent against the dollar.

“Nevertheless, just like the stock market valuations, these are just theoretical numbers. The market dynamics and the trade sentiments more often determine the exchange rate of a currency. With the holdup in the IMF’s ninth review, unstable economic conditions and poor foreign exchange reserves, the rupee will stay under pressure in the medium-term. However, major losses will be capped, as the major global central banks pivot and turn dovish on their monetary policy,” John added.

The rupee’s real value is below 200 against a dollar, and, God willing, it will come below 200 (rupees). The rupee would be strengthened though government policies as the current rate was inflated due to speculation

Ishaq Dar

Finance minister

The widening differential between the rupee in the interbank market, the open market and the rate on offer by the black market system accounts for the gradual decline in the remittance inflows

Arun Leslie John

Chief market analyst at Century Financial

If the global oil prices remain at the current levels and if the government is able to control inflation, then the rupee may stabilise below Rs250. The rupee under 200 is an unrealistic

dream now

A A H Soomro

Independent analyst

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.