Balancing the Books

The increase of 100 basis points in the key policy rate by the State Bank of Pakistan (SBP) on November 25, 2022, shocked all the stakeholders and would continue to haunt the people of Pakistan in the shape of enhanced inflationary pressures.

The decision reflects that the inflationary pressures have proven to be stronger and more persistent than expected. The central bank believed the measure is aimed at ensuring that elevated inflation does not become entrenched and that the financial stability risks are contained; thus, paving the way for a higher growth on a more sustainable basis.

It seems that the delay in the negotiations with the International Monetary Fund (IMF) for the ninth review of the loan programme under the Extended Fund Facility has also compelled the State Bank to contain inflation by taking this measure.

Unfortunately, the central bank is only focusing on inflation, whereas it has to take into consideration the overall economic situation.

In real terms, after the decision, the financing cost would increase and would ultimately hit the corporate sectors’ bottom-line. This would further slowdown the economic activities, while the markets will react negatively. The rate hike would badly impact the formal sector.

At present, the global inflation is on the downward trajectory but it seems that the SBP is expecting higher inflation in the near future. The large-scale manufacturing is already on the declining path after the LSM Index, which peaked to 153.6 in March, dropped to 115 in September. This raise in the discount rate would also hit the domestic industrial sector and would choke the liquidity.

Similarly, the supply shocks, both local and international, and the fuel adjustments have elevated the inflation projections at a time when the external account is confronted with numerous challenges.

Earlier this month, the Federal Reserve had raised its policy rate to a range of 3.75 per cent to 4 per cent, its fourth straight 75 basis points hike.

Likewise, the Bank of England also increased the rate to 3 per cent from 2.25 per cent and warned that the British economy might not grow for another two years.

There has been growing uncertainty about the ability of Pakistan to meet external financing obligations. However, with the payment of $1 billion to international bond three days in advance on December 2, 2022, the situation is still uncertain.

The SBP decision to raise the interest rate has been widely rejected by the businessmen, as most of them believe that it is tantamount to destroy the industry by raising the cost of doing business in the country.

Many businessmen sounds dejected on the central bank’s decision and fails to understand how the industry and other businesses function and flourish in such a scenario.

The rightfully argued that with the addition of 2.5 per cent of the commercial banks, the interest rate will hover around 18.5 per cent, which will ultimately enhance the cost of doing business.

There are several other methods through which inflation could be controlled but raising the interest rate would further jack up the inflation, as with the increase in the cost of doing businesses the borrowing cost would eventually go up, translating into more expensive goods for the end consumers. Such steps would further add fuel to fire in the shape of slowdown in economic activities and the authorities would be unable to stabilise the economy.

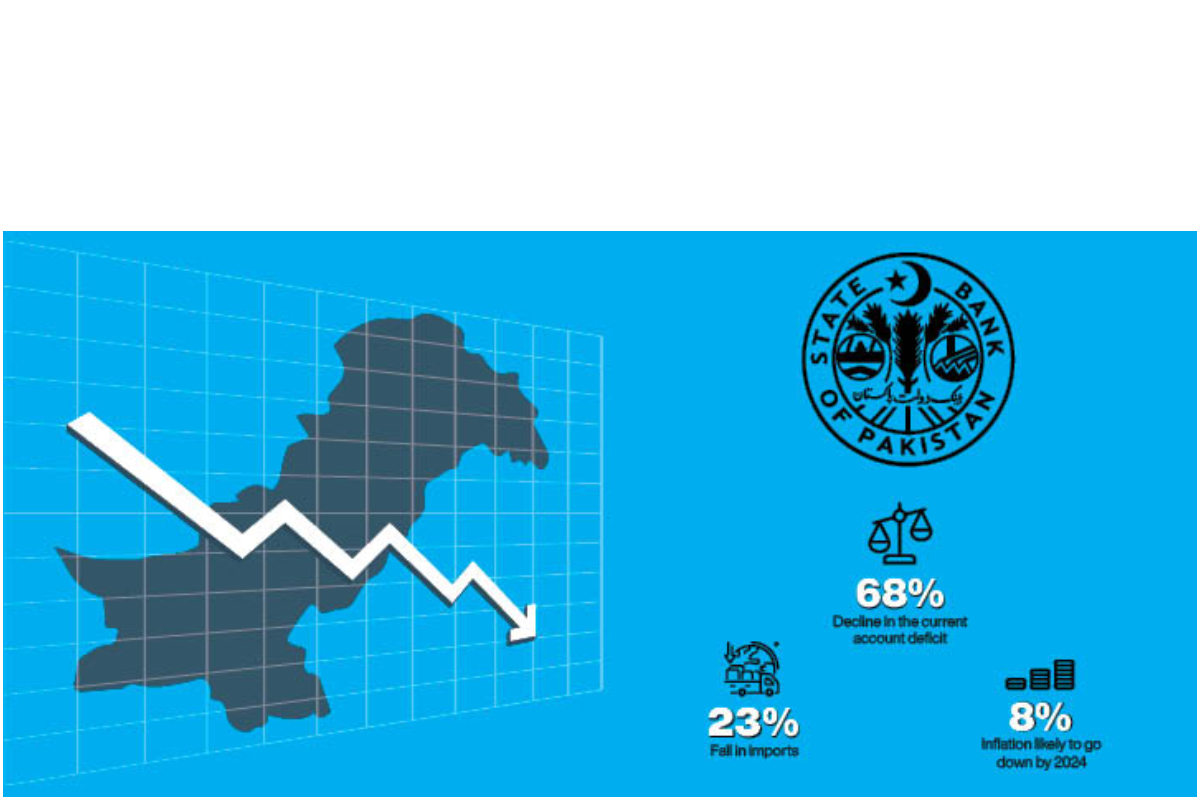

Moreover, the dollar pledge from the Asian Investment Infrastructure Board (AIIB) and the repayment of the Sukuk bond next week are expected to support the market and increase the investors’ confidence. In addition, the current account deficit declined 68 per cent YoY, primarily due to a decline in imports, which went down 23 per cent YoY. This will also give some respite to the fragile economy of the country.

However, inflation is expected to remain on the higher side, as the government would revise up the food prices and the electricity tariff under the IMF condition for its ongoing $6.5 billion loan programme.

According to some estimates, the inflation is likely to fall towards 7 to 8 per cent, a medium-term target, by the end of FY24 if the government make prudent macroeconomic policies, bring down the value of the rupee against the dollar and a reduction in the global commodity prices. Before that there seems no respite from the price hikes.

The supply chain disruptions owing to the flash floods and the ongoing policy and administrative measures have slowed down the economic activities in the country.

The economic indicators in October showed a double-digit contraction on a yearly basis, including cement, petroleum products and automobiles sales. The central bank’s decision will further dent the economy until or unless stability returned on the arena.

The authorities need to reduce the electricity tariff for at least the households and the Small and Medium Enterprises (SMEs) to bring down the cost of production, maintain the key policy rate at the regional level and provide a level-playing field to the domestic market and the export industry.

To say it simply, the central bank should revisit its monetary policy stance to mitigate the sufferings of the people and its harmful impact on the businesses and the overall economy.

Pakistan is going through difficult times, while the State bank has taken an untimely decision to raise the interest rate to 16 per cent.

As Pakistan’s economy is import-oriented where exchange rate plays havoc with the prices of the commodity and raw materials, the authorities have to show some maturity in taking concrete economic measures.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.