More Economic Pain

The year 2022 was supposed to be considered as the recovery year for the world economies after the devastations caused by the Covid-19 pandemic but, unfortunately, it saw record high inflation, unemployment and the climate-linked disasters, resulting in further pain to the people.

It appears that there will be more economic gloom next year, especially in Pakistan, which seems on the verge of default but the government functionaries are denying this fact, assuring that the country faces no risk of any default, as they have managed it. But the economic conditions hinted at more miseries in 2023.

The number of crises has increased since the start of the Covid-19 pandemic and we have never seen such a complicated situation.

After the economic crunch of 2020, the consumer prices rose in 2021. The Pakistan government and the central bank insisted that high inflation would only be temporary but the Russia-Ukraine war, which started in late February 2022, sent energy and food prices soaring.

Similarly, many countries are now grappling with the cost of living crisis because of the low wages in comparison with the rising inflation.

Everything has become expensive from food items to petrol, diesel and above all the cost of doing business.

The State Bank of Pakistan (SBP) started to raise interest rates in September 2021 in an effort to tame galloping inflation. However, the inflation is still moving upwards.

According to the Organisation for Economic Cooperation and Development (OECD), the consumer prices in the Group of 20 developed and emerging nations are expected to reach 8 per cent in the fourth quarter before falling to 5.5 percent next year. The organisation encourages governments to provide aid to bring relief to the households. Rising interest rates have also hurt the consumers and businesses, though Finance Minister Ishaq Dar has signalled that the pace of hikes could ease soon.

Some economic experts believe that Pakistan has technically defaulted but the government has been in a denial mode and paints a rosy picture for the future. For Pakistan, the biggest crisis is climate change.

Floods in Pakistan resulted in around $40 billion in damages and economic losses this year. The governments agreed at the United Nations climate talks (COP27) in Egypt in November to create a fund to cover the losses suffered by the vulnerable developing countries, especially Pakistan.

However, the Ministry of Finance in its monthly economic update and outlook showed improved economic conditions in 2023. According to the ministry, Pakistan has met all its debt obligations in a timely manner and the government is comfortable with its medium- to long-term obligations.

To avert the balance of payments crisis, the country needs a manageable current account deficit and guaranteed financing, it said, while claiming that the government has a vibrant financial plan in place for FY23. Over the medium-term, sustainable growth requires economic fundamentals based on balanced economic policies.

But to sustain economic stability, Pakistan requires sufficient investment to enhance the production capacity and productivity and also realise the high growth of potential output, which needs accommodative fiscal and prudent monetary policies.

Several high frequency indicators point to lower growth since the start of the current financial year. The economic dynamics seems to be hindered if the conditions in the main export markets remain volatile and uncertain.

Pakistan’s economy continues to deteriorate owing to several structural imbalances, as decisions regarding the economic policies like taxes and subsidies remained unaddressed.

The foreign exchange reserves position worsened as they depleted to a critical low of around $6.7 billion, compared with $20 billion in August 2021, making the government unable to make external payments.

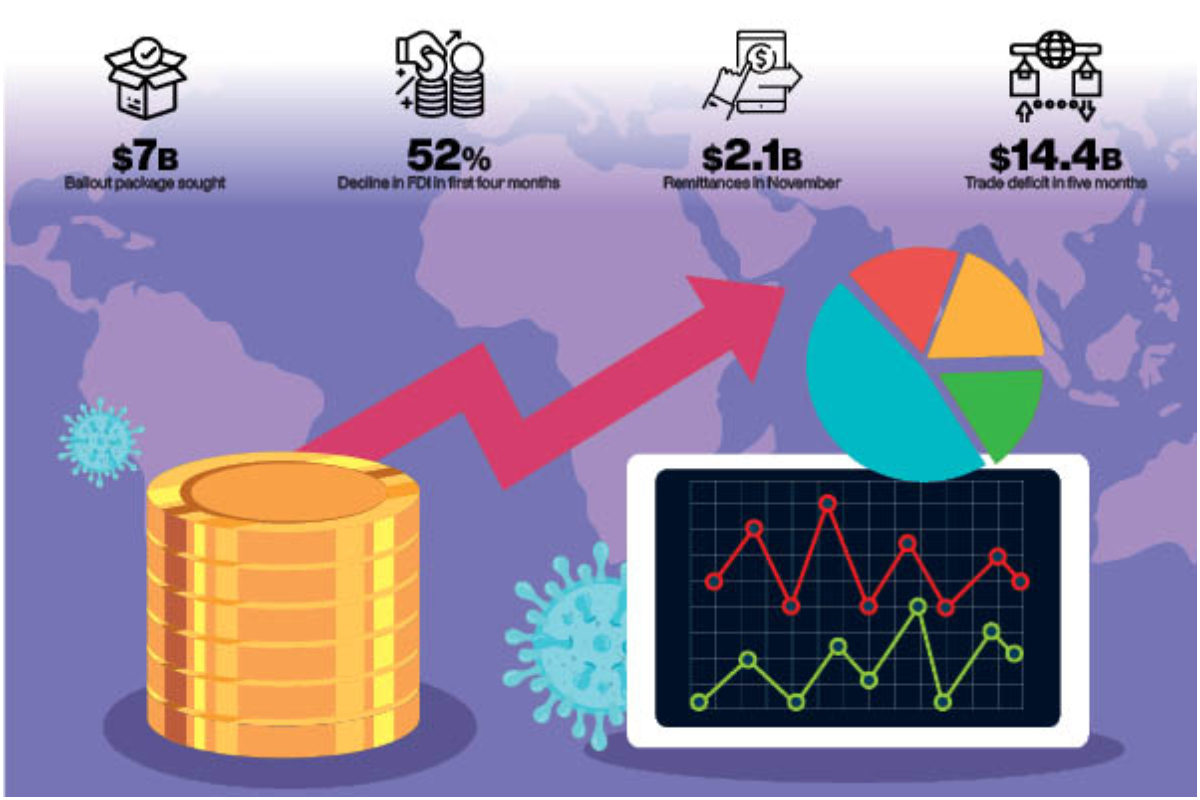

The dismal economic performance of the country can also be seen through the foreign direct investment (FDI), which went down 52 per cent in the first four months of the current fiscal year, while a decline in remittances is adding to the rupee woes.

The remittances amounted to $2.1 billion in November 2022, down 14.3 per cent from $2.45 billion in the same period of the last year.

Although the overall trade deficit of Pakistan narrows 30.14 per cent to $14.41 billion in the first five months of FY23, compared with the deficit of $ $20.621 billion, in the same period of the last fiscal year, there is no reason for complacency, as it is primarily due to a decline in imports, which is a sign of economic slowdown.

Despite Pakistan government’s repeated assurances for bonds payment on time, the investors’ are unwilling to trust, as the economy is still struggling to avoid default and seeking more assistance from the donors and friendly countries.

Similarly, the delay in the negotiations between the Pakistan authorities and the IMF on the ninth review of the loan programme is also denting the economic progress of the country.

The IMF has asked Pakistan to work on its commitments of adjusting sales tax on the petroleum products and also to take other measures needed under the agreement.

Meanwhile, Pakistan has sought a $7 billion economic bailout package from three major IMF shareholders in an attempt to pacify jittery markets.

In this regard, Dar and his team held back-to-back meetings with Islamabad-based top diplomats of the US, China and the UK, having 16.5 per cent, 6.08 per cent and 4.03 per cent voting rights in that order and took them into confidence over the economic challenges mostly caused by exogenous factors and difficulties in dealing with the IMF staff.

Japan, Germany, and France are the three other leading voting powers in the IMF’s Executive Board with 6.14 per cent, 5.31 per cent and 4.03 per cent votes.

Dar assured the diplomats that Pakistan was committed to the IMF programme, despite all the difficulties and there was no truth to the economic emergency in the offing.

All in all, the country is under severe pressure on the economic front, whether it is rupee depreciation, whopping energy circular debt, depleting foreign exchange reserves, ballooning twin deficits, etc, but one thing is clear that the people have to bear more economic pains in the months or even years to come.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.