Rupee expected to remain under pressure next week

KARACHI: The rupee is likely to continue on a downward path, owing to narrowing foreign exchange reserves, economic slowdown, besides the lack of inflows and funds from the multilateral lending institutions, dealers said.

The local currency failed to recover against the greenback and remained under pressure throughout the outgoing week, as Pakistan’s macroeconomics continued to deteriorate.

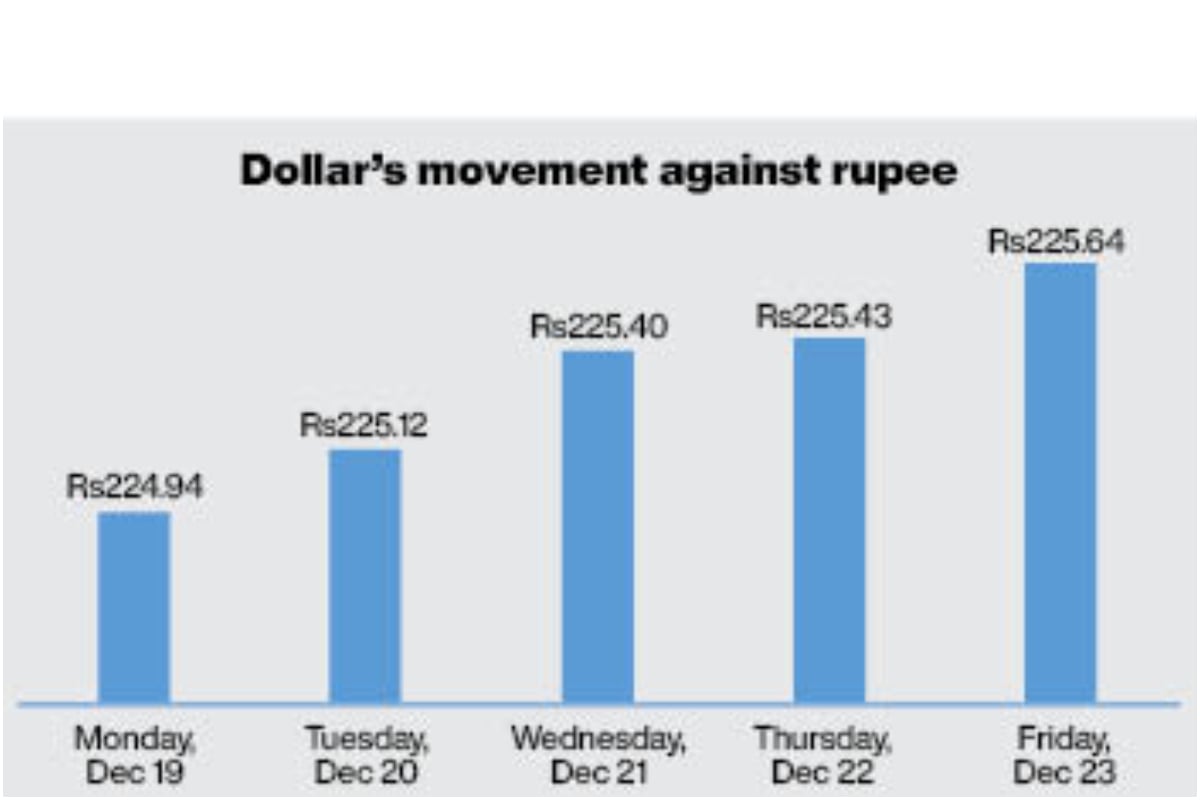

The rupee shed 70 paisas to close at Rs225.64 against the dollar on Friday, compared with the closing of Rs224.94 on Monday, December 19, in the interbank foreign exchange market.

Experts said the long stalled International Monetary Fund (IMF) programme further increased the pressure on the economy, as the country is confronted with a balance of payments crisis, due to narrowing forex reserves.

The IMF officials raised concerns over the fiscal slippages emanating from a combination of the devastating floods and revenue shortfalls, they added.

The forex reserves held by the State Bank

of Pakistan (SBP) dropped $584 million to

reach $6.1 billion during the week ended December 16, compared with $6.7 billion on December 9.

The forex reserves went down to the levels worth just eight weeks of imports, their lowest since April 2014.

The overall liquid foreign currency reserves held by the country, including the net forex reserves held by the commercial banks stood at $12 billion. The net foreign exchange reserves held by the commercial banks amounted to $5.88 billion.

The current account deficit declined over 85 per cent on a year-on-year basis to clock-in at $0.28 billion in November, as the government took measures to curb imports and to reduce the outflows of the greenback.

However, the move to curb imports hit the export-oriented industries, owing to the challenges in opening letters of credit (LCs) for importing raw materials.

Resultantly, the exports of the country were also hit, depriving Pakistan of export receipts to support the depleting foreign exchange reserves.

According to the data released by the Pakistan Bureau of Statistics (PBS), the exports fell to $2.37 billion in November, compared with $2.9 billion in the same month of the last year.

As the country’s macroeconomic indicators worsened, the global ratings agency S&P Global on December 22, 2022 cut Pakistan’s long-term sovereign credit rating by one notch to “CCC+” from ‘B’ to reflect a continued weakening of the country’s external, fiscal and economic metrics.

Pakistan’s already low foreign exchange reserves will remain under pressure through 2023 unless oil prices slump or foreign assistance improves, the agency said.

The country’s economy will grow at a slower pace in the current fiscal year than was forecast a few months ago in the wake of catastrophic flood losses and falling demand, and some headwinds such as high interest rates, the SBP’s annual report on Pakistan’s Economy for the fiscal year 2021/22 noted.

“Taking into account the destruction caused by the floods and the policy focus on stabilisation, the SBP projects real GDP growth below the previously announced range of 3 to 4 per cent for the fiscal year 2023,” it added.

With a huge spread between the interbank and the grey market, the unauthorised dealers take dollars out of legal channels to sell in grey markets across the country, where they can find lucrative margins.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.