Uncertain Future

A slowdown risk still haunts the automobile manufacturers

KARACHI: The automobile sector has picked up momentum, as the car sales have improved for the second consecutive month in November 2022. However, the risk of a slowdown in the coming months still haunts the manufacturing companies.

According to the latest data, the car sales in November clocked-in at 20,000 units, up 35 per cent on a month-on-month basis, mainly owing to the availability of the already imported completely knocked down (CKD) kits, which led to a rise in the production of vehicles. However, the import restrictions on the import of CKD kits should be lifted for a smooth sailing.

The previous bookings have been supportive for the industry. Once they taper off, the sales will again come down.

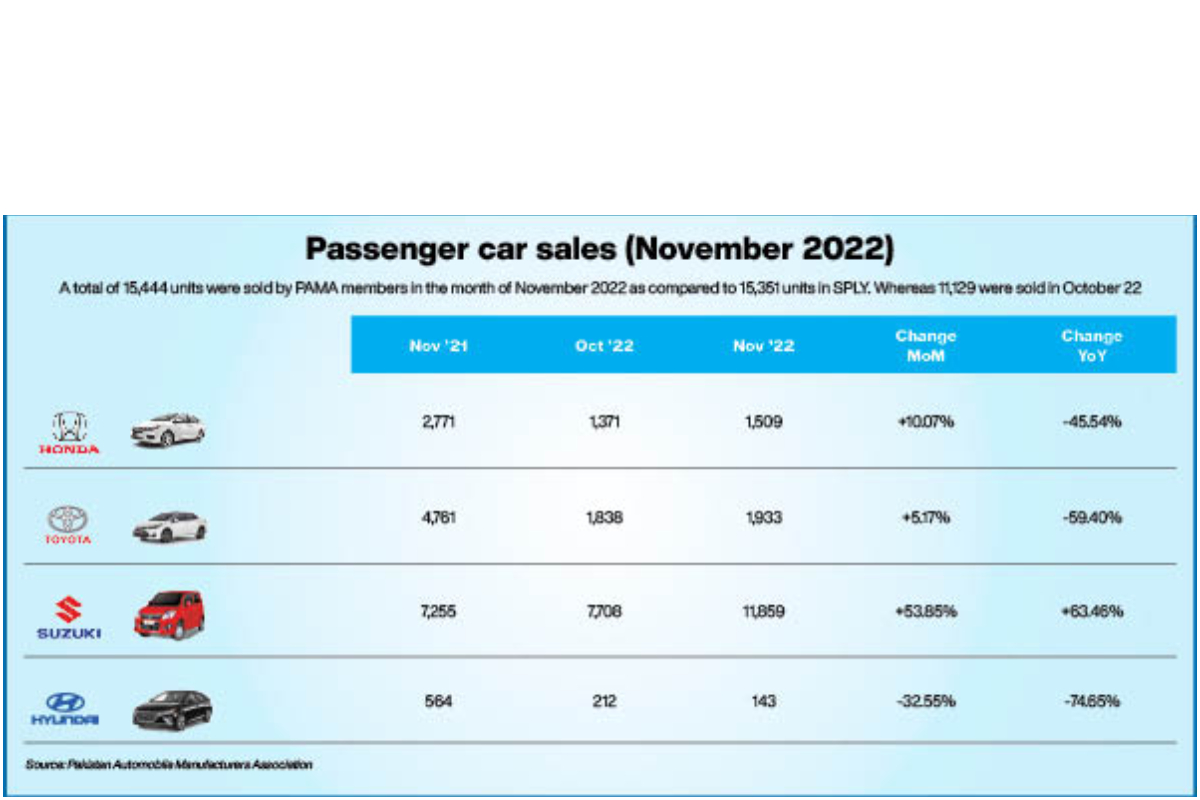

The car sales increased to 15,444 units, a rise of 39 per cent in November 2022, compared with 11,129 units in October, the latest figures released by the Pakistan Automobile Manufacturers Association (PAMA) revealed. On a yearly basis, the sale of cars remained flat, compared with 15,351 units sold during the same period of the last year.

Ahsan Mehanti, managing director at the Arif Habib Corporation, said that the automobile sales have picked up momentum in November 2022, owing to price adjustments and the government’s support over stalled imports after the receipts from the IMF.

“The government is determined to enhance exports. The reports of productive talks with the IMF for the financial support will cushion the auto industry to run on capacity during the next fiscal year,” he added.

Sensing the overheated economy, the State Bank of Pakistan (SBP) in September 2021 revised down the regulations for consumer financing, including the auto sector. The restrictions included a financing limit and the period for auto financing.

The central bank wanted to moderate the demand growth in the economy, leading to slower import growth to support the balance of payments position. This was mainly due to higher trade deficit, which continued to haunt Pakistan and only worsened.

According to the restrictions, the maximum tenure of auto financing was reduced to five years from seven years; maximum debt-burden ratio, allowed to a borrower, was decreased to 40 per cent from 50 per cent; the overall auto financing limits availed by a person would not exceed Rs3 million; and the minimum down payment for the auto financing was increased to 30 per cent from 15 per cent.

The locally-manufactured or assembled vehicles of up to 1000cc engine capacity and electric vehicles were exempted from the revised regulations.

H M Shahzad, Chairman of the All Pakistan Motor Dealers Association (APMDA), said that the prices of automobiles will remain on an upward trajectory, amid the dollar’s continuous flight against the rupee.

There is no manufacturing of cars in the country. The automobile companies import semi-knocked down units (SKDs) and completely knocked down units (CKDs), which entirely depends on the rupee/dollar parity, he added.

For Shahzad, there seems no respite for the consumers during the fiscal year FY23, owing to the worsening economic conditions of the country where the local currency is plunging to new lows on a daily basis.

PAMA reported the sales of 1300cc cars at 5,831 units in November 2022, compared with 8,102 units in the same month of 2021, showing a fall of 28 per cent on a year-on-year basis.

The manufacturing companies are expecting further improvement in the months to come owing to likely availability of raw materials; following a rise in the issuance of letters of credit.

Meanwhile, the sales of trucks, buses, tractors, jeeps, pickups, motorcycles declined, compared with the same period of the last year.

The sales of buses and trucks fell to 342 units in November 2022, compared with 532 units in the same period of 2021. Similarly, tractor sales also witnessed a drop to 1,240 units during the period under review against 4,617 units in November 2021.

According to the Topline Securities, Pak Suzuki Motor Company (PSMC) reported a 55 per cent month-on-month increase in sales that reached 12,400 units in November, followed by a notable increase of 38 per cent recorded by Honda Atlas Cars (HCAR) that sold 1,973 units in the month.

The auto sales increased in November possibly due to the improvement in the supply and clearance of some backlog. However, on a year-on-year basis, the sales increased by only one per cent, which showed that the sector was still absorbing the shocks of economic slowdown.

Indus Motors sales declined 4 per cent on a month-on-month basis to reach 3,242 units in November 2022, compared with 3,374 units in October.

Hyundai sold 48,003 units in November 2022, up from 48,001 units in October 2022. The company managed to grow its share to 28 per cent this year, marking a growth of 7 percentage points.

The top three Hyundai models — I10 Nios, Creta and Venue — together accounted for 92 per cent of the brand sales in November.

In the tractor category, Al Ghazi Tractors (AGTL) saw a 65 per cent month-on-month fall in the sales to hit 137 units in November 2022; followed by Millat Tractors (MTL) whose sales clocked-in at 1,103 units, down 27 per cent.

This took the total tractor industry sales to 10,498 units in the five months of the fiscal year 2022/23, down 52 per cent on a year-on-year basis due to the flash floods, higher prices and a reduction in the buying power of the consumers.

However, motorbike sales in November 2022 dropped 34 per cent on a year-on-year basis, while it dipped 3 per cent on a month-on-month basis.

Atlas Honda (AHL) recorded sales of 92,000 units, down 3 per cent on a month-on-month basis and 28 per cent on a year-on-year basis.

No matter whether we talk about Honda, Yamaha or some other manufacturing companies, the numbers are negative for most of them. However, when these bike manufacturers faced a decline in their sales, Suzuki got a significant increase in both monthly and annual comparisons.

Regarding the trucks and buses, the PAMA data showed that the sales went up 5 per cent on a month-on-month basis but remained down 36 per cent on a year-on-year basis to 342 units in November 2022.

This took the five-month sales to 1,661 units, down 39 per cent on a year-on-year basis, primarily owing to a drop in the transportation activity and a slump in the overall economy.

Experts expect the demand to contract by the end of CY22 due to higher interest rates, imposition of capital value tax, increase in advance taxes in the budget for FY23, restrictions on auto financing and the likely third round of price hike by the automobile players.

Going forward, the economic slowdown, increase in the interest rate and further tightening of the financing requirements by the SBP will significantly impact car sales, they added.

At present, the government has managed to tackle the dip in the demand for the vehicles, as the country depends on imports, while the prices and demand for the cars are directly linked with the rupee/dollar parity.

The automobile sales are exhibiting impressive progress on a monthly basis due to the improvement in production. The companies are delivering pending orders for which they have taken advances. However, once these companies delivered the cars, the sales might again see a downward trajectory.

SBP restriction to moderate sales growth

The maximum tenure of auto financing was reduced to five years from seven years; maximum

debt-burden ratio, allowed to a borrower, was decreased to 40 per cent from 50 per cent; the overall auto financing limits availed by a person would not exceed Rs3 million; and the minimum down payment for the auto financing was increased to 30 per cent from 15 per cent

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.