VPS — an attractive retirement product

KARACHI: Savings are an important determinant of economic growth of a country because higher savings lead to higher investments, which, in turn, boost economic development and prosperity, said Dr Amjad Waheed, chief executive officer of the NBP Fund Management Limited.

Weak institutions, political instability, inconsistent economic policies, low rank in ease of doing business, weak judicial system and unsupportive regulatory framework act as an obstacle to attract the foreign direct investments (FDI) and the foreign portfolio investments (FPI) in Pakistan, he added.

Hence, much of the difference in economic performance between Pakistan and other developing countries over the last few years could be attributed to low rates of savings and investments.

According to the World Bank, Pakistan’s national savings rate stands at just around 13 per cent of GDP, which is in sharp contrast to Bangladesh and India, whose savings rates stand at 36 per cent and 30 per cent of GDP, respectively. Besides public dissaving, one reason for Pakistan’s low savings rate is lower level of contractual savings in the country.

Existing occupational saving and pension schemes cover only provincial governments and the private sector corporate employees and they remain significantly underfunded.

At the federal level, there is no pension fund to service the retirement obligations; thus, the liability remains totally un-funded. The voluntary pension schemes (VPS) offer a retirement saving platform to all the private citizens of Pakistan. However, they are in an infancy stage, despite good growth during the last few years, Dr Waheed said.

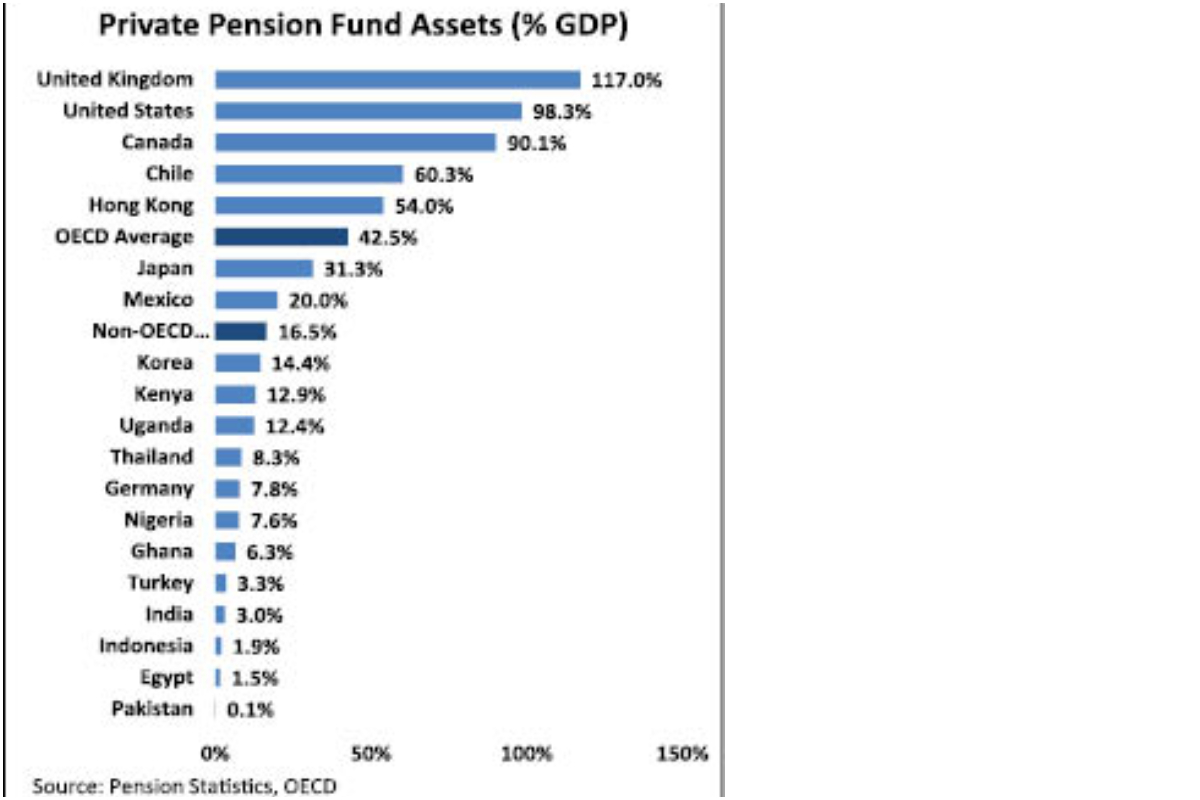

According to the latest OECD global pension statistics, the private pension assets in Pakistan form less than 0.1 per cent of the GDP, compared with 42.5 per cent for OECD countries and 16.5 per cent for selected non-OECD countries.

Pakistanis, in general, are not aware of the existence or attractiveness of these schemes, including the tax benefits. The Voluntary Pension Schemes are an attractive alternative to retirement savings, offering myriad benefits, compared with the conventional occupational schemes such as Provident Fund and Gratuity Schemes.

For instance, VPS are actively managed by investment professionals with vast experience and successful performance track record in managing savings and investments.

In a typical employee scheme, all the employees have similar asset allocation since they are part of the same pool, while in VPS, each employee has the flexibility to choose an individualised asset allocation based on their risk and return profile determined by the investment time horizon, liquidity needs and willingness and capacity to take risk.

Further, the investment allocations being flexible can be changed anytime. VPS also offers portability and continuity, as the investors can easily switch between available pension fund managers.

It also offers the participants both Shariah-compliant and conventional investment options. Unlike the Provident Fund and Gratuity Scheme, the pension plan continues even after change of the employer.

In addition, VPS provide special tax benefits, unavailable in other investment vehicles. Individuals are entitled to a tax credit of up to 20 per cent of the taxable income for the relevant tax year.

The NBP Funds Management Limited launched two Voluntary Pension Schemes, NAFA Pension Fund (NPF) and NAFA Islamic Pension Fund (NIPF) in July 2013. These pension funds have delivered attractive returns since inception.

The investors who had invested at inception Rs100,000 in NAFA Pension Fund (Equity) would have more than tripled their investment to Rs320,000. Both our equity pension funds rank number one since inception, with NPF outperforming the peer group and the KSE-100 Index by 93 per cent and 130 per cent, respectively, and NIPF outperforming the peer group and KMI-30 Index by 119 per cent and 139 per cent, respectively.

We recommend the investors to consider NAFA Pension Funds for their retirement savings to optimise their wealth and enjoy tax and other benefits.

During the outgoing month of November, the stock market continued its uptrend. The benchmark KMI-30 Index rose by around 2,458 points (up 3.5 per cent) on a monthly basis.

The stock market started off the month on a strong note, as the KMI-30 Index surged around 5.5 per cent in the first eight trading sessions. At end of October, the rising political noise and uncertainty surrounding the long march by the Pakistan Tehreek-e-Insaf (PTI) dampened the sentiments. However, as we saw de-escalation on the political front, despite a failed assassination attempt on the PTI chief, the investors’ sentiments improved.

Further, other key catalyst was soft merchandise trade deficit, which clocked-in at $2.32 billion for October 2022, declining by around $574 million on a monthly basis.

Later, it reflected in a benign current account deficit of $567 million for October 2022. Though the current account deficit increased slightly by $204 million MoM, it was significantly below the last 12 months average run rate of around $1.35 billion.

During July-October 2022, the cumulative current account deficit fell to $2.8 billion, down from $5.3 billion, reflecting a decline of 47 per cent on a YoY basis, driven by 11.6 per cent decline in goods import.

During the month, Finance Minister Ishaq Dar announced that the country has secured around $13 billion financial support, including rollovers, from two friendly countries (around $9 billion from China and over $4 billion from Saudi Arabia), though it remains to be seen when these inflows materialise.

Additionally, there were commitments from other multilateral institutions, as the World Bank and the Asian Infrastructure Investment Bank (AIIB) announced $3 billion and $500 million funding for various energy projects and flood rehabilitation, which also propped up the sentiments.

During the month, China on the maiden visit of Prime Minister Shehbaz Sharif assured its continued support to Pakistan’s sustainable economic and strategic projects, including the main line-1 (ML-1) rail track.

However, towards the end of the month, some gains were trimmed, as the news surrounding the potential delay in the International Monetary Fund (IMF) programme caused uneasiness.

Reportedly, differences have emerged between the IMF and the government over the impact of flood damages on the fiscal deficit targets for FY23. The news surrounding the announcement of mini-budget to narrow revenue and expenditure gap also dented the sentiments. The central bank held its Monetary Policy Committee meeting in November; whereby, it raised the key policy rate by 100 basis points against the market expectations, citing the stickiness of inflation and worrisome trend in core inflation.

During the month, the fertiliser, oil and gas exploration, oil and gas marketing, power generation and distribution, sugar and allied industries, technology and transport sectors outperformed the market.

Besides, auto assemblers, auto parts and accessories, cable and electrical goods, cement, chemicals, engineering, food and personal care, glass and ceramics, paper and board, pharmaceutical, refinery, and textile composite sectors lagged the market.

On the participant-wise activity, the individuals emerged the largest buyers, with the net inflows of $16 million. Alongside, the banks and the development financial institutions and companies also increased their equity holdings by $4 million and $3 million, respectively. On the contrary, the insurance and mutual funds sold stocks worth $12 million and $7 million, respectively.

Looking ahead, the political noise is expected to subside somewhat in the coming days, as a change in the top military brass has taken place without any altercations and contentions. Therefore, the state of macroeconomic affairs, especially the progress on the resumption of IMF programme will again take a centre stage and will shape the market outlook.

Though the surprise 100 basis points hike in the key policy rate has dampened the sentiments, it will act as an anchor to inflationary expectations. It may also be a precondition to secure the next tranche of the IMF loans.

We may also see further policy actions on the economic front, as the focus of government again shifts towards economy and the country has to move ahead swiftly to secure the next IMF loan tranche.

With the positive nod of the IMF, we expect healthy inflows from the World Bank, the Asian Development Bank (ADB), Islamic Development Bank (IDB) and the Asian Infrastructure Investment Bank (AIIB), which coupled with the IMF loan tranche, will bolster dwindling forex reserves and support the investors’ confidence.

The central bank governor in its post-MPC meeting iterated that the country remains committed to meeting its external debt obligations and has retired around $1.8 billion in November and has prepaid the $1.1 billion Sukuk maturing on December 5, 2022, which should also give some confidence to the market.

Lastly, the ongoing softness in the international commodity market, especially, crude oil prices also portends well for the country.

The Arab Light prices touched their lowest level of $82/barrel since January in November, which will offer respite to the country on the external front. Looking at the fundamentals, the price-to-earnings ratio (P/E) of the market is at multiyear low of around 4 times (earnings yield of around 25 per cent).

In addition, it offers healthy dividend yield in excess of 8 per cent. Therefore, we advise the investors with medium-to long-term horizon to build position in the stock market through our NBP stock funds.

The Monetary Policy Committee took the decision so that the inflationary pressures be controlled and not become entrenched and the risks to financial stability are contained.

The increasing inflation, driven by the persistent global and domestic supply shocks, could de-anchor inflation expectations and undermine the medium-term growth.

The net liquid foreign exchange reserves with the State Bank of Pakistan (SBP) stands at $7.5 billion (as of November 25, 2022), posing challenges and persistent risks to the financial stability and fiscal consolidation.

The SBP held two T-Bill auctions with a target of Rs2.10 billion against the maturity of Rs1.98 trillion. In the first T-Bill auction, Rs485 billion was accepted at a cutoff yield of 15.71 per cent, 15.74 per cent and 15.74 per cent for three-month, six-month and 12-month tenures.

In the second T-Bill auction, Rs730 billion was accepted at the cutoff yield of 15.71 per cent, 15.73 per cent and 15.70 per cent for three-month, six-month and 12-month tenures.

In the third T-Bill auction, Rs206 billion was accepted at the cutoff yield of 16.99 per cent, 16.80 per cent and 16.84 per cent for three-month, six-month and 12-month tenures, respectively.

In the PIBs auction, the bids of around Rs27 billion were realised for five-year tenure only at the cutoff yield of 13.35 per cent. The bids for three-year and 10-year tenures were rejected, whereas no bids for 15-year, 20-year and 30-year were received.

We have calibrated the portfolio of our money market and the income funds based on our interest rate outlook and will remain alert to any developments that may influence our investment strategy.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.