A Fragile Economy

Pakistan continued to remain a fragile economy in 2022, as the political shake-up disturbed the entire development process by bringing in a slowdown in the economic activities and creating a sense of insecurity among the investors in the financial sector of the country.

All this lead to a host of problems for the coalition government led by the Pakistan Muslim League (PML-N), as it faces the gigantic tasks such as spiralling inflation, massive rupee depreciation, increasing fuel prices, drying up of the foreign exchange reserves, circular debt and ballooning twin deficits, which hinted at an imminent default situation.

The successive governments in Pakistan made decisions without taking into consideration the economic consequences in the long-term and that is why they failed because they did not have a good team of economists who could frame sustainable economic policies.

The governments mostly relied on senior bankers or chartered accountants to run the Ministry of Finance, which proved disastrous for the country.

The main factor behind the poor economic conditions is the inconsistent policies, pursuit of the wrong priorities and above all bad governance.

Ironically, the change in the government policies on a frequent basis shook the confidence of the investors and the donors, which creates immense problems for the country in fulfilling their debt obligations.

It has become a norm that every government blames previous government for all the economic ills rather than making efforts to pull the country out of the economic crunch.

Usually, the governments approached the International Monetary Fund (IMF) for assistance to overcome the fiscal problems and reduce the budget deficit but each time they utilise the revenue in debt repayments.

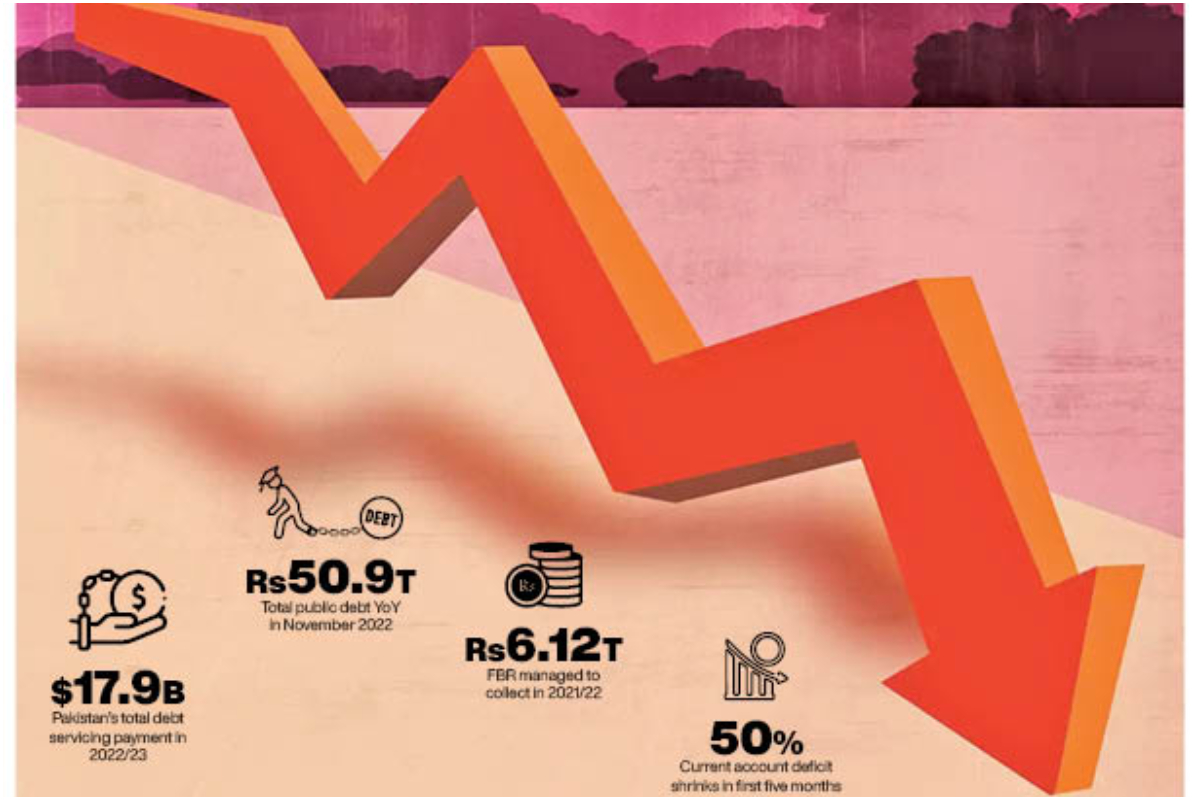

In the fiscal year 2022/23, Pakistan’s total debt servicing payment is estimated to be around Rs3.95 trillion, or $17.9 billion. Similarly, the total public debt stock of the federal government increased 24 per cent, or Rs10 trillion, to Rs50.9 trillion on a year-on-year (YoY) basis in November 2022, compared with the same month of the last fiscal year.

The taxation governance remains weak in Pakistan, as the government remains unable to collect genuine taxes because of bad governance, wrong policies and the lack of strong tax culture.

The country also lacks proper and easy documentation process to register retail businesses, which in turn, gave rise to undocumented economy.

According to official data, the Federal Board of Revenue (FBR) managed to collect Rs6.12 trillion in the financial year 2021/22, as against the fixed target of Rs7 trillion.

Usually, the FBR meets its revenue targets but it does not mean that this is the due tax amount collected from 220 million population. According to estimates, the tax authorities are collecting around Rs3 trillion less tax. Despite financial support from the World Bank and other international donors to reform and restructure the tax system, the successive governments in Pakistan failed to get the desired results. This can be gauged by its failure to curb tax evasion and increase the number of taxpayers.

More burden on the taxpayers further deteriorated the business environment and slowed down the economic activities. According to estimates, around 2 per cent of the total population of 220 million people are filing their tax returns, which is a cause of concern.

Despite numerous measures by the Federal Board of Revenue (FBR) to enhance tax collection, such as introduction of a special fixed tax regime for retailers, through the Finance Bill 2022; whereby, the retailers, other than Tier 1 and specified service providers, would pay fixed amounts of income tax, ranging from Rs3,000 to Rs10,000, through their commercial electricity bills, the tax authorities missed the revenue targets.

It was estimated that with this measure, the government would collect around Rs30 billion in taxes from the retailers but the authorities remained unsuccessful in bringing many of the retailers under the tax ambit.

Later, owing to the protests by the retailers, the government has to withdraw all the tax schemes, which were meant for the small retailers.

Pakistan’s current account deficit shrank more than 50 per cent in the first five months of the current fiscal year FY23 owing to a lower import bill and a marginal increase in exports.

The deficit during November alone was recorded at $0.28 billion, the rupee is depreciating on a regular basis, while the country has to make principal repayments of around $24 billion on its external debt.

Since April, the rupee has depreciated over 22.96 per cent. Owing to the political uncertainty, the demand for the dollars has increased, while the foreign exchange reserves are disappearing from the market by each passing day.

Inflation is also at its peak due to the record rise in fuel and energy prices. The government is facing a daunting task of tackling multiple challenges the country is confronted with.

At present, the economy depicts a gloomy picture. On the socioeconomic level, income disparities have widened, while poverty has increased, particularly because of the soaring food prices.

Unwarranted expenditures in recent years have generated a fiscal deficit that has ballooned to somewhere between 7.5 and 9.5 per cent of GDP. Such a deficit invariably leaks into trade numbers.

The economic growth projection has been reduced from negative 0.38 per cent to around 3 per cent of GDP, the overall budget deficit has been revised upwards to 9.1 per cent of GDP from 7.1 per cent, the FBR’s revenue loss has been projected at Rs900 billion, exports and remittances were adversely affected and non-tax revenue was decreased.

Despite all the above-mentioned issues, Pakistan’s economy can jumpstart and can grow around 7 to 8 per cent annually if the government make sincere efforts and evolve right policies.

Unfortunately, the people at the helm of affairs only fret about the role of judiciary, military establishment and other political issues, rather than the economic mess created by them, while the common man has been burdened by the double-digit inflation. The country needs a pragmatic approach and has to adopt such public policies, which can resolve the economic woes.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.