PSX: Beyond the short-term turmoil

KARACHI: The Pakistan Stock Exchange (PSX) has declined 9.4 per cent due to political turbulence, heightened economic risks arising out of the devastating floods, elevated inflation, slowing economic growth, rupee depreciation and the declining foreign exchange reserves during CY22, according to NBP Fund Manager Report for December 2022.

Given very little room to manoeuvre in the backdrop of abysmally low reserves position, we believe that the country has no other option than to go back to the International Monetary Fund (IMF), it added.

It is only a matter of time that the government will be forced to continue to take the harsh but necessary measures and reforms required by the IMF.

The inflows from the friendly countries, particularly Saudi Arabia and China are also critical and contingent upon the IMF programme’s resumption, which should buttress our foreign exchange reserves. Therefore, we expect the stock market to provide double-digit return in excess of 20 per cent for CY23 based on the record low valuations.

The IMF’s scheduled visit to Pakistan is now overdue by almost three months and despite holding virtual talks, the IMF and the Pakistan government have yet to reach an agreement on tax collection targets, exchange rate policy and overdue energy reforms, including the resolution of the circular debt.

The IMF has also expressed concern over Pakistan’s recently announced package of Rs1.8 trillion for the agriculture sector and unfunded Rs110 billion subsidies for concessional electricity to the export-oriented sectors.

“We believe that the implementation of the economic reforms under the IMF programme will determine the direction of the economy and its capital markets. Though the administrative policies pursued by the government and the central bank have achieved desired results in containing the ballooning current account deficit, the same has resulted in considerable slowdown in the economic activities and falling business confidence,” it noted.

Inflation and interest rates are also expected to remain elevated in the first half of CY23, though in the second half, we expect an ease off due to high base effect. Importantly, CY23 will also be an election year, which should keep the political noise high, amid heightened security risks from the Afghan border.

According to the report, despite these challenging times, we believe that the current stock market valuations compensate for the heightened political, economic and security risks highlighted above. Due to the lacklustre market performance over the last few years, the price-to-earnings ratio (P/E) has come down to a multiyear low of around 3.8 times.

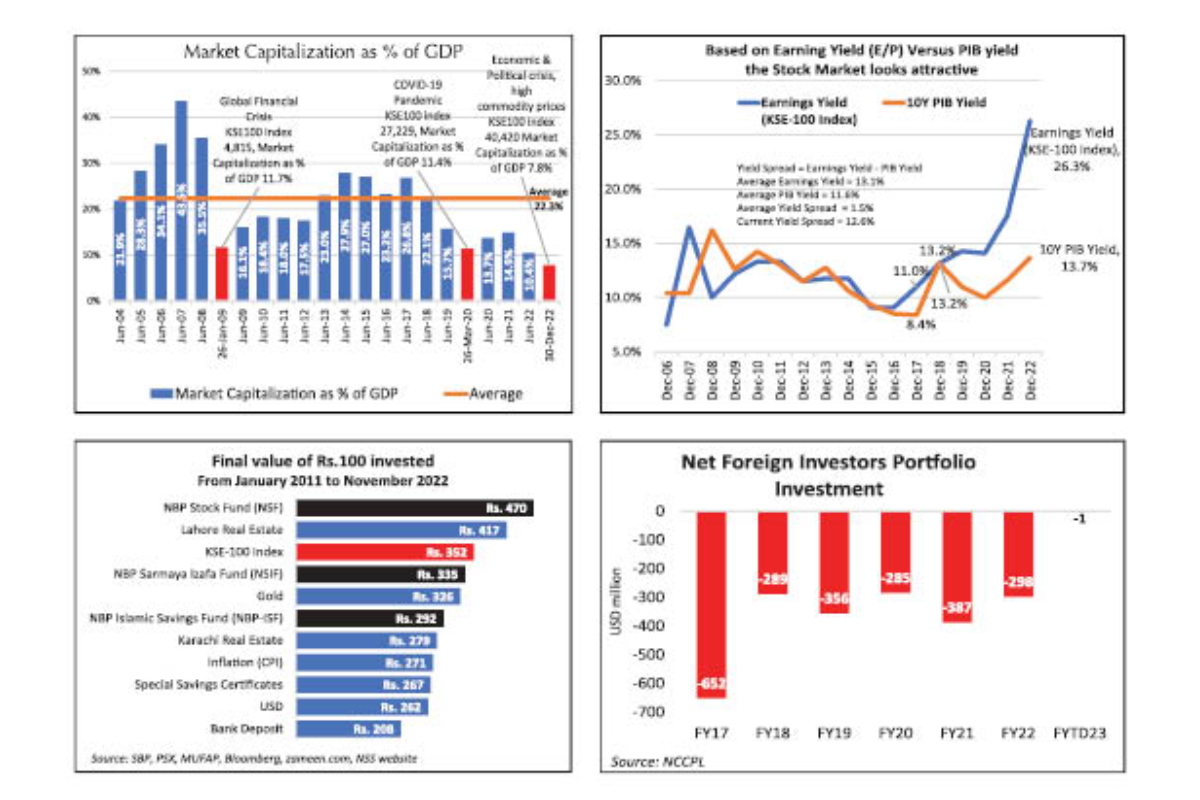

The market capitalisation-to-GDP ratio has also touched the historic low level of 7.8 per cent against the long-term average of 22.3 per cent, while the inflation and interest rates remain high, we highlight that the difference between earnings and bond yield is also at the historic high (earnings yield of around 26.3 per cent vs 10-year Pakistan Investment Bond yield of 13.7 per cent), which further strengthens the case for the equities.

Foreign selling, which has been a key reason for the market’s underperformance, has also slowed down significantly, as the foreign holdings are now a very small proportion of the total free float.

From FY17, where the stock market hit its peak, the annual foreign selling each year has averaged $378 million with the highest outflow of $652 million witnessed in FY17.

For FY23, we expect a significant decline in the foreign selling. During the first six months of FY23, the foreign outflows stand at $0.9 million. This slowdown in the foreign selling should help the stock market generate better returns in CY23.

Well-managed equity mutual funds have provided better returns to their investors than the stock market and other asset classes, including real estate and gold over the last 12 years.

For performance comparison, we have used the index provided by zameen.com for the performance of the real estate sector. As a case in point, our flagship equity fund, NBP Stock Fund (NSF) has outperformed the stock market by 118 per cent over the last 12 years (from January 2011 till November 2022) by earning a return of 370 per cent versus 252 per cent rise in the stock market.

During the same period, The NBP Stock Fund has outperformed gold by 144 per cent. An investment of Rs100 in the NBP Stock Fund 12 years ago would have grown to Rs470 today, whereas an investment of Rs100 in the stock market (KSE-100 Index) and gold 12 years ago would be worth Rs352 and Rs326, respectively, today. This outperformance of the NBP Stock Fund is net of the management fee and all other expenses. We highlight that the current valuations are more attractive than what we had seen at the bottom of the 2008 financial crisis, when the market touched 4,815 points. Given a strong case for the equities, we advise the investors to gradually build position in the stock market through the NBP Stock Funds, keeping their long-term investment objectives in mind.

Stock market review

In the outgoing month of December 2022, the benchmark KSE-100 Index fell sharply by around 1,928 points (down 4.6 per cent) on a monthly basis. With this, the calendar year 2022 comes to an end with index declined 9.4 per cent on a yearly basis.

The equities started off on a frail note and remained under the grip of bear throughout the month, as a combination of economic and political factors dented the sentiments.

The surprise 100 basis points increase in the policy rate towards the end of November had rattled the investors and led to expectations of a further 100 to 200 basis points rate hike. The news flow on the IMF programme also dented the sentiments, as major differences on various policy matters and economic targets could not be ironed out between the authorities and the IMF.

Reportedly, the areas of contention were the exchange rate regime, where there was a wide gap in the interbank and open market rates, burgeoning circular debt (on both gas and electricity), unfunded subsidies to the exporters and farmers and higher-than-envisaged fiscal deficit for the ongoing year.

This comes at a time, when the foreign exchange reserves are at a precarious level and on a continuous decline. Due to scheduled external debt repayments, the foreign exchange reserves held by the central bank fell by another $1.9 billion till December 23, 2022, clocking-in at $5.8 billon (lowest level since April 2014), despite benign current account deficit of $276 million.

The manufacturing data of large industries was released for October 2022, which reflected 7.75 per cent YoY drop in the large-scale manufacturing (LSM) activity with 2.9 per cent contraction in its output during the four months of FY23.

The workers’ remittance remained another area of concern, which stood at $2.1 billion (YoY decline of 14 per cent) for November 2022, taking the five months of FY23 overall inflows to $12 billion (down 10 per cent YoY).

The unending political uncertainty also weighed on the sentiments, as the Pakistan Tehreek-e-Insaf (PTI) chairman threatened to dissolve Punjab and Khyber-Pakhtunkhwa assemblies, while the opposition in Punjab submitted a no-confidence motion against the chief minister in a bid to forestall the dissolution of the assembly.

However, towards the end of the month, there was some recovery led by the oil and gas sector, as the government formed a committee to undertake a detailed mapping of the gas sector circular debt stock and to work out a comprehensive settlement plan through cash and non-cash adjustments.

During December, fertiliser, food and personal care, insurance, oil and gas exploration, sugar and allied industries, textile composite, tobacco and the Real Estate Investment Trust (REIT) sectors outperformed the market.

Besides, auto assemblers, auto parts and accessories, cable and electrical goods, cement, chemicals, engineering, glass and ceramics, oil and gas marketing, paper and board, pharmaceutical, refinery, transport and technology sectors lagged the market.

On the participant-wise activity, the banks and the development finance institutions (DFIs) emerged the largest buyers, with net inflows of $44 million.

Alongside, the companies and other organisations also increased their equity holdings by $13 million and $5 million, respectively. On the contrary, the foreigners and mutual funds sold stocks worth $34 million and $14 million, respectively.

Looking ahead, we believe the state of macroeconomic affairs, particularly any tangible development on the IMF programme will shape the market outlook.

The precarious level of the forex reserves and its decline have unhinged the investors and only the resumption of the IMF programme will lead to gradual buildup in forex reserves and will restore the confidence of the market.

So far, there has been an impasse but we believe that necessary policy actions for the continuation of the IMF programme are inevitable. It entails higher revenue collection, further rationalisation of utilities, especially gas tariffs and flexible exchange rate regime.

We reckon that with the positive IMF nod, the inflows from friendly countries will also materialise, particularly from Saudi Arabia and China.

The inflows from the multilaterals have not dried up so far, as the country signed multiple loan agreements in December with the Asian Development Bank (ADB) and the World Bank (WB) worth $775 million and $1.7 billion, respectively, for various flood rehabilitation activities and reconstruction efforts and for other project and programme loans.

This pipeline is expected to improve further when the country will be under the IMF umbrella. Looking at the fundamentals, the price-to-earnings ratio (P/E) of the market is at multiyear low of around 3.8 times (earnings yield of around 26.3 per cent).

In addition, it offers healthy dividends yield in excess of 8 per cent. Therefore, we advise the investors with medium- to long-term horizon to build position in the stock market through our NBP stock funds.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.