Seeking Financial Lifeline

IMF programme set to revive soon as govt bows down to all its demands

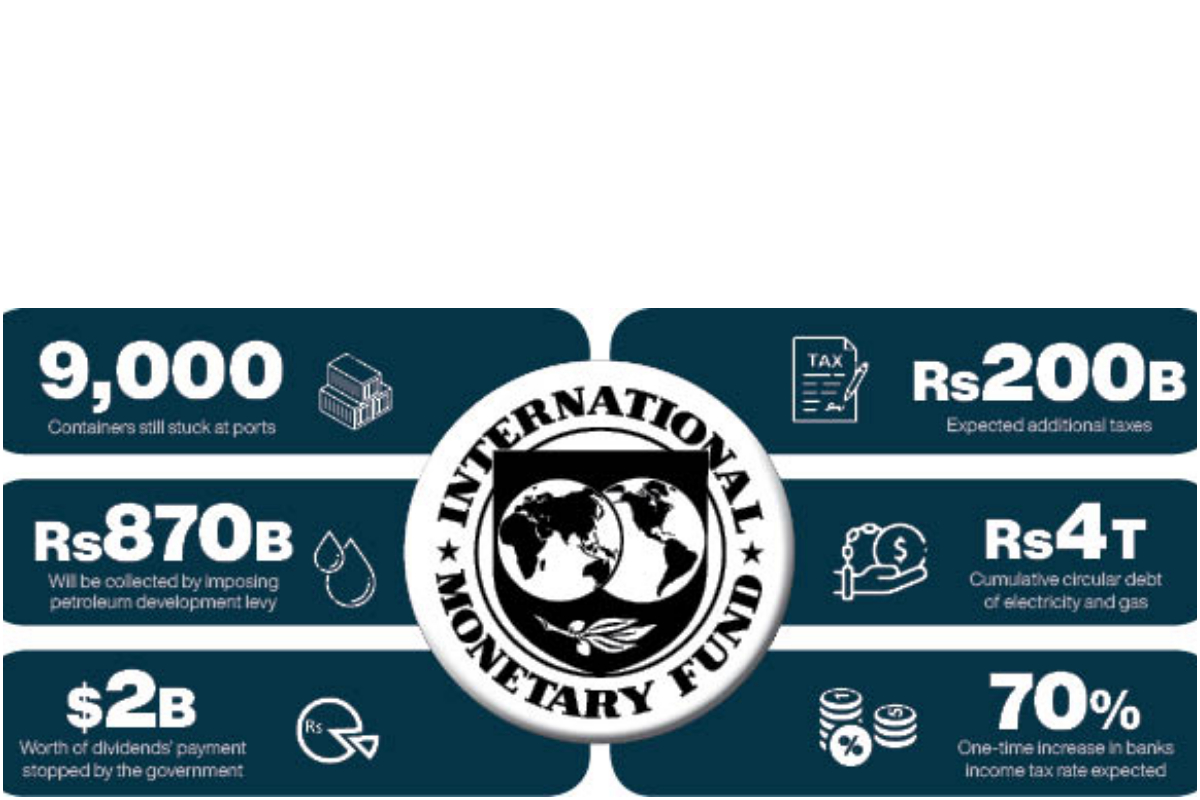

Islamabad: After the removal of an unofficial price cap on the exchange rate, finally the government has convinced the International Monetary Fund (IMF) to revive negotiations for the ninth review of the Extended Fund Facility (EFF) and also agreed to meet the majority of demands put in its wish list, including a hike in the electricity and gas tariffs and additional tax measures worth Rs200 billion.

IMF Resident Representative for Pakistan Esther Perez Ruiz in a statement said: “On the request of the Pakistan authorities, an in-person IMF mission is scheduled to visit Islamabad from January 31 to February 9 to continue the discussions under the ninth review of the Extended Fund Facility.”

The mission would focus on the policies to restore domestic and external sustainability such as strengthening the fiscal position with durable and high quality measures, while supporting the vulnerable and those affected by the floods; restore the viability of the power sector and reverse the continued accumulation of the circular debt; re-establish the proper functioning of the foreign exchange market, and allowing the exchange rate to clear the forex shortage, she added.

“Stronger policy efforts and reforms are critical to reduce the current elevated uncertainty that weighs on the outlook, strengthen Pakistan’s resilience and obtain financing from the official partners and the markets that is vital for Pakistan’s sustainable development,” she remarked.

The IMF mission’s visit was very much on the cards after Prime Minister Shehbaz Sharif announced that the government was finally ready to swallow the bitter pill of the IMF ‘stringent’ conditions to revive the loan programme.

In a meeting held in Islamabad, Finance Minister Ishaq Dar also urged Deputy Assistant Secretary of the US Department of the Treasury for Asia, Robert Kaproth to use their diplomatic influence and convince the lender to show a lenient attitude towards Pakistan.

Sources said Pakistan and the IMF continued exchanging data for some time but the fund has not shown any lenient attitude or relaxed its tough conditions, so far. One of the bones of contention, which delayed the talks was the persistent difference over the approach to deal with the exchange rate, as the IMF considers it completely unacceptable to maintain an artificially stabilised exchange rate.

The Washington-based multilateral agency wants to increase the electricity and gas tariffs to help the government reduce the circular debt of these two sectors, which now cumulatively accumulated over Rs4 trillion.

Besides, the IMF wants revenue measures of around Rs200 billion. For this, the government is considering imposing a flood levy of one to three per cent on imported goods, a one-time increase in the income tax rate of banks to 60 or 70 per cent from the existing 38 per cent, mainly because of the astonishing high profits they made through dollar price manipulation in the interbank market.

An increase in the federal excise duty on sugary drinks is also on the cards. The IMF also wants full recovery of the petroleum development levy (PDL) target of Rs870 billion and demands the government to impose general sales tax (GST) on petroleum products, which the finance minister is not willing to do.

Though the revival of the negotiations will be a sigh of relief for the prime minister, yet it caused a lot of embarrassment for the incumbent Finance Minister Dar who blamed his predecessor Miftah Ismail for succumbing to the demands of the IMF and inability to convince them.

After assuming the charge as the finance minister, Dar on numerous occasions vowed not to take the IMF dictation on the issue of the exchange rate, electricity and gas tariffs and also regarding imposition of new taxes.

The tall claims of Dar not only irked the IMF but his decision to cap the exchange rate caused scarcity of dollars in the market, which completely disturbed the trade cycle, as importers desperately approached the central bank and commercial banks to open their letters of credit. With over 9,000 containers still stuck up at ports, threatening to break the supply chain of the essential goods, concerns have reached their peak that Pakistan is fast heading towards economic meltdown and hyperinflation.

Experts sounded alarm bells that the country is facing a deepening financial crisis with the fears that it could go bankrupt, as inflation rises to record levels, food prices skyrocketed and its coffers run dry. The mushrooming crisis will soon tip over into an ugly catastrophe striking households, offices and hospitals.

On the one hand, the importers are unable to get over 8,531 containers cleared due to the shortage of dollars, while, on the other, the shipping companies are threatening to suspend Pakistan’s operations over the country’s failure to make timely payments. This will hurt both imports and exports.

According to industry people, there cannot be a worse situation than this, as the State Bank of Pakistan (SBP) has now $3.68 billion in foreign exchange reserves — barely enough for three weeks of imports — while the estimated need to clear the containers and pending requests for opening more letters of credit stand in the range of $1.5 billion to $2 billion.

In addition, the government has stopped over $2 billion in payments of dividends, which will hurt the future investment prospects, they added.

The import-dependent businesses are now teetering towards closure, which would trigger a breakdown of the supply chain, as the country’s domestically-manufactured goods are also based on imported raw materials.

Goods such as wheat, fertiliser, cotton, pulses, onions, tomatoes, tyres, newspaper prints and electric bulbs are all imported.

The Petroleum Division has also warned the central bank that the stocks of petroleum products may dry up, as the banks are reluctant to open and confirm the letters of credit for imports.

An oil cargo of Pakistan State Oil (PSO) had already been cancelled, while the LC for another cargo, scheduled for loading on January 23, was not confirmed till last week.

One crude oil cargo of 532,000 barrels for Pakistan Refinery Limited (PRL) is scheduled for loading on January 30. However, its LC has not so far been confirmed and it is being negotiated with a state-owned bank.

Similarly, two cargoes of the PSO, which are in the pipeline, are also awaiting the confirmation of LCs by the local banks.

Pakistan is an energy deficient country and to fulfil the energy requirements, approximately 430,000 tonnes of petrol, 200,000 tonnes of diesel and 650.000 tonnes of crude oil are imported on a monthly basis at a cost of around $1.3 billion.

The situation has severely deteriorated during the current month, as the banks declined clearance of LCs.

Earlier, the SBP was entertaining requests to open LCs but now the banks are refusing to open letters of credit or even release documents for the imports that had already arrived but are stuck up at ports.

The telecommunication industry, in a letter to the Information Technology Ministry, expressed apprehensions over the banks’ refusal to open LCs for the telecom companies and said that the restrictions were causing delays in the execution of new projects.

C-Jazz, Zong 4G, Telenor and Ufone, as well as the backend technology equipment suppliers, depend on imported items for maintenance and expansion of their networks.

The industries have started shutting down operations temporarily. Beco Steel Limited halted production until further notice, owing to delays in the approval of the letters of credit.

Its inventory levels have seen “significant reductions” with a negative impact on the supply chain. Sitara Peroxide Limited has informed the shareholders that it was impossible for it to operate the production facility due to several reasons, including the non-clearance of LCs for necessary raw materials.

Pak Suzuki Motor Company said that the ongoing shortage of inventory, which was partly imported, has led it to extend the shutdown of its automobile plant. Crescent Fibres Limited also reduced its production by up to 50 per cent, owing to widespread demand destruction.

Suraj Textile Mills Limited, Nishat Chunian Limited and Kohinoor Spinning Mills have also announced production cuts, partly because of high operational costs and low demand.

Diamond Industries, the manufacturer of a popular brand of foam, has suspended production until the availability of the raw materials. Likewise, Indus Motors Company (IMC), the maker of Toyota vehicles, had shut down its production plant in the country from December 20 to 30, 2022, citing a delay in the import approvals by the SBP.

Pakistan is also facing an acute shortage of life-saving drugs needed to treat cancer, diabetes, epilepsy, heart diseases, etc.

Besides the mismanagement by all successive governments, the current crisis is aggravated by the indecisiveness of the ruling alliance that has twice delayed the decision of going back to the IMF.

The government has wasted four months on the hope that it will receive condition-free loans from Saudi Arabia, China and the UAE in addition to selling some family silver. However, this did not materialise and the country’s forex reserves kept depleting.

After facing embarrassment from all sides, the government has now reached a conclusion that the IMF is the only solution to deal with crises. Once this issue is resolved, the exporters may start bringing back their receipts from abroad, where they are keeping the money to take advantage of the depleting local currency.

This may provide $500 million more to the central bank — the funds sufficient to unlock the majority of around 9,000 withheld containers at ports.

Senior economist Sajid Amin Javed said that a delay in the implementation of the IMF reform agenda is the major cause behind the economic crisis in the country.

Both Pakistan Tehreek-e-Insaf (PTI) and the Pakistan Democratic Movement (PDM) governments abandoned the IMF programme for short-term political gains, which cost the country dearly.

“The PTI government’s decision to freeze the oil prices and reduce the electricity tariff and later the coalition government’s decision to impose restrictions on the imports and capping of the exchange rate caused structural problems in the economy, which now become difficult to overcome,” he added.

According to Javed, the political parties should develop a consensus that no political point scoring will be done on the IMF programme, exchange rate regime or petroleum prices in the national interest of the country.

The rupee depreciated significantly during 2019/20 after years of overvaluation. Similarly, the sharp dip in the rupee after removing a cap is a direct outcome of the accumulated depreciation over the last four months, he remarked.

“The only way in which the country could avoid the IMF programme in the future is by addressing the distortions in its growth structure,” he said, adding, at present, the growth of Pakistan is mainly consumption and import-based and that is why after three to four years, the trade imbalance caused balance of payments crisis.

“To address this issue, we have to change our growth structure to investment and export-based and also through economic inclusion so that all the segments will benefit from the growth,” he concluded.

Comments

Esther Perez Ruiz

IMF Resident Representative for Pakistan

An in-person IMF mission is scheduled to visit Islamabad from January 31 to February 9 to continue the discussions under the ninth review of the Extended Fund Facility

Sajid Amin Javed

Senior economist

Pakistan Tehreek-e-Insaf and the Pakistan Democratic Movement governments abandoned the IMF programme for short-term political gains, which cost the country dearly

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.