Weak economic fundamentals likely to grapple common man

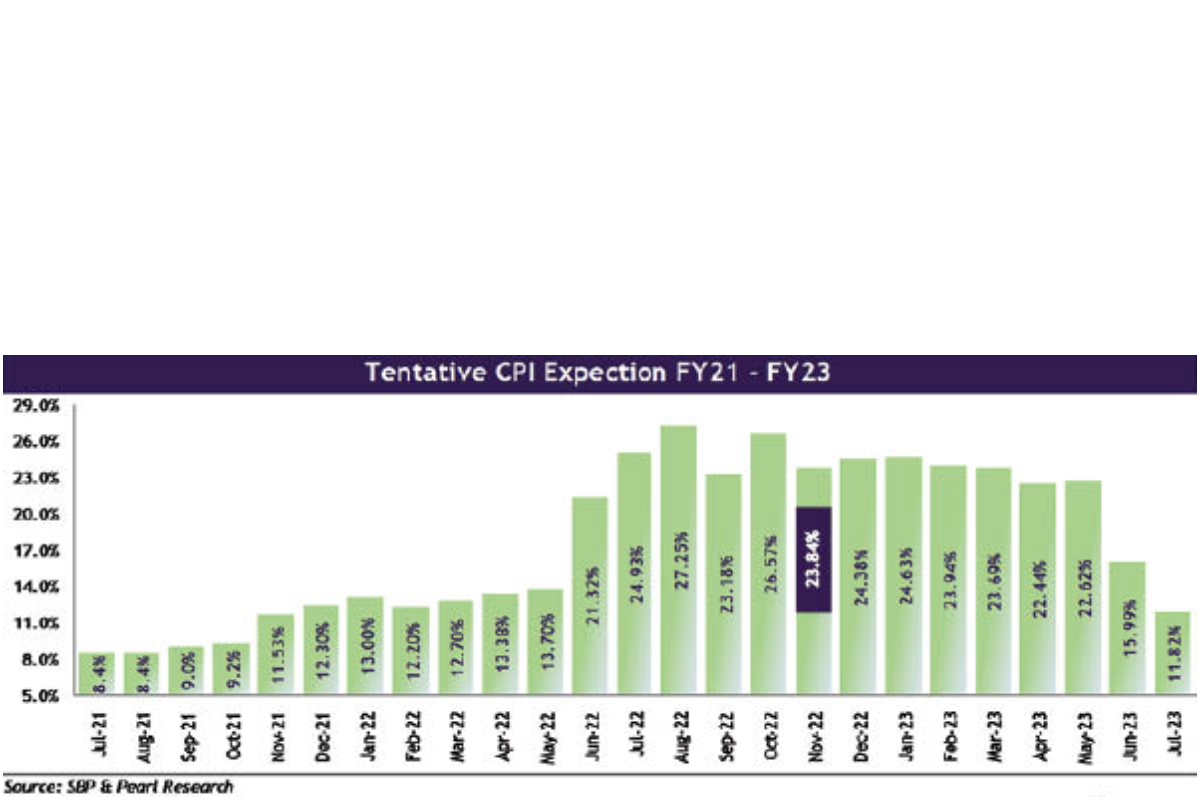

KARACHI: Amid Pakistan’s weak economic fundamentals, the average national inflation is likely to clock-in at 23.50 per cent in the fiscal year 2023 due to an upsurge in food, energy and transport costs, analysts said.

The delay in the implementation of the International Monetary Fund (IMF) programme, mounting current account deficit, widening trade deficit and massive rupee depreciation along with the depletion in foreign exchange reserves triggered economic consolidation in the fiscal year 2023.

As per a report by Pearl Securities, the inflationary and currency depreciation pressures in the medium-term will be fuelled by higher food and cotton imports and lower textile exports, owing to the impact of floods, limiting economic growth and the double-digit inflation during 2023.

“The floods impacted the economy from all sides and continue to pose challenges to economic stabilisation. With an election scheduled in the coming year, we expect the pre-election political turmoil to spillover, as volatility into the capital markets,” the report showed.

The race to counter inflation is not likely to be over till the third quarter of 2023, as the impact of the US Federal Reserve tightening will continue to support advances of the dollar and the global currencies would remain under pressure.

Pakistan’s political, economic and food security pain is likely to stay during 2023. Similarly, higher debt repayments, amid dwindling foreign exchange reserves reflects higher prospects for further weakening currency.

The present forex reserves are under pressure, staying close to a historic low of $6 billion in December 2022. Meanwhile, the foreign exchange reserves are expected to be boosted with the funding from the IMF, multilateral lenders and rollover of bilateral loans.

The government introduced policy and administrative measures to implement economic consolidation plans, which halted the economic activity last year.

In November 2022, the State Bank of Pakistan (SBP) increased the policy rate by 100 basis points to 16 per cent, as it cited persistently high inflationary pressures.

“This was a sharp departure from the dovish stance taken since August 2022 when the SBP placed a greater emphasis on sustaining growth in the wake of the floods. The rate increase may, in part, be a response to the IMF’s implicit pressure to keep inflation under control before the postponed ninth review,” it remarked.

The central banks globally have to use tools at their disposal to reduce inflation such as raising the cost of borrowing to curb the demand for goods and services and further raising short- to medium-term interest rates with either a flatter or an inverse yield curve.

It may also be a proactive measure to protect against currency pressures before high-profile external debt servicing even though the forex reserves are still depleting.

On the flip side, the current account deficit is on a declining trend. It stood at $276 million in November 2022, while it came down to $3.1 billion in the first five months of the fiscal year 2023, compared with $7.2 billion in the same period of the last fiscal year.

The decline was witnessed after the SBP introduced strict measures such as limiting the letters of credit (LCs) opening and a volumetric quota system to control imports.

Additionally, the policy rate was hiked to a historic high of 16 per cent along with the implementation of market-determined exchange rate that led to considerable rupee depreciation.

The country’s imports also went down 16 per cent on a year-on-year basis to $26 billion in the first five months of the fiscal year 2023, compared with $31 billion during the corresponding period, resulting in a lower trade deficit of $14 billion, down 24 per cent on a year-on-year basis.

However, fiscal slippages and the rising food and cotton imports due to the floods impact are likely to keep the current account deficit under pressure to clock-in at $8.5 billion in the fiscal year 2023.

The narrowing foreign exchange reserves of the central bank remained a major concern during the outgoing year on the back of dried up inflows, high import payments and scheduled debt repayments.

The forex reserves have been on the lower end, despite resumption of the IMF programme and receiving the long due tranche of $1.2 billion. Pakistan’s debt liabilities are forecasted at $32 billion for the fiscal year 2023.

The country received $1.5 billion from the Asian Development Bank (ADB) and $500 million from the Asian Infrastructure Investment Bank (AIIB) in lieu of the flood aid, while inflows from the World Bank and friendly countries are in the pipeline.

“However, inflows from multilateral lenders and friendly countries have been slow. Saudi Arabia and China have agreed to rollover the existing loans. However, this development will only sustain rather than increase the reserves,”

On the international front, the global economies are bracing for a protracted recession, engineered by rapid interest rate hikes in the Western countries to put a lid on the 40-year high inflation.

Consequently, both export earnings and remittances of Pakistan are expected to slow down in 2023 and 2024.

Pakistan’s exports remained flat on a monthly basis to reach $2.4 billion in November 2022, while the same marginally declined 5 per cent to $12 billion during the first five months of the fiscal year 2023.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.