Expanding the Begging Bowl

Govt seeks early loan approval from IMF to restore economic activities

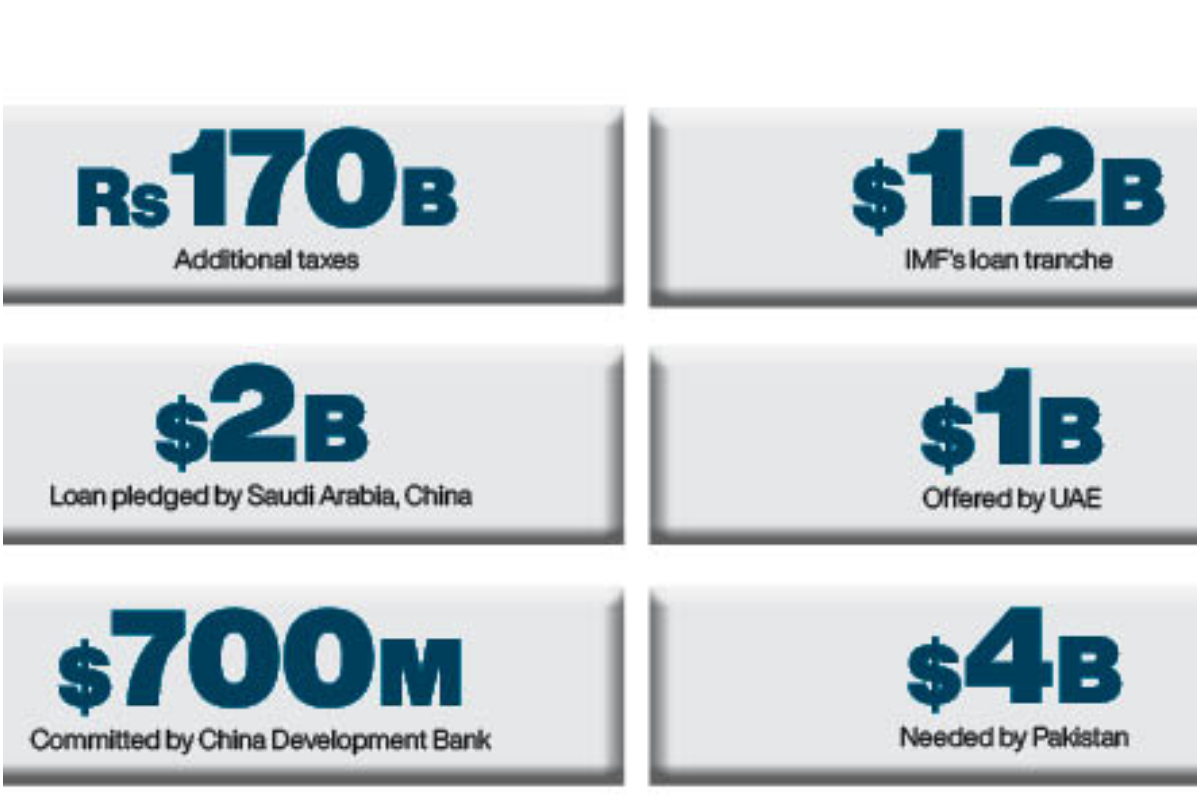

Islamabad: After the implementation of the Finance (Supplementary) Bill, 2023 with additional taxes and duties of Rs170 billion to meet the understanding reached with the International Monetary Fund (IMF) for the Extended Fund Facility, there is a likelihood that the staff-level agreement will be signed by the end of this month.

But the IMF condition to seek confirmation from bilateral and multilateral donors may delay the release of the tranche and cause problems for the government.

A senior official of the Finance Ministry told BOL News that the government is hopeful of signing the staff-level agreement by the end of this month.

“We are hopeful that the staff-level agreement with the IMF will be signed by February 28, but the Board approval may take five to seven weeks because the IMF wants confirmation from our donors and we have urged them to approve tranche of $1.2 billion within two to three weeks to overcome the prevailing economic uncertainty,” the official said.

The government has assured the IMF that the bilateral donors; China, Saudi Arabia, the UAE and Qatar have already committed to lend soft loans, whereas multilateral donors: the World Bank, the Asian Development Bank, Islamic Development Bank and the Asian Infrastructure Investment Bank have also confirmed lending.

On numerous occasions in the past, on the government’s request, the IMF has convened its board meeting ahead of schedule, and even this time, we are making this request because of the abysmal economic situation.

“Saudi Arabia and China have already assured us publicly that they will provide $2 billion each and the UAE government will also extend a loan of $1 billion. For the remaining $4 billion, we are holding negotiations with various financial institutions and they are keen to extend loans to Pakistan once the staff-level agreement has been approved,” the official added.

Finance Minister Ishaq Dar in his tweet confirmed that the China Development Bank has approved the facility of $700 million for Pakistan. The State Bank of Pakistan (SBP) is expected to receive this amount this week.

“One has to understand that no multilateral or bilateral donor lends money to a country, which is likely to default,” he said.

According to him, because of last year’s floods the major and minor crops were badly affected, leading to food scarcity, while the food import bill went up substantially.

He admitted if the letters of credit (LCs) of $4 to $5 billion are not cleared immediately, the situation can again go out of control.

“The government is trying its level best to get the IMF tranche before Ramazan to avoid food shortages,” Dar said.

The consignments of DMO soyabean feed for chickens are stuck at the ports because the government has termed it harmful but sources said the government is not clearing the consignments, owing to the scarcity of the dollars.

“Because of non-clearance of our consignments, the chicken price has almost doubled in two months from Rs240/kg to Rs480/kg and if the situation persists, the price of chicken may further go up to Rs800 Rs1,000/kg in the holy month of Ramazan,” he warned.

The positive developments on the IMF talks is already creating a positive impact on the country’s foreign exchange reserves, which continued to improve for the second consecutive week, rising by $66 million to a four-week high of $3.26 billion.

The foreign exchange reserves have cumulatively increased by almost $369 million in the last two weeks to $3.26 billion on February 17, 2023, compared with a nine-year low of $2.92 billion on February 3, 2023, according to the latest weekly update released by the State Bank.

The forex reserves have continued to improve after the central bank opted to buy the dollars from the interbank market in the wake of a surge in the supply of the greenback.

“The surplus supply of the US dollars in the interbank market has prompted the central bank to intervene (buy the surplus),” a source said.

According to experts, the improvement in the reserves came apparently after the government made no major payment, including foreign debt repayment in two weeks. The good news was that the government’s foreign income — through export earnings and workers’ remittances — has grown higher than its import payments.

Pakistan incurred a trade deficit of $1.7 billion, which was financed through the workers’ remittances at $1.9 billion in January 2023.

Inflows have remained on an uptrend since the government ended its control on the rupee/dollar exchange rate and allowed the market forces (mostly commercial banks) to determine the rate.

Accordingly, the currency nosedived 16.5 per cent in 10 days to an all-time low of Rs276.58/dollar on February 3, 2023, the black market collapsed and the exporters and overseas Pakistanis received export earnings and dispatched remittances through the official channels, respectively.

The remittances are anticipated to improve to $2.3 billion to $2.4 billion in February onwards, considering the availability of the improved exchange rate in the interbank market. Besides, the overseas Pakistanis usually send high remittances in the fasting month of Ramazan.

Earlier, a better exchange rate in the black market encouraged some traders and non-resident Pakistanis to receive and send funds through the illegal hawala and hundi operators. Despite meeting the majority of the conditions, there are teething issues, which the IMF wanted to resolve before the tranche’s approval. The IMF wants the government to maintain a primary deficit at 0.5 per cent to fulfil its requirement.

The IMF also wanted the central bank to increase the interest rate by 400 basis points but the government did not want the increase beyond 200bps because it not only increased the domestic debt financing of the government but also slowed the economic activities in the country.

Against the government’s decision to impose a new surcharge for eight months (March-October 2023), the IMF has also asked the government to keep the levy as a permanent fixture in the electricity bills until the government settles the Rs800 billion circular debt parked in a company.

According to the IMF projections, because of the implementation of the reform agenda, the GDP growth projection of 2 per cent will further go down below one per cent. The IMF will not extend the loan programme any further but may offer a new programme after reviewing the performance of the existing one.

As per the IMF projections, the headline inflation is likely to cross 30 per cent and that is why it wanted a further hike in the policy interest rate of 17 per cent. However, the IMF is willing to give waivers in the interest of the economy and the common man but will not accept unfunded subsidies.

Senior economist Dr Ikramul Haq said that things are moving in the right direction.

“Now, it seems that the government will get the approval of the IMF Board but it will be a short-term solution or just a breather.”

For at least next three years, the government needs additional $10 billion/annum to pay off its external liabilities.

“Neither the finance minister or the State Bank governor know where this money comes from,” he said and advised the finance minister that instead of pleading for charter of economy, he should introduce Fiscal Transparency Act and Debt Retirement Act and form a commission of credible and competent professionals who will monitor that these acts will not be violated, the way it happened with the Debt Limitation Act introduced during President Gen Pervez Musharraf’s regime.

Without broadening the tax base and reducing expenditures, the government will remain in hot waters, he added.

For him, even after getting the IMF tranche, the economic situation might not improve if the prevailing political uncertainty persists.

“I think only fair and transparent general elections is apparently the solution to our political and economic problems, because no one wants to invest in this kind of situation,” he noted.

Zubair Motiwala, a leading exporter and the chairman of the Businessmen Group, said that unfreezing the exchange rate regime will ease off pressure on the exporters and importers, as well.

“Many exporters and expatriates are now sending money through legal channels because the dollar rate has jumped from Rs228 to Rs270 plus.”

Though the exporters’ cost of production went up with a hike in the energy tariff, raw material prices and labour wages, yet it would be compensated to some extent with a substantial rise in the exchange rate.

According to Motiwala, the major impact of the IMF conditions will be on the domestic industry, which constitutes 92 per cent of the GDP.

“Definitely, the purchasing power of the common man is badly affected by the depressing economic climate and the IMF programme makes it worse, which in the end will be reflected on the output of the local industry,” he lamented.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.