Expenditures’ reallocation towards key areas needed

KARACHI: The global economy is perilously close to falling into recession. The World Bank has slashed the global economic growth outlook to 1.7 per cent for 2023 from its earlier projection of 3 per cent. Very high inflation has triggered unexpectedly rapid and synchronous monetary policy tightening around the world, according to the Finance Division’s Monthly Economic Outlook for July-December 2022.

Although this tightening has been necessary for price stability, it has contributed to a significant worsening of the global financial conditions, which is exerting a substantial drag on the economic activity.

The major economies, including the United States, Euro area and China are all undergoing a period of pronounced weaknesses. The spillovers of sluggish growth are exacerbating other headwinds faced by the emerging markets and developing economies.

In the ongoing Rabi season 2022/23 of Pakistan, wheat crop sowing is estimated at 21.48 million acres, which is 94 per cent of the targeted area of 22.85 million acres.

The timely availability of inputs and government’s pro-agri initiatives are playing a role in the revival of the agriculture sector.

The Rabi season crops production is expected to increase due to favourable weather conditions with timely rains. During July-December of FY23, the agriculture credit disbursement increased 31.5 per cent to Rs842.4 billion from Rs640.8 billion during the corresponding period of the last year.

The Consumer Price Index (CPI) recorded at 24.5 per cent on YoY basis in December 2022, compared with an increase of 23.8 per cent in the previous month.

Similarly, the fiscal deficit during July-November FY23 has been contained to the same level of 1.4 per cent of GDP, as it was recorded in the comparable period last year. While the primary balance improved during this period and posted a surplus of Rs511 billion.

The private sector credit has observed developments in December, as it increased by Rs458 billion, compared with Rs413.6 billion in December 2021, emanated more credit demand both from working capital and fixed investment.

During July 1 to December 30, FY23, money supply (M2) shows a growth of 2 per cent (Rs562.8 billion), compared with the growth of 4.3 per cent (Rs1.047 trillion) last year.

The current account deficit shrank to $400 million in December 2022 as against $1.8 billion in the same period of the last year, largely reflecting an improvement in the trade balance.

The current account posted a deficit of $3.7 billion for July-December FY23 as against a deficit of $9.1 billion last year, mainly due to a contraction in imports.

According to the Global Economic Prospects 2023, the growth in 2023 is expected to contract to 1.7 per cent from the previous forecasts of 3 per cent, reflecting synchronous policy tightening aimed at containing high inflation, worsening financial conditions and continued disruptions from the Russia-Ukraine conflict.

The sharp downturn in growth is expected to widespread, with forecasts in 2023 revised down for 95 per cent of the advanced economies and nearly 70 per cent of the emerging markets and developing economies.

The growth for advanced economies is projected to slow from 2.5 per cent in 2022 to 0.5 per cent in 2023. In the United States, the growth is forecast to fall to 0.5 per cent in 2023 — 1.9 percentage points below the previous forecasts.

In 2023, Euro area growth is expected at zero per cent — a downward revision of 1.9 percentage points. In China, the growth is projected at 4.3 per cent in 2023 — 0.9 percentage points below the previous forecasts.

Excluding China, the growth in emerging and developing economies is expected to decelerate from 3.8 per cent in 2022 to 2.7 per cent in 2023, reflecting significantly weaker external demand compounded by high inflation, currency depreciation, tighter financing conditions and other domestic headwinds.

The FAO food prices index (FFPI) averaged 132.4 points in December 2022, down 2.6 points from November, marking the nine consecutive monthly decrease.

The downward movement in the index in December was mainly due to a sharp fall in the international prices of vegetable oils, cereals and meat prices but partially offset by a slight increase in the prices of sugar and dairy.

According to the Institute of Supply Management (ISM) report, the US manufacturing activity contracted for second month in December 2022, stood at 48.4 per cent, lower than 49 per cent in November 2022.

The ISM index dropped 10.4 points in 2022, the biggest annual retreat since the Great Recession. The contraction was led by the decline in the new orders and production gauges shrank, indicating a further lowering demand.

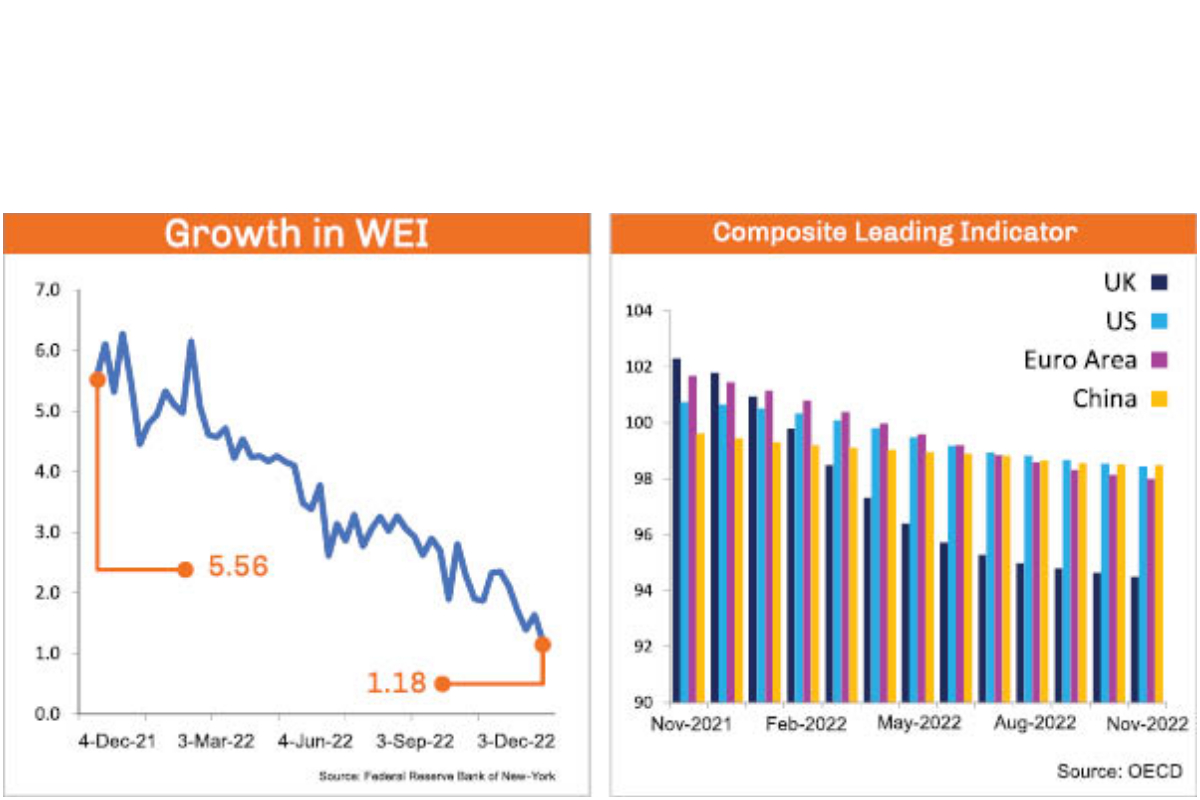

Measures of exports and imports also contracted. This is also reflected through WEI, which is on a declining trend.

Monthly performance of Pakistan’s economy

The automobile sector also remained under pressure due to compressed economic environment.

During July-December FY23, the car production and sales decreased 33.4 per cent and 40 per cent, respectively, while the trucks and buses production and sales decreased 23.9 per cent and 36.4 per cent.

The contraction of automobiles both on the supply and demand sides also suppressed the sale of petroleum products by 19 per cent in July-December FY23 to 9 million tonnes from 11.1 million tonnes in the same period of the last year.

The oil sales YoY decreased 11 per cent in December 2022 to 1.4 million tonnes, compared with 1.5 million tonnes in December 2021.

The total cement dispatches declined 20.7 per cent to 21.8 million tonnes during the period under review, compared with 27.5 million tonnes last year. On a YoY basis, it declined 15.6 per cent to 3.9 million tonnes in December 2022, as against 4.6 million tonnes in December 2021.

Similarly, the Consumer Price Index (CPI) inflation has been recorded at 24.5 per cent on a YoY basis in December 2022, compared with 23.8 per cent in the previous month.

On a MoM basis, the CPI increased to 0.5 per cent in December 2022, compared with an increase of 0.8 per cent in the previous month and a decline of 0.02 per cent in December 2021.

The average CPI in the first six months of the current fiscal year has been recorded at 25 per cent, compared with 9.8 per cent during the same period of the last year.

The FAO’s food price Index, which captures the movement of most globally traded food commodities, increased 14.3 per cent from 2021 to 2022. Similarly, the YoY rupee depreciation has been recorded at 21.9 per cent from Rs176.5 to Rs226.3 in December 2022. Hence, being the net importer of food commodities, the spike in inflationary pressure has been observed.

Likewise, the Sensitive Price Indicator (SPI) for the week ended January 26, 2022, recorded an increase of 0.45 per cent, compared with the previous week.

The prices of 50 per cent essential items either declined or remained stable, which shows the effectiveness of the policy measures.

The fiscal deficit during July-November FY23 has been contained to the same level of 1.4 per cent of GDP, as it was recorded in the comparable period last year. While the primary balance improved during the period under review and posted a surplus of Rs511 billion (0.6 per cent of GDP).

The large-scale manufacturing (LSM) sector witnessed contraction of 3.6 per cent during July-November FY23. The net federal revenues grew 34.7 per cent to reach Rs1.996 trillion during the period under review as against Rs1.48 trillion in the corresponding period of the last year.

Due to a considerable collection under the State Bank of Pakistan (SBP) profit and petroleum levy, non-tax revenue saw a remarkable increase of 58 per cent. Similarly, the tax collection grew 16.1 per cent during the period under review. Thus, both tax and non-tax revenues have contributed to achieving a significant growth in revenues.

The total expenditures increased 16.4 per cent to Rs3.367 trillion during July-November FY23 as against Rs2.894 trillion in the same period of the last year.

The current expenditures grew 22.6 per cent, owing to an 83.6 per cent increase in the markup payments. Likewise, the Public Sector Development Programme (PSDP) expenditures slide down to Rs130 billion during July-November FY23 as against Rs252 billion in the corresponding period of the last year.

Meanwhile, the provisional net tax collection by the Federal Board of Revenue (FBR) increased 17.4 per cent to Rs3.428 trillion during July-December FY23 as against Rs2.919 trillion in the same period of the last year.

The increase in growth is largely attributed to a 49 per cent growth in direct taxes. The domestic tax collection grew 21.3 per cent, sales tax was reduced by 0.2 per cent, and the federal excise duty grew 12.3 per cent.

The revenues from the Customs duty were reduced by 2.1 per cent during the period under review.

In the absence of adequate fiscal space to mitigate the impact of various shocks on the economy, the Pakistan government’s options would be to reallocate expenditures towards critical areas, while improving the spending efficiency and raising the revenues by broadening the tax base, making the tax system more progressive and reducing tax avoidance and evasion.

Pakistan is currently confronted with the challenges like high inflation, low growth and low levels of official foreign exchange reserves.

Further the month-on-month increases in the consumer prices may be countered by a further mean reverting international commodity prices and some exchange rate stability due to decreased pace of depreciation.

The overall money supply growth remains compatible with the return to low and stable inflation. But the outlook of M2 broadly depends on the fiscal accounts, which are under immense pressure on account of heavy interest payments and rehabilitation spending.

Nonetheless, the first five months of the current fiscal year have ended with some developments; containing fiscal deficit and surplus in primary balance due to effective fiscal management.

Fiscal consolidation is key to saving official reserves and the exchange rate stability. This may temporarily be costly in terms of growth prospects in the short-term but long-run prosperity and growth can only be achieved by augmenting the country’s long-term equilibrium growth path by expanding production capacities and productivity. This is a shared responsibility of both the private and public sectors.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.