IMF Programme and its Ramifications

KARACHI: Faced with precariously low foreign exchange reserves and waning hopes of unconditional bailout from friendly countries, the government appears to have conceded to a critical demand of the International Monetary Fund (IMF) and has let the currency float as per the market dynamics, according to the Fund Manager Report 2023, issued by the NBP Fund Management Limited.

“We saw the rupee depreciate 9.6 per cent on January 26, 2023, the largest single day drop since 1998,” it added.

An immediate response from the IMF came in the form of an announcement of the long-awaited team visit to discuss the stalled ninth review of the country’s current funding programme.

The IMF team has now arrived and discussions are in progress for the requisite policy actions that will pave the way for the successful resumption and completion of the programme.

The continuation of IMF programme is inevitable if Pakistan wants to remain solvent. The programme will provide the much-needed immediate financial relief, ameliorate the credibility of Pakistan in the eyes of the global financial community; thus, paving the way for continuation of flows from multilateral agencies such as the World Bank, Asian Development Bank, Islamic Development Bank and international capital markets.

“We believe that the implementation of the delayed policy actions will salvage the IMF programme, which will unlock critical additional funding and rollovers from friendly Gulf countries and China.”

The expected inflows of $8 to $9 billion from the IMF and friendly countries would help fill in the gap in the external account and shore up the foreign exchange reserves.

This will alleviate concerns on the balance of payments position and boost the confidence of the investors. That being said, the implementation of the IMF conditions will be a painful and challenging task.

The retail fuel prices had already been increased by 15 per cent and another jump is expected once the sales tax is implemented.

Further necessary policy actions required by the IMF include higher revenue collection, where a plan had already been chalked out for additional revenue collection of Rs300 billion, rationalisation of utility tariffs, resolution of the circular debt and maintenance of flexible exchange rate regime.

All of these measures will hit the masses in the form of higher inflation, high and upward sticky interest rates and economic slowdown.

The corporate profitability, which has remained resilient, will also take a hit, as the businesses will find it difficult, amid dwindling demand to pass on the rising costs and taxes.

The alternative to the IMF program (default) will be worse than following the IMF conditions.

Persistent political turbulence, heightened economic risks arising from the devastating floods, elevated inflation and interest rates, slowing economic growth, rupee depreciation and the declining foreign exchange reserves have led to an overall dismal stock market performance during the last six years.

The aforementioned factors have significantly shaken the investors’ confidence, as manifested by a large 65 per cent contraction in the price-to-earnings (P/E) multiple from 11x at the market peak in May 2017 to the prevailing level of 3.9x. This is the lowest P/E multiple in the last 15 years and we believe that the stock market has more than adequately priced in all the political and economic risks highlighted earlier.

We have analysed the defaults, including restructuring by nations on their sovereign debt since 2000, where we find that there have been 33 instances of default by 23 countries.

Several countries such as Argentina, Nigeria, Greece, Cote de Ivorie and Ecuador have defaulted two or more times on their foreign debt.

The latest defaults (2020 and afterwards) have come from Argentina, Ghana, Sri Lanka, Russia, Zambia, Ecuador, and Lebanon.

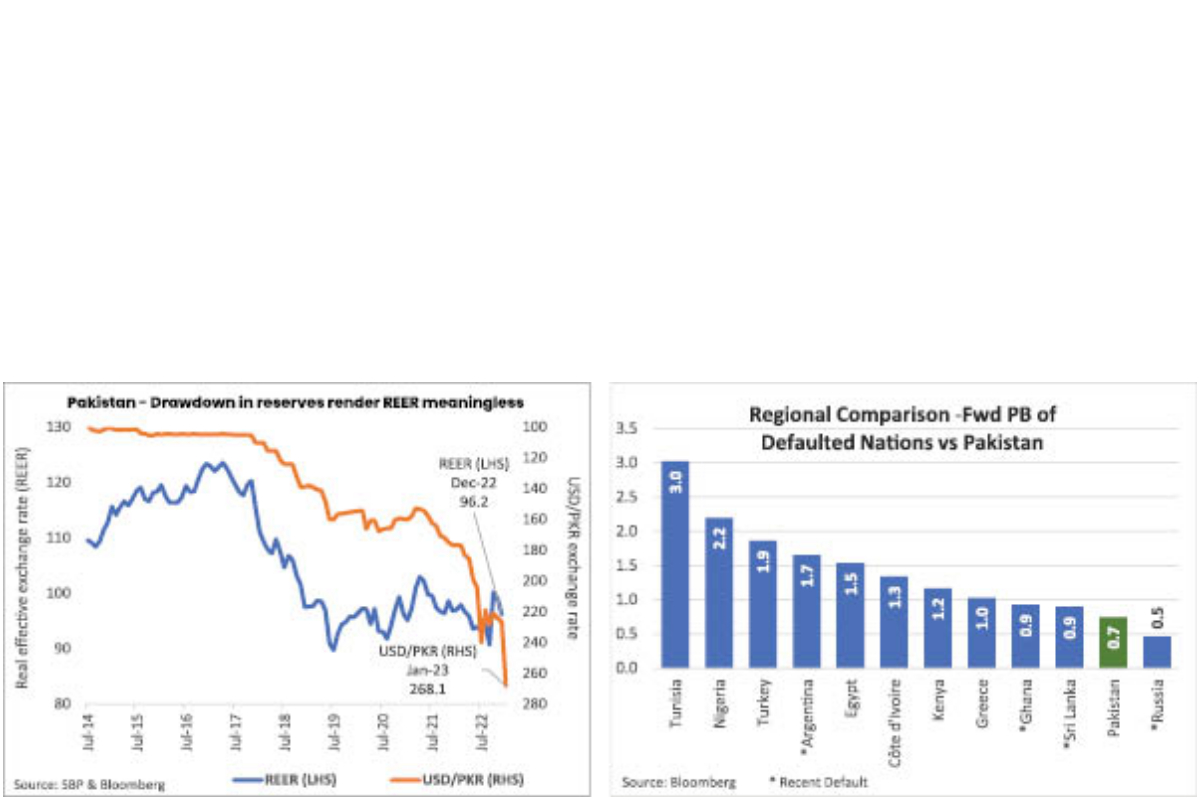

Bloomberg data indicates that of the 11 defaulted countries whose updated valuations were available, the median forward PE stood at 7.2x (6.3x for recent defaults) against Pakistan’s PE of 3.9x, and median forward PB stood at 1.3x (0.9x for recent defaults) against Pakistan’s PB of 0.7x.

In other words, the countries that have defaulted in the past, trade at a premium of 85 per cent and 86 per cent to Pakistan on PE and PB, respectively. The recently defaulted countries trade at a premium of 62 per cent and 29 per cent to Pakistan on PE and PB, respectively.

We highlight that the current valuations are more attractive than what we had seen at the bottom of the 2008 financial crisis, when the market touched 4,815 points.

This is also seconded by the regional valuation comparison of defaulted nations discussed above. We advise the investors to gradually build position in the stock market through the NBP Stock Funds, keeping their long-term investment objectives in mind.

For risk averse investors, our money market and income funds, which do not invest in the stock market, are yielding an attractive return of around 16 per cent/annum.

Stock market review

The stock market remained volatile during January 2023 and the benchmark KSE-100 Index inched up 253 points on a monthly basis, translating into a return of 0.6 per cent.

January remained turbulent for the equities, characterised by large index drifts on both sides, as the index movements heavily depend on the incoming news flow. The market started off the month on firm footing and we saw renewed interest in the fertiliser space, as the players increased urea bag prices by Rs190/bag and the oil and gas sector, on the growing optimism surrounding the resolution of the circular debt.

The sentiments were also propped up by better-than-anticipated commitment in the “International conference on climate resilient Pakistan” in Geneva, where the country was able to secure pledges worth $10 to $12 billion, with the bulk of financing commitments by the multilateral donors such as the World Bank, Asian Development Bank, Asian Infrastructure Investment Bank and the Islamic Development Bank.

There were other bilateral commitments by the Kingdom of Saudi Arabia and the European Union (EU) worth $1 billion and 500 million euros, respectively. However, the market could not sustain the momentum, as the political uncertainty shot up significantly after the Punjab and Khyber-Pakhtunkhwa chief ministers signed summaries to dissolve their respective provincial assemblies, to force the federal government into holding snap general elections.

It dented the investors’ sentiments, and as a result, the market hit its recent bottom on January 17, when it was down by around 5.1 per cent.

During the month, the UAE successfully rolled over $2 billion deposit; followed by Prime Minister Shehbaz Sharif’s visit.

The current account deficit for December rose marginally on a monthly basis to $400 million, taking the first half of FY23 current account deficit to $3.7 billion, against $9.1 billion in the same period of FY22.

The inflation for January clocked-in at 27.6 per cent YoY, which was highest monthly price jump in last 48 years, driven by significant increments across almost all the sub-categories of the inflation basket.

The Monetary Policy Committee (MPC) continued with the tightening, as it raised the key policy rate by another one per cent, in line with the market expectations, necessitated by the broad-based persisting inflationary pressures and to anchor inflationary expectations.

Towards the end of the month, the rupee witnessed massive depreciation, as the currency was allowed to float freely. Although it will further stoke inflationary pressures, yet it was construed favourably by the investors, as it was one of the key sticking points and prior condition of the IMF.

Consequently, the equities rebounded sharply, making up for the previous losses and the KSE-100 Index surged around 2,200 points (5.8 per cent) in the last six trading sessions of the period, as the investors pinned their hopes on the impending IMF programme resumption.

During January, chemical, fertiliser, oil and gas exploration, power generation and distribution, refinery, transport, REIT and miscellaneous sectors outperformed the market.

On the contrary, auto assemblers, auto parts and accessories, cable and electrical goods, cement, engineering, food and personal care, paper and board, pharmaceutical, sugar and allied, textile composite and technology sectors lagged the market.

On the participant-wise activity, individuals and foreigners emerged the largest buyers, with net inflows of $16 million and $9 million. On the contrary, the mutual funds and insurance sold stocks worth $21 million and $18 million, respectively.

Looking ahead, we remain cognizant of the challenging macroeconomic backdrop, particularly the precariously low forex reserves held by the State Bank of Pakistan.

Since the IMF mission is in the country, after much delay, and the parleys are under way, we remain hopeful of its resumption, since it is the only viable option for the country right now.

Although the gaps are very wide in key targets and policy actions are too stringent, since the thorniest issue of reversion to market-driven exchange rate has been addressed, we believe that the rest of the demands will also be met with some concessions from the IMF, in terms of timelines.

These conditions include fiscal discipline and new revenue measures, stemming the flow of the circular debt, market driven exchange rate and removal of the import restrictions.

With the positive IMF nod, the inflows from friendly countries will also crystalise, particularly from Saudi Arabia, the UAE and China that will help shore up the country’s foreign exchange reserves and restore investors’ confidence in equities.

Looking at the fundamentals, the price-to-earnings (P/E) ratio of the market is at multiyear low of around 3.9 times, earnings yield of around 25.6 per cent.

In addition, it offers healthy dividends yield in excess of 8 per cent. Therefore, we advise the investors with medium-to long-term horizon to build position in the stock market through the NBP stock funds.

Money market review

In January 2023, the MPC again raised the policy rate by 100 basis points to 17 per cent, with a view to anchor inflationary pressures and achieve the objective of price stability.

Despite moderation, the inflation continues to remain on the rising trend. The increase in food inflation remains the major contributor to this persisting inflation. Besides, near-term challenges for the external sector have increased, despite policy-induced contraction in the current account deficit.

Also, production cuts by firms and supply constraints led the large-scale manufacturing (LSM) growth to decline, as the manufacturing output fell 5.5 per cent in the previous month.

The lack of fresh financial inflows and the ongoing debt repayments have led to a continuous drawdown in the official forex reserves.

The net liquid foreign exchange reserves with the SBP stands at $3.068 billion as of January 20, 2023, posing challenges and persistent risks to the financial stability and fiscal consolidation.

The central bank held three T-Bill auctions with the target of Rs1.60 trillion against the maturity of Rs1.27 billion.

In the first T-Bill auction, Rs630 billion was accepted at a cutoff yield of 16.99 per cent for three-month tenure, rejecting the bids for six-month and 12-month.

In the second T-Bill auction, Rs304 billion was accepted at a cutoff yield of 16.99 per cent and 16.83 per cent for three-month and six-month tenures. The bids for 12-month were rejected.

In the third T-Bill auction, Rs818 billion was accepted at a cutoff yield of 17.94 per cent for three-month tenure, again rejecting the bids for six-month and 12-month.

In the PIB auction, bids for three-year, five-year and 10-year tenure were rejected, whereas no bids for 15-year, 20-year and 30-year were received.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.