It’s All About Affordability

POL products prices rising due to sharp fall in rupee, increased cost of oil imports

Karachi: There is no fuel shortage in the country, said spokesman for the Oil and Gas Regulatory Authority (Ogra). “Sufficient stock is available, while future supplies are on schedule.”

Availability is not the issue, affordability is. Petrol and diesel prices have been on the rise for a while, in the wake of a sharp decline in the local currency and the rising cost of oil imports.

The petrol prices were increased by Rs22.20/litre to reach Rs272/litre on February 15, 2023. Earlier, on January 29, the prices were raised by Rs35/litre, two days ahead of schedule. It is expected that the prices of petroleum products will be increased by over 10 per cent during the second half of February.

The estimated rupee/dollar adjustment applies Rs15/litre for both products (petrol and high-speed diesel), while the petroleum development levy (PDL) on high-speed diesel (HSD) has been assumed to rise to Rs50/litre.

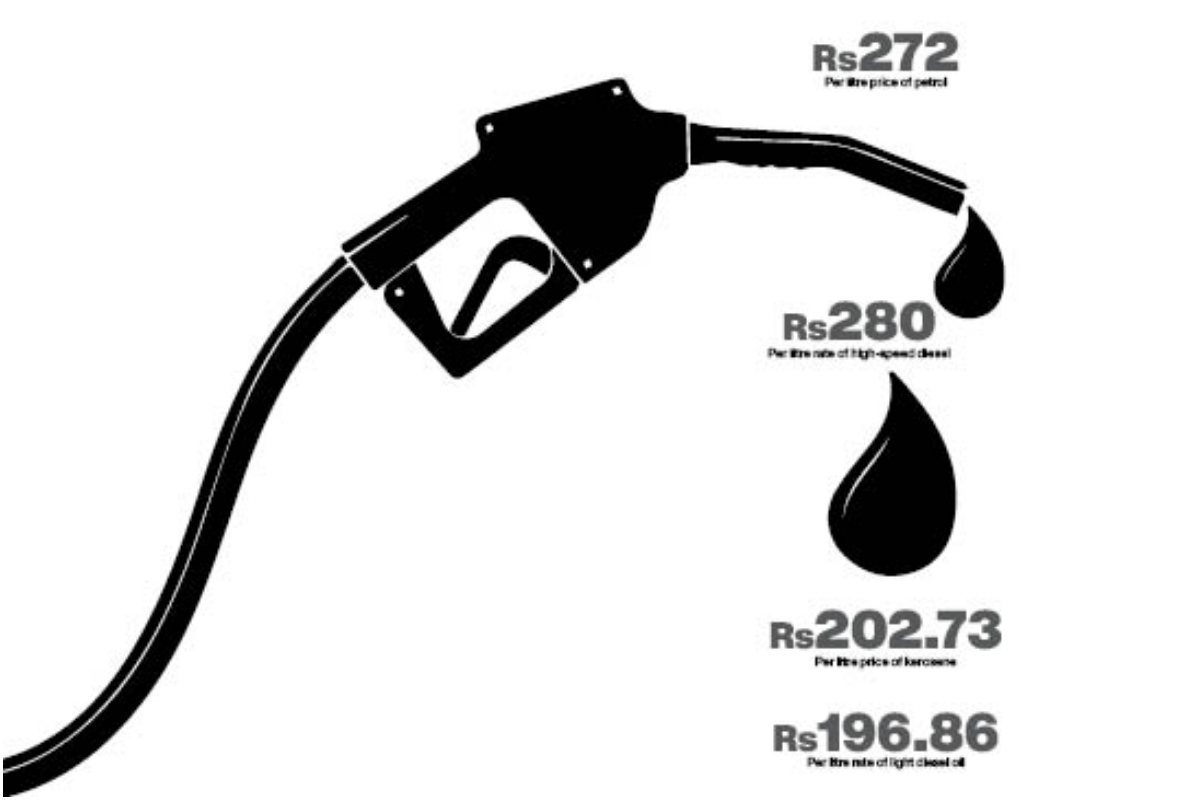

At present, petrol is available at Rs272/litre; HSD, after an increase of Rs17.20, at Rs280/litre; kerosene, after a rise of Rs12.90, at Rs202.73/litre and the Light Diesel Oil (LDO), after being raised by Rs9.68, is now available at Rs196.86/litre.

The government has also proposed measures to meet the prerequisites of the International Monetary Fund (IMF) programme, which will bring the much-needed clarity. To begin with, the government has proposed to increase the general sales tax (GST) by 100 basis points to 18 per cent, along with an increase in the federal excise duty (FED) on tobacco and sugary drinks.

Moreover, the rationalisation of the power and gas tariffs has now been approved, which was a key IMF demand.

The fuel price increase will further burden the people, most of whom are poor even by the standards of low-income countries. The prices of essential food and other items had already gone through the roof and are far beyond the reach of the common man.

The Consumer Price Index (CPI) inflation for January 2023 surpassed the street estimates of 26 per cent to clock-in at 27.6 per cent.

Amreen Soorani, head of research at JS Global Capital, said that higher CPI reading was foreseeable in the near future, given direct impact of the rupee depreciation of 20 per cent of the CPI basket accumulated by fuel, edible oil and items for which Pakistan is a net importer and now a higher base set in January 2023.

“For February, assuming higher food prices led by higher transport costs (Rs35/litre hike in petrol and HSD in January end), higher POL products and higher gas and electricity prices, the CPI is estimated to remain at 32.9 per cent,” she added.

However, the oil companies have a different dilemma. The Oil Companies Advisory Committee (OCAC) in a recent letter to the Ministry of Energy and Ogra highlighted the severe impact of the recent currency depreciation.

“As you are aware, the sudden rupee depreciation has caused a loss of billions of rupees to the industry, whose letters of credit (LCs) are expected to be settled on the new rates, whereas the related product had already been sold,” the letter read.

OCAC said that these losses not only have an impact on the profitability but also on the viability of the sector, since these losses, in some cases, might exceed the entire year’s profit.

The letter comes after the Pakistani rupee witnessed massive depreciation against the dollar, and in a span of days jumped from Rs230 to over Rs270, amid the government’s decision to free float the currency in its bid to appease the IMF.

Moreover, OCAC pointed out that amid an increase in the oil prices and successive rupee depreciation, the trade finance limits available from the banking sector to the industry had become inadequate.

Earlier, it was reported that Pakistan could face a crunch in fuel supplies in February, as the commercial banks have stopped financing and facilitating payments for imports due to depleting foreign exchange reserves. Certain dealers even started hoarding the commodity.

Imran Ghaznavi, a spokesman for Ogra, said that certain elements were hoarding fuel, which would have caused a panic-like situation. “However, the situation was dealt with and the supply is as per the routine.”

Pakistan needs to complete the ninth review of a $7 billion IMF programme that would not only lead to a disbursement of $1.2 billion but also unlock the inflows from friendly countries and other multilateral lenders.

Prime Minister Shehbaz Sharif has said that his coalition government was determined to complete the bailout plan even though it will have to pay a political cost for the decision.

Measures to meet the IMF conditions include increasing fuel and energy prices and raising more taxes, which together with the currency slump may further stoke inflation.

Comments

Imran Ghaznavi

Ogra spokesman

Certain elements were hoarding fuel, which would have caused a panic-like situation. However, the situation was dealt with and the supply is as per the routine

Amreen Soorani

Head of research at JS Global Capital

For February, assuming higher food prices led by higher transport costs (Rs35/litre hike in petrol and HSD in January end), higher POL products and higher gas and electricity prices, the CPI is estimated to remain at 32.9 per cent

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.