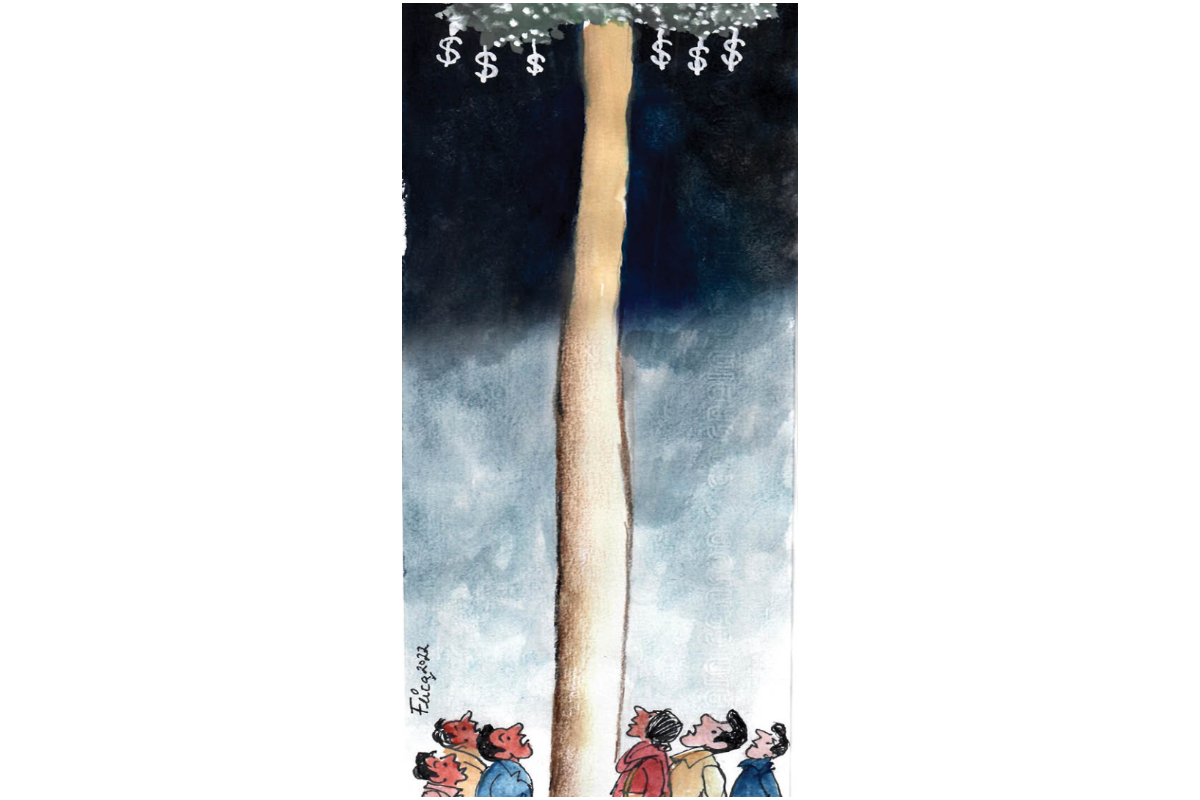

In search of dollars

KARACHI: The country is facing an unprecedented dollar crisis of its history. From importers to students going abroad, there is no way to get greenback in required quantities.

Saba Khan has been scrambling to collect five thousand dollars since last week but failed miserably.

“I have to go on a study tour abroad but what they (money changers) are offering is not more than 200 bucks,” Saba lamented.

The conversion rate of the US dollar was hovering at 225 rupees. The rate was displayed at almost every money changer office, but when you ask for dollars they deny availability.

“I needed ten thousand dollars for a trip to Turkey along with my family. I could not get it from any of the currency shops,” Syed Adnan Ali said while coming out empty-handed from an exchange company. “Now I have asked a friend to arrange the currency and hopefully the problem will be solved now.”

The greenback is available in the black market usually 10 to 15 rupees higher than the open market rates. Or some people send their friends, drivers or colleagues separately to collect 200 dollars from each money changer for meeting the target.

At the beginning of December, the central bank’s foreign exchange reserves shed another $784 million to a perilous level of $6.7 billion, the lowest since 2019.

Dwindling reserves, coupled with frantic curbs by Finance Minister Ishaq Dar set the market into a panic where people raced to collect greenback from the open market.

The government restricted overseas payments and imports of nearly 300 luxury items, tightened the noose around money changers and reduced the foreign exchange amount a traveller can carry abroad. By looking at the market, it is quite evident that Ishaq Dar’s gimmickry of pumping dollars into the market, pressurising importers, coercing exchange companies and hundi business is proving zero results.

However, the President of the Forex Association of Pakistan Malik Bostan claims that money changers are providing greenbacks to travellers, students and patients going abroad despite the acute shortage in the country. Pakistan has always been an import-dependent economy with imports soaring to $70 billion and not even half of exports to balance the trade. Never in history, there has been an attempt to whittle down the import bill or balance the trade by increasing exports. As a result, what we are experiencing these days is a technical default where the country is unable to retire Letters of Credit for not having enough dollars to finance imports. Textiles, the largest industry dependent on imported raw materials, saw an 18 per cent decline in November against the corresponding month last year.

Jawed Bilwani, Coordinator of Value-added Textile Forum, said there is a sharp decline in new orders as they cannot purchase raw materials, machinery and parts at a higher dollar rate.

Malik Bostan blamed the dollar outflow to neighbouring Afghanistan as the main reason behind the shortage.

“Almost 30 million dollars are being drained to Afghanistan every day. This happened after the Taliban government directed their public to convert the rupee they had with the Afghani or US dollar,” Malik Bostan explained.

The second big problem, he said, is the restrictions on imports which are proving futile since all restricted items are now being imported through the Afghan transit channel. Pulses importer Muzammil Chappal said shipments are stuck at the port while importers are nearing default by paying heavy demurrages. “The pulses are for the poor and the government must arrange dollars to bail us out,” he said.

Chaudhry Muhammad Ashraf, Chairman Pakistan Poultry Association said, “the ship carried soybean has been anchored since October 20 at the harbour but we are not getting the release order. If the soybean, used in chicken meal, is not released, it will jack up the prices of eggs and chicken exorbitantly in days to come.”

Catch all the Urban Insight News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.