Falling Down

Fitch cuts Pakistan’s rating to ‘CCC-’; no outlook assigned

Karachi: Fitch — the international rating agency — in its latest update downgraded Pakistan long-term foreign currency issuer default rating (IDR) to that level where the country has lost outlook.

“There is no outlook assigned, as Fitch typically does not assign outlooks to ratings of ‘CCC+’ or below,” the rating agency said in a statement. Fitch Ratings has downgraded Pakistan’s IDR to ‘CCC-’, from ‘CCC+’.

The rating agency has painted a horrible picture of the country’s present economic situation. The foreign exchange reserves of the country fell to critically low levels, it said, adding that the downgrade also reflects large risks to continued International Monetary Fund (IMF) programme performance and funding, including in the run-up to this year’s elections.

Default or debt restructuring is an increasingly real possibility, the rating agency said.

Muzzammil Aslam, spokesperson on economy and finance for the Pakistan Tehreek-e-Insaf (PTI), said that the rating has been downgraded courtesy to the experience of the Pakistan Democratic Movement (PDM) and 25 years of Ishaq Dar.

“Fitch has downgraded the ratings by two notches to ‘CCC-’ with no outlook assigned. The Fitch rating has been priced in default. Unfortunately. Time to question PDM.”

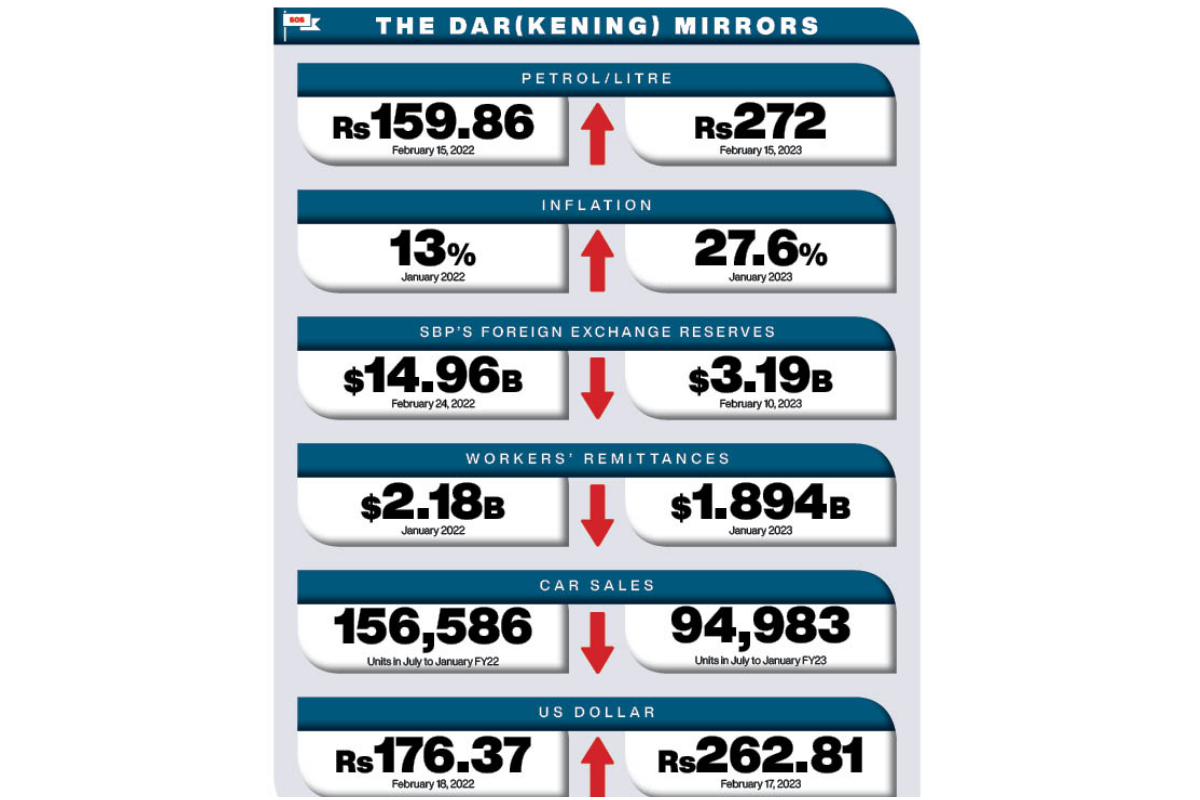

The net liquid foreign exchange reserves of the State Bank of Pakistan (SBP) were around $3.19 billion on February 10, 2023, or less than three weeks of imports, down from a peak of more than $20 billion at the end of August 2021.

Falling reserves reflect large, albeit declining, current account deficit, external debt servicing and earlier foreign exchange reserves intervention by the central bank, particularly in the fourth quarter of 2022, when an informal exchange rate cap appears to have been in place.

“We expect the reserves to remain at low levels, though we do forecast a modest recovery during the remainder of FY23, due to anticipated inflows and the recent removal of the exchange rate cap,” according to Fitch.

Shabbar Zaidi, former chairman of the Federal Board of Revenue (FBR), explained why international rating is important.

“The Finch Rating is very serious for Pakistan. Neither the government nor the opposition and media is realising the severity of the situation,” he said, adding: “We are really down.”

“The ordinary people are suffering and we are still engaged in useless discussions. Pakistan requires complete revamping of the economy.”

The rating agency noted that the external public debt maturities in the remainder of the fiscal year ending June 2023 amounted to over $7 billion and will remain high in FY24.

Of the $7 billion remaining for FY23, $3 billion represent deposits from China (SAFE) that are likely to be rolled over and $1.7 billion are in the form of loans from the Chinese commercial banks, which we also assume will be refinanced in the near future.

The SAFE deposits are scheduled to mature in two instalments: $2 billion in March and $1 billion in June.

Pakistan’s current account deficit was $3.7 billion in the second half of 2022, down from $9 billion in the same period of 2021. As such, we forecast a full-year deficit of $4.7 billion (1.5 per cent of GDP) in FY23 after $17 billion (4.6 per cent of GDP) in FY22.

The narrowing of the current account deficit has been driven by the restrictions on imports and forex availability, as well as by fiscal tightening, higher interest rates and measures to limit energy consumption.

Reported backlogs of unpaid imports on the Pakistani ports indicate that the current account deficit could increase once more, when funding becomes available. Nevertheless, the exchange rate depreciation could limit the rise, as the authorities intend for imports to be financed through banks, without recourse to official reserves.

The remittance inflows could also recover after they were partly switched to unofficial channels in the fourth quarter of 2022 to benefit from more favourable exchange rates in the parallel market.

The shortfalls in revenue collection, energy subsidies and policies inconsistent with the market-determined exchange rate have held up the ninth review of the IMF programme, which was originally due in November 2022.

“We understand that the completion of the review hinges on additional front-loaded revenue measures and increases to regulated electricity and fuel prices,” Fitch said.

The IMF conditions are likely to prove socially and politically difficult, amid a sharp economic slowdown, high inflation and the devastation wrought by the widespread floods last year.

The elections are due by October 2023 and former Prime Minister Imran Khan, whose party will challenge the incumbent government in the elections, earlier rejected an invitation by Prime Minister Shehbhaz Sharif to hold talks on the national issues, including the IMF negotiations.

Shaukat Tarin, former finance minister, highlighted the objective analysis of the PDM’s 10-month mismanagement of Pakistan’s economy.

“It is a case study of how a well-performing economy can be destroyed for political reasons. Result is that people and businesses are suffering, we are on our knees and begging from the IMF to help,” he said.

The Consumer Price Index (CPI) rose to 27.6 per cent and the food inflation to 39 per cent in January on a year-on-year (YoY) basis.

“It does not include the latest increases in the fuel prices. As predicted by us, the prices will rise sharply after the IMF conditions are implemented. The PDM government came to reduce inflation, which was 12.2 per cent in March 2022,” he added.

According to him, the so-called experienced and competent PDM government, which was imposed on us, has brought the country to the brink of default.

“Now, there is no time for further inaction. They should fulfil the IMF conditions and quit to save the country from the economic meltdown.”

The rating agency elaborated that the recent external sector crisis said that the recent funding stress has been marked by the apparent reluctance of traditional allies — China, Saudi Arabia and the United Arab Emirates — to provide fresh assistance in the absence of an IMF programme, which is also critical for other multilateral and bilateral funding.

The authorities appear close to agreement on the ninth review after the conclusion of the IMF’s staff visit to Pakistan on February 9 and have already taken action that should facilitate the agreement.

This includes an apparent removal of a cap on the rupee exchange rate in January. The prime minister has repeatedly expressed the intention to remain in the programme.

In addition to the remaining IMF disbursements of $2.5 billion, Pakistan would receive $3.5 billion from other multilaterals in FY23 after the IMF deal is concluded.

There have been reports of over $5 billion in additional commitments being considered by allies, on top of the rollovers of existing funding, although details on the size and conditions are still pending.

Pakistan received $10 billion in pledges at a flood relief conference in January 2023, mostly in the form of loans.

The prime minister has also expressed the intention to pay all debt obligations on time. Pakistan repaid a Sukuk due in December 2022 and the next scheduled bond maturity is not until April 2024.

Tarin said that Pakistan would seek debt relief from the non-commercial creditors.

The prime minister has also appealed for bilateral debt relief within the Paris Club framework, although no official request has been sent and this is no longer under consideration, according to the authorities.

Should Paris Club debt treatment be sought, the creditors would be likely to require comparable treatment for private external creditors in any restructuring.

“We believe the local debt might be included in any restructuring, despite macro-financial stability considerations, as it accounts for 90 per cent of the government’s interest burden,” Fitch added.

comments

Shabbar Zaidi

FBR’s former chairman

The Finch Rating is very serious for Pakistan. Neither the government nor the opposition and media is realising the severity of the situation. We are really down

Muzzammil Aslam

PTI spokesperson

Fitch has downgraded the ratings by two notches to ‘CCC-’ with no outlook assigned. The rating has been priced in default. Unfortunately. Time to question PDM.

Catch all the Economic Pulse News, Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.