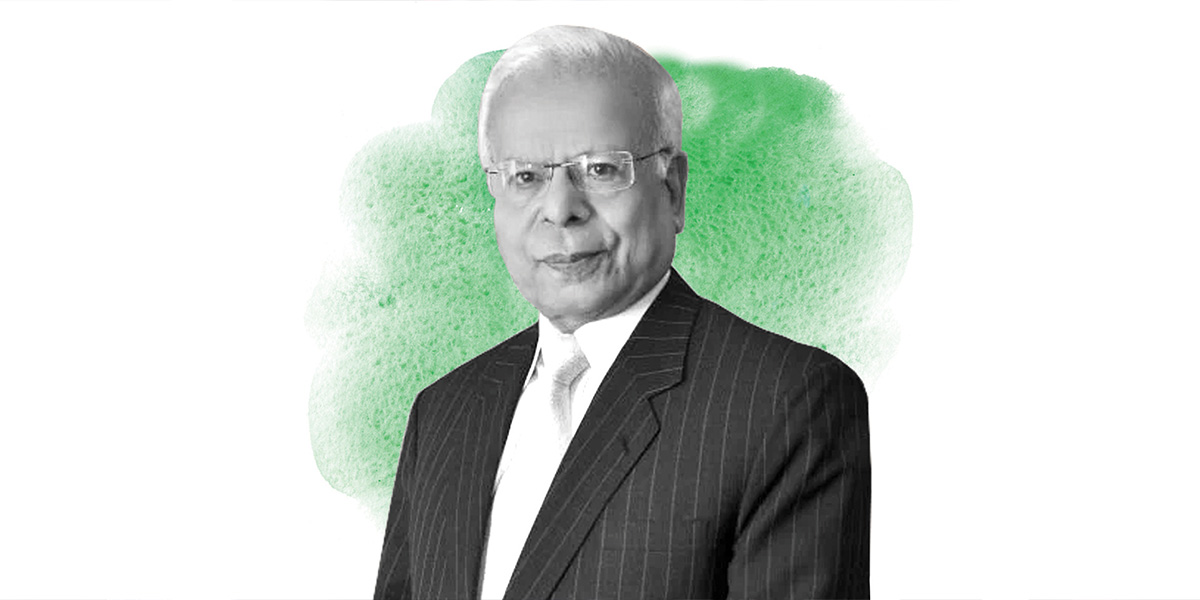

After spending nearly six decades in public service in Pakistan and abroad, Dr. Ishrat Husain’s thirst for work and intellectual pursuits has not waned. Until recently, he served as an advisor to the Prime Minister on Institutional Reforms and Austerity with the status of Federal Minister. While working for the Pakistan Tehreek-e-Insaf (PTI) government, he led the efforts to reform the Civil Services and restructure the Federal Government, presenting a two-volume set of recommendations which await implementation.

This is only the second time that Dr. Husain has worked with a government in Pakistan. Earlier, he had a successful run as the Governor of the State Bank of Pakistan (SBP) during President Gen. Pervez Musharraf’s period. As Governor SBP (1999-05), he implemented a major restructuring programme of the central bank and spearheaded the reforms of the banking sector. He also played a key role in the impressive economic turnaround of Pakistan during the Musharraf era as a member of the government’s economic management team.

After playing an eventful innings at the SBP, he took on the challenging responsibility of leading the prestigious Institute of Business Administration as its dean and director in 2008 and served this institution for eight years. At the IBA, Dr. Husain’s period is remembered for raising the bar of teaching, expansion and modernization.

Dr. Husain also had a distinguished career at the World Bank for over two decades – from 1979-1999. Among the major positions he held at the World Bank were resident representative to Nigeria, head of the Bank’s Debt and International Finance Division, Chief Economist for Africa and later as Chief Economist for East Asia and Pacific Region, including China. He also served as World Bank’s director of the poverty and social department and in 1997 was named the Country Director for Central Asian Republics.

In recognition of his services, Dr. Husain was conferred the prestigious “Hilal-e-Imtiaz” and “Nishan-e-Imtiaz” awards. He has authored and co-authored more than two dozen books and regularly writes articles for leading national and international publications.

Bol News talks to Dr. Husain…

Pakistan’s economy is in a dire state once again. What went wrong?

Dr. Ishrat Husain (IH): First, we have not laid down a long-term direction in which the economy should be moving. We are taking very patchy, ad hoc measures. Every new regime that assumes power, abandons what the others before it had done. They don’t sift out what is good for the country and retain those policies, or fine tune others with which they disagree or to which they have objections…And bring in new initiatives. That is how the economy really moves. But here, when a new government comes in, it abandons everything done by the previous government, which means you have to start from point zero. They don’t realise that reaching one’s destination takes much longer.

And what is the destination? That is also an important question. As long as your productive capacity of the real sectors does not rise to match the aggregate demand, you will always have a balance of payment crisis. Imagine that you have 10 billion dollars, which you are spending on wheat, cotton, sugar, crude oil, palm oil, pulses. If you had designed a strategy whereby you could substitute these imports and increase productivity then you would be able to save, if not 10 billion, at least seven to eight billion dollars. That reduces your current account deficit.

Second, you get out of your dependence on textiles as your main earning source for exports. You are giving all types of concessions to the textile sector. You have to give concessions to newcomers, new sectors, new products and new companies, so that your gap between export and import earnings is also reduced.

Third, you bring in foreign direct investment in the manufacturing, agriculture, agro-processing sectors, which will reduce the gap between demand and supply.

[The point is] even if you devise a strategy, it is not going to be completed in five years, which is the life-cycle of an elected government. It takes more time. So, you need to continue to implement [workable] policies and programmes without any interruptions. There, I see a disconnect — between the mid- and long-term direction and execution of policies. And that’s the reason we are in crisis every now and then.

The Imran Khan government inherited challenging economic conditions, but by mid-2021, there was a lot of optimism and indications of an economic revival. Did the economy get too over-heated prematurely, landing us in trouble once again?

IH: I don’t think that is true. If you look at exports, they have gone up by 25 to 26 percent, which is very good. You look at the FBR’s revenues collection. It has also gone up by 25 to 30 percent in 10 months. And Pakistan’s remittances are going to reach up to 31 billion dollars this fiscal year.

However, our trouble stems from the import side. There has been a huge surge in international commodity prices. Crude oil, which used to cost 40 dollars a barrel, has been trading between 80 to 100 dollars a barrel. Similarly, the prices of palm oil and all other import items have gone up sharply because of the supply-chain problem in the global economy. Secondly, there has been an impact on the exchange rate. If you were once importing a product at 150 rupees a dollar, now you are paying Rs. 180 or 180-plus. This creates inflationary pressure. When you create inflationary pressure, you have to increase the interest rates. In Pakistan, the government remains the biggest borrower, and when you increase the interest rates, it has to make higher interest payments, which results in an increased fiscal deficit. This makes for a cycle, which starts from the external factors, but permeates into the domestic front. This has caused all the problems.

Many economists criticise the State Bank of Pakistan (SBP) under the stewardship of its former governor Dr. Reza Baqir for keeping the interest rates too high for too long. Is this a valid criticism?

IH: The interest rate is not decided by the central bank governor. There is a whole exercise carried out by the staff that presents various options before the Monetary Policy Committee, which has two independent economists as its members. This independent committee decides whether to increase the interest rates or not. It is a judgment call based on the information available at that particular point of time. One cannot be blamed if the underlying assumptions have changed. So, you have to wait for the next Monetary Policy Committee meeting. You cannot always make a judgment call which is accurate, because the situation is fluid and constantly in flux.

The US Federal Reserve is increasing the interest rates, and there is a lot of criticism of this move. We have to understand that the interest rates have two wheels. One wheel is for the saver, and the other is for the borrower. If you have higher interest rates, you will encourage savings. But in our case, the biggest borrower from the banking system is the government of Pakistan. So, if you increase the interest rates, who gets hurt? It is the government of Pakistan. You have a fiscal deficit which has to be financed by banks. And banks are the primary dealers here and say that we need 15 percent interest on the PIBs. They serve as the only window from which the government can borrow.

Therefore, we have to change the monetary policy mechanism from what it is today and open it for retail investors, and the Stock Exchange. An individual small-time investor, who wishes to invest in the PIB or T-Bills cannot do so without going through the bank, which is not interested in entertaining this money. Therefore, we have to diversify the whole process. All over the world, this is not confined to banks only.

The former SBP Governor was also under fire because of what was considered an undue devaluation of the local currency.

IH: You have only two options. If the demand for foreign exchange is rising and you want to maintain the exchange rate at a certain level, then the central bank has to throw dollars from its reserves into the open market. The moment the market realises that your reserves are depleting because you are defending a certain level of exchange rate, speculators move in and build further pressure on the local currency.

In this scenario what’s the option for the central bank? Either to intervene or leave the market to adjust on its own. Artificially, maintaining a particular exchange rate should not be an option. Instead, the government should work on getting more foreign exchange through remittances, exports, and foreign direct investment, as well as saving dollars by reducing imports. That’s the only way to ensure a realistic exchange rate.

Although it is now water under the bridge, Pakistani economists appeared divided during the Imran Khan government about whether to go to the IMF or not. What’s your take?

IH: Former Prime Minister Imran Khan consulted many independent economists, and at that time everybody said that there was no other option but to go to the IMF because the country’s economic situation was very precarious. How can you finance the massive current account deficit? Financing it through Saudi Arabia, the UAE or China was not a viable proposition. The previous government made a critical mistake of not going to the IMF soon after it assumed power. The Imran Khan government would have stopped the rot and stabilised the economy, benefited themselves and the country, as well as saved their political capital. But they wasted nine to 10 months and the economy took a turn for the worse because of all the uncertainty. This could have been avoided.

Some economists contend that IMF programmes have never been able to fix any country’s economy. They say it is better not to go to the IMF as it gives the same set prescription to every country regardless of its problems. What is your take on this?

IH: That’s not really true. Pakistan and Argentina are the only two countries which are prolonged borrowers from the IMF. Bangladesh had gone to the IMF twice, but they have since fixed their economy. Their investment ratio is now 30 percent, while their saving rate is also hovering between 28-30 percent.

The Indian government went to the IMF in 1991, when they had to sell their gold in order to build up their reserves. But after that they undertook drastic economic reforms and turned the economy around. Since then, India has not gone to the IMF even once.

We have to understand that the responsibility lies with a country — how well it uses the IMF to stabilise its economy and put it on a growth path. For example, if someone has a bad diet, and doesn’t exercise, obviously there will be health issues. That person would be rushed to the doctor, who might initially give the patient some medicine. If that didn’t work, he would probably administer an injection, and if even that does not work, then he would go for surgery. If I eat a proper diet, exercise then I don’t have to go to a doctor. The same goes for a country. If it manages the economy well, it won’t have to go to the IMF. I don’t agree with the claims that our economic woes are the fault of the IMF.

Don’t you think that implementing the IMF’s harsh economic conditions would be difficult for any government?

IH: As I pointed out, we must have a roadmap and a defined path to fix the economy. If you take IMF money — which also opens other financing doors – but do not fix your power sector which is accumulating circular debt at a breakneck speed, if you don’t do anything to turn around state-owned enterprises, which are incurring massive losses, if you cannot broaden the tax base and fail to invest on your human capital, then you will have keep going to the IMF.

The IMF money can give temporary relief, but you have to mark your own future trajectory. This requires a government to spend its political capital, which will benefit it later. The problem of reforms is that while the losers are known, the beneficiaries emerge after five to six years when the economy takes off.

Do you think the current circumstances call for an immediate implementation of IMF conditions and the resumption of its programme?

IH: The government should absolutely do that. There is no other option. There is a six-billion-dollar financing gap. The delay would mean more uncertainty. Look at the past few days, how the markets are reacting to the daily uncertainties. The country cannot afford to do this.

The former SBP governor is being accused of bringing a lot of hot money into the system, which has increased its vulnerability. What is your opinion?

IH: That doesn’t matter. It is a portfolio investment. If you ask my opinion, I will always go for Foreign Direct Investment (FDI) rather than portfolio investment. The FDI brings not only money, but also technology and an international marketing experience, and helps increase efficiency. So, for future prospects, I will prefer the FDI. But if your interest rate is attractive from an investor’s point-of-view, they will come in, and they will go.

Why does Pakistan keep moving in circles when it comes to the economy? Every finance minister knows what is to be done, but remains unable to do it.

IH: All the political parties commit to privatisation in their manifestos, but when in opposition, they start opposing it if the government moves in this direction. And they even go to the streets in an attempt to stop it. So, unless we completely end this hypocrisy of saying one thing and acting totally the opposite, the country will never prosper. Today, it is your government, tomorrow it is the opposition government. If they all stick to their manifestos and continue on the same path, Pakistan will be out of trouble. This I can assure you.

There are calls for the imposition of an economic emergency…

IH: No, that would add more panic in the economy. That would not be the right thing to do. But an economic charter built on consensus is the need of the hour. All the stakeholders must think about this.

What course should the government take now?

IH: Abolish untargeted subsidies for fuel, power and gas and everything else. Use the Benazir Income Support database for targeted subsidies. You can save 500 to 600 million rupees by targeted subsidies. Today, you are getting a subsidy and I am getting a subsidy, but I don’t deserve subsidy. It doesn’t make sense that those driving luxury vehicles and SUVs and those on motorbikes get fuel at the same rate. This needs to be changed.

Similarly, you have to give electricity out to the private sector to manage. Successive governments have failed to manage the electricity companies. The government should own the assets of the company, but give the private sector management control and they should be judged on their performance indicators. If that happens you will know how much money we are able to save from our fiscal accounts.

Catch all the Breaking News Event and Latest News Updates on The BOL News

Download The BOL News App to get the Daily News Update & Live News.

Read the complete story text.

Read the complete story text. Listen to audio of the story.

Listen to audio of the story.